In the backdrop of an uncertain world, people’s financial insecurities are also increasing. In the wake of COVID-19, only 62 per cent feel secure to provide for their child’s education, against 65 per cent of those surveyed in pre-COVID times, revealed Max Life India survey.

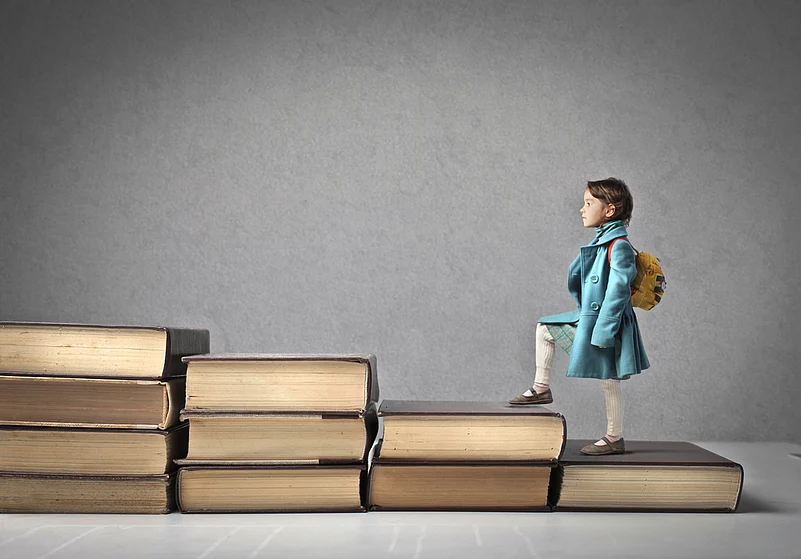

However, with sound planning, one can take thoughtful steps towards securing their child’s future in an uncertain world.

Explore and understand their interests

To make your child’s future a promising one, it is the parents’ responsibility to identify children’s interests. It can be done through observation during play, interactions and general discussions with the child. By identifying a child's interests, parents can plan for a well-resourced environment and organise learning around them as they grow.

Research on courses available

Parents are their children's educators. Research reveals that regardless of parents’ income and educational background, their involvement in children’s higher education helps them develop more positive attitudes about school, have more self-confidence, and prioritise academic achievement. The more and early on you start to research with your child on the avenues available for further studies and academic development, the more you will foster a growth-oriented future for the child.

Ensure a corpus for your child’s education

Sending children to top universities in popular destinations such as the US and Canada can be an expensive affair with average tuition fees ranging from Rs 45 lakh to Rs 67 lakh for a four-year undergraduate degree. If parents begin to practice financial planning for children soon after they are born, they would be better equipped to cushion their future.

With the cost of education mounting with each passing day, it is crucial to invest in a savings plan that will offer enough funds to meet a host of expenses for your child. A child insurance plan is an insurance cum investment plan that can help the child achieve financial security by creating a long-term corpus.

Child plans aim to achieve a child's goals and benefit parents with tax savings and additional wealth. There are very few investments ensuring achievement of a child's goals regardless of circumstances. The added benefit of partial withdrawals also enables the parents to meet financial requirements at key educational milestones in a child’s life, while providing tax relief under section 80C and section 80D.

Furthermore, guaranteed wealth creation plans are specific life insurance policies designed to assure you guaranteed returns. These assured wealth products offer fully guaranteed lump sum benefits to meet your savings goals, fulfil your dreams for your loved ones and accomplish milestones with certainty.

Working towards a bright future

Parents always want to protect their child and are a source of strength to fall back on during tough times. By building a robust foundation that can nurture your children’s needs as they grow up, you can work towards creating a bright future for them,

For in the words of former U.S. Senator, David Vitter “I continue to believe that if children are given the necessary tools to succeed, they will succeed beyond their wildest dreams!”.

The author is the Director & CMO - Max Life Insurance.

DISCLAIMER: Views expressed are the author's own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person or organisation directly or indirectly.