By now, we all know the importance of having a health insurance. And over time, varoius froms of health insurance plans have come up catering to particular illnesses like breast cancer and blood cancer. Of late, certain health insurance providers have also started including diseases like brain tumours. Yes. True. A lot of health insurance companies have started including brain tumour.

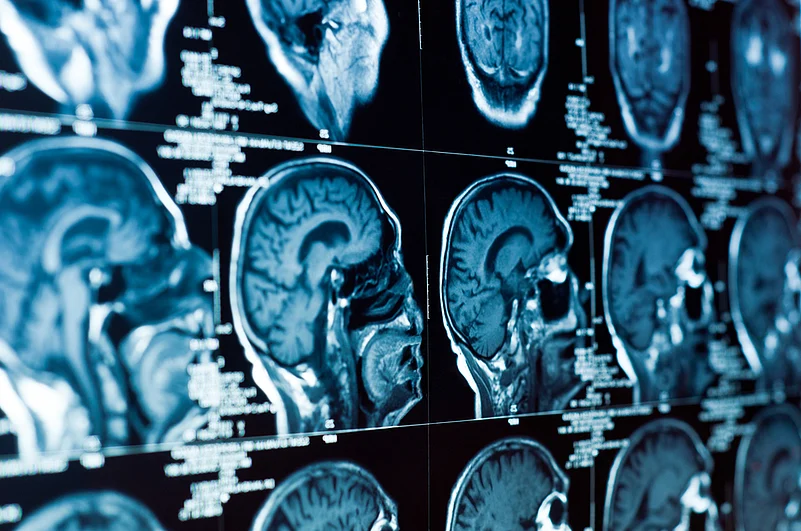

A brain tumour is a collection or mass, of abnormal cells in the brain. The skull, which encloses the brain, is very rigid. Any growth inside such a restricted space can cause problems. Brain tumours can be cancerous (malignant) or noncancerous (benign). When benign or malignant tumors grow, they can cause the pressure inside the skull to increase. This can cause brain damage, and it can be life-threatening.

Brain tumors are a growing reason for claims, across both metro and tier II and III cities. According to Bajaj Allainz General Insurance, there has been a 40 percent increase in the number of claims due to brain tumor between 2016 to 2019. In the same time period, there has been a 25 percent increase in the average claim size due to brain tumor and is around Rs 3 lakh and several cases where the hospitalization expenses run into more than Rs.10 lakh.

Commenting on the increase in claims surrounding brain tumours, Gurdeep Singh Batra, Head, Retail Underwriting, Bajaj Allianz General Insurance said, “ To provide an adequate coverage for brain tumor treatment the basic health insurance policy should not be less than Rs 5 lakh, and one can opt for super top up policy with a Rs 10 lakh. Not only would this give you an adequate coverage, but it would also be an economically viable option – an apt financial shield against any health exigency”.

The claim payment depends on the type of policy and not the disease. So, if it’s a hospitalisation policy the claim will be paid as per expenses incurred during hospitalization and if it’s a critical illness policy under, which the claim is triggered then a lump sum amount is paid to the policyholder and the policy will stop, since critical illness is a benefit only policy.

The maximum numbers of cases are reported from Mumbai, Pune, Hyderabad, Bengaluru and Gurgaon. Close to 70 percent of the claimants were covered under group medical coverage policies, as against individual health insurance policies. The average age of claimants range between 40-45.

“Renewal of the policy cannot be stopped because of adverse claims as lifetime renewal is mandatory in health insurance policy. Applicability of waiting periods differs from policy to policy. Once the claim is paid, the disease is covered under the policy, a waiting period doesn’t apply afresh after a claim is paid. There is no change in calculation of premium if a there’s a claim, whatever factors are considered for everybody renewing policy under that product remain the same with a person making a claim, like change in age of the policyholder, sum insured opted”, added Batra.

Depending on the types of plan a policyholder can renew the existing policy. However, the conditions and provisions vary from insurer to insurer. Life is uncertain and at any point of time your health insurance will give you the best way to bear such unforeseen medical emergency.