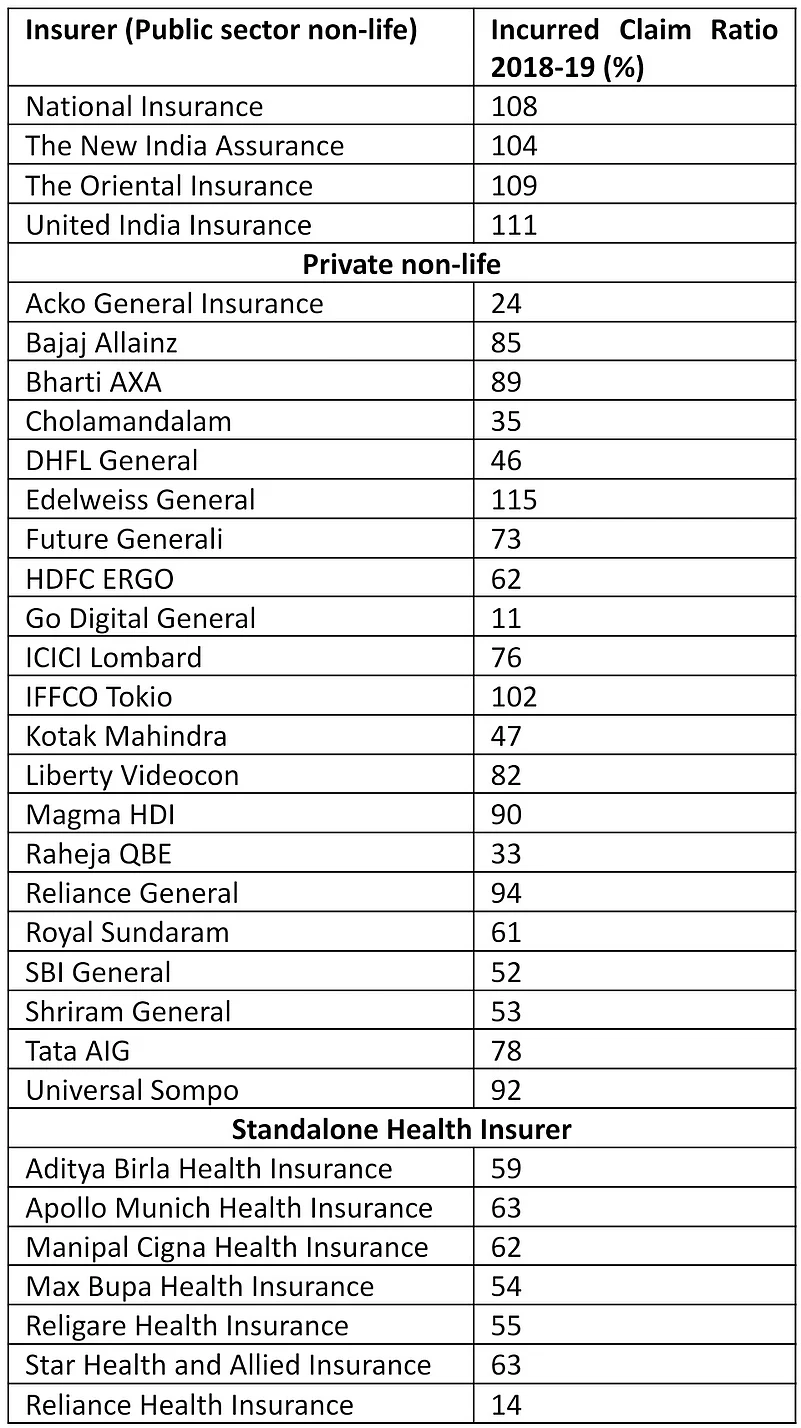

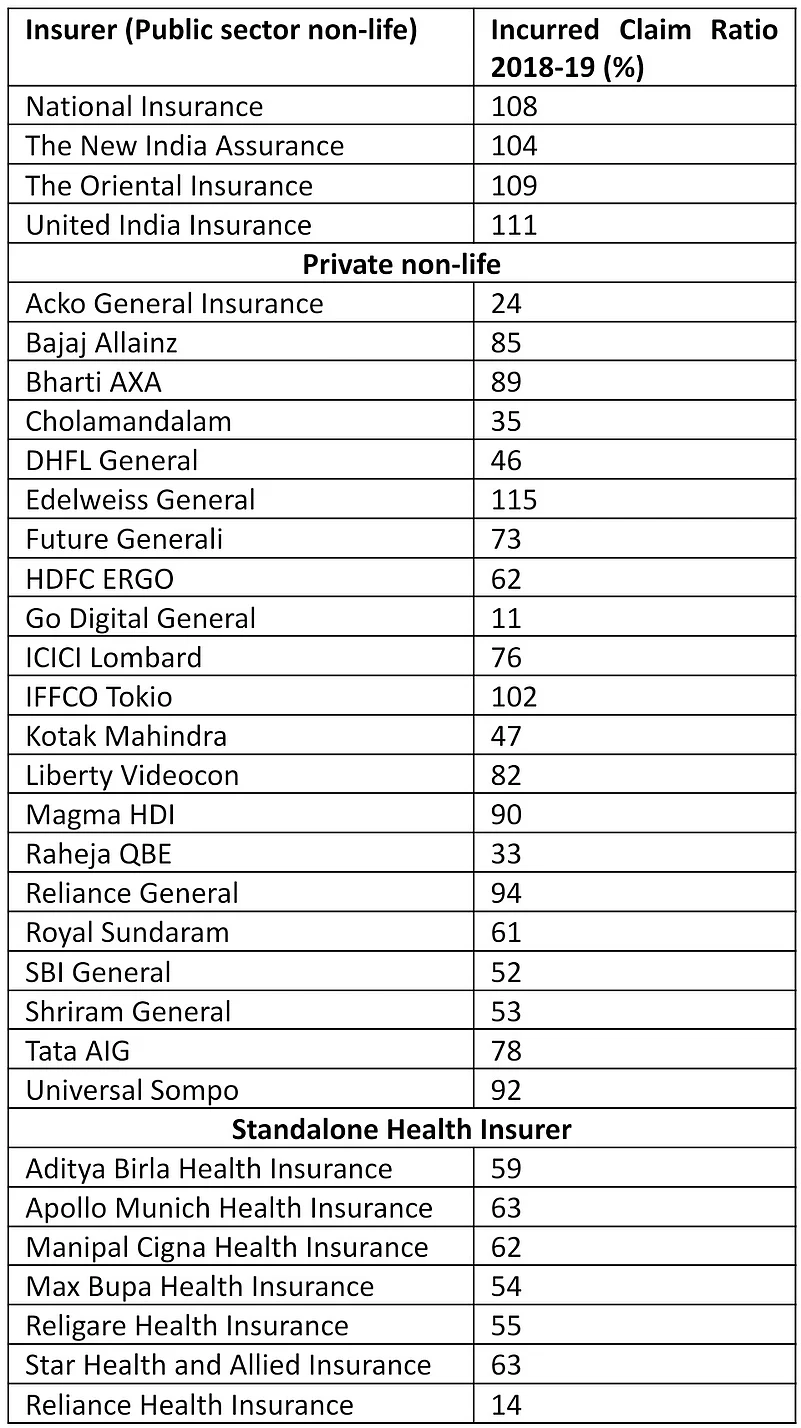

For instance, for every Rs 100 premium if an insurer is paying Rs 98 as a claim for a year, it means the insurer is earning a profit of Rs 2 as the income is more than the expenses. On the other hand, if an insurer is collecting a premium of Rs 100 and paying Rs 105 as a claim for a year, this indicates the insurer is making a loss of Rs 5, since the income is less than the expenses.