Mumbai, February 13: Insurance Regulatory and Development Authority of India, IRDAI has amended the definition of pre-existing diseases (PED). The regulator advised all insurers and Third-Party Administrators (TPAs), wherever applicable to make changes and ensure compliance with immediate effect.

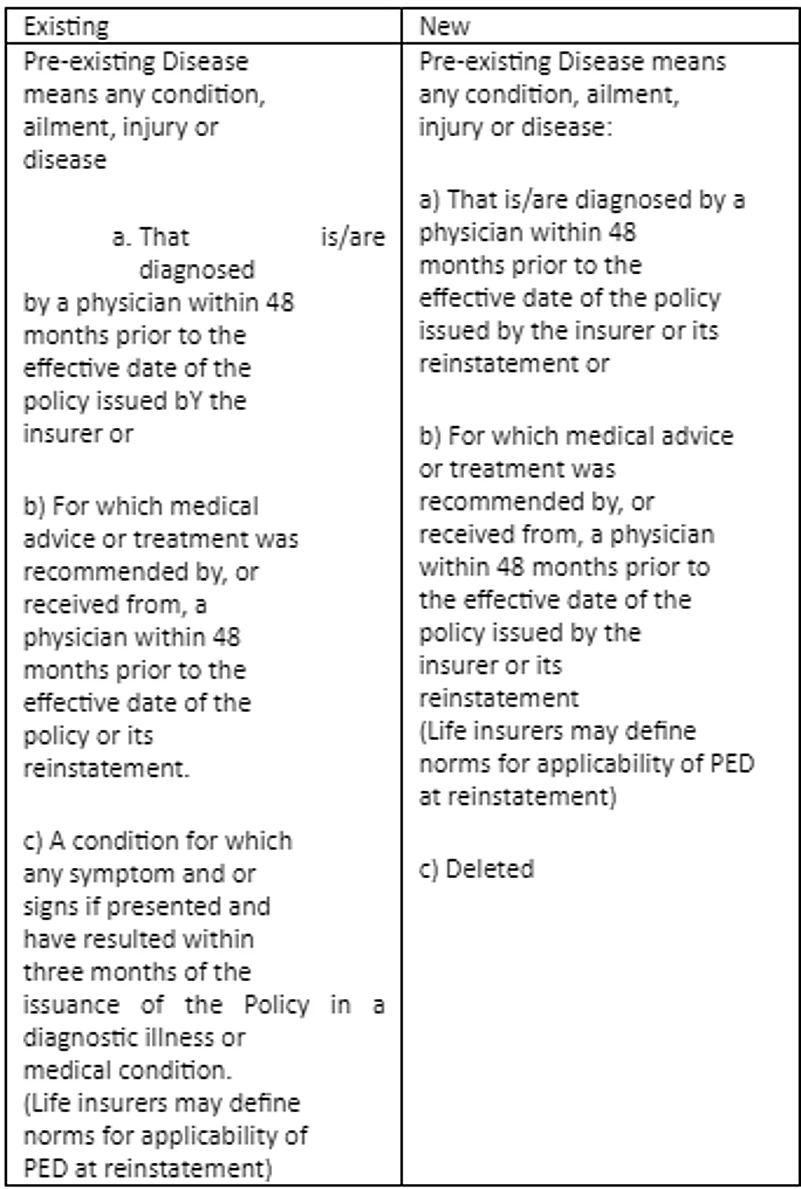

As per IRDAI’s latest guidelines on the definition of PED (not applicable for overseas travel insurance)

Source: IRDAI

What is PED?

According to IRDAI, pre-existing diseases have been defined as “any condition, ailment or injury or related condition(s) for which the insured had signs or symptoms, and/or was diagnosed, received medical advice or treatment within 48 months prior to the first policy issued by the insurer.”

In health insurance, insurers have the right to reject a claim under the pre-existing illnesses clause. Health insurance providers offer coverage of a limited range of pre-existing diseases however, it varies from insurer to insurer. Insurers offer coverage of pre-existing diseases with a waiting period of 24 months to 48 months.

A condition for which any symptoms and or signs if presented and have resulted within three months of the issuance of the policy in a diagnostic illness or medical condition has been deleted under the new guidelines.

Industry experts believe that the new guidelines of pre-existing diseases would reduce the rejection of claim as insurers cannot reject a claim if the policyholders develop conditions within three months of buying the health insurance plan.