Mumbai, December 22: There is a good news for life insurance industry. The 2018-19 annual report released by Insurance regulatory and Development Authority of India (IRDAI) shows the industry registered a double digit growth as opposed to the previous year.

This growth in industry numbers not only comes as a good news for the industry but also highlights growing life cover and security for Indian citizens. According to the annual report, life insurance industry recorded a premium of Rs 5,08.132.03 crore during 2018-19 as against Rs 4, 58.809.44 crore in the previous financial year and registered growth of 10.75 per cent (9.64 per cent growth in previous year).

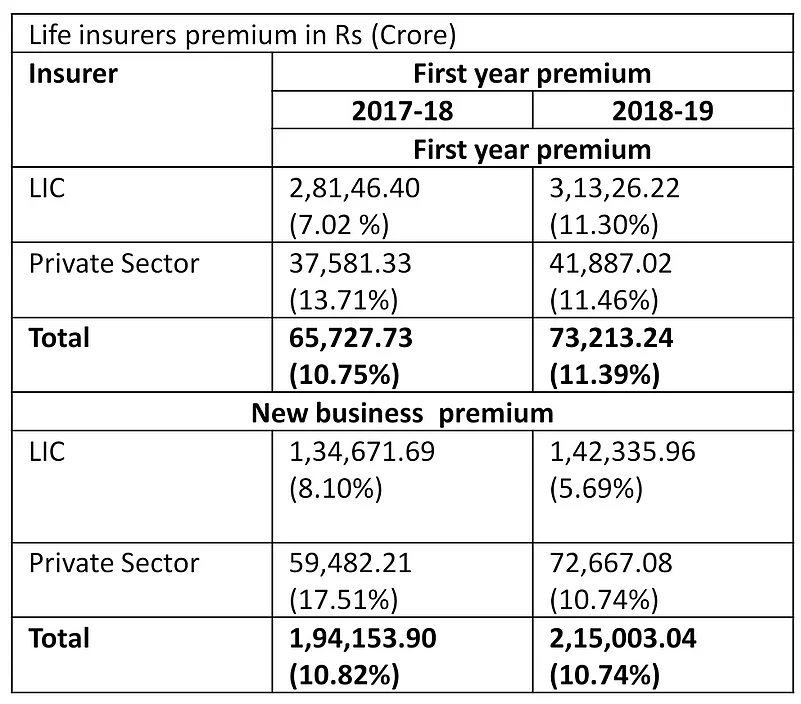

During 2018-19, Life Insurance Corporation of India (LIC) recorded 6.06 per cent and private sector life insurers posted 21.37 per cent growth. The renewal premium accounted for 57.68 per cent of the total premium received by the life insurers and new business premium contributed the remaining 42.32 per cent. Overall growth in renewal premium was 10.76 per cent and new business premium growth was 10.74 per cent.

The first year premium registered 11.39 per cent growth in 2018-19, as against 10.75 per cent growth in previous financial year. The private life insurers registered a growth of 11.46 per cent while LIC registered a growth 11.36 per cent.

ULIPs registered a growth of 17.42 per cent premium from Rs 64,850.90 crore in 2017-18 to Rs 76,152.17 crore in 2018-19. Accordingly, the share of ULIPs in total premium increased to 14.99 per cent in 2018-19 as against 14.13 per cent in previous year.

The growth in premium from traditional products was at 9.65 per cent, with premium Rs 4,31,979.87 crore in 2018-19 as against Rs 3,93,958.54 crore in previous year.

On the basis of total premium income, the market share of LIC decreased from 69.36 per cent in 2017-18 to 66.42 per cent in 2018-19. The market share of private insurers has increased from 30.64 per cent in 2017-18 to 33.58 per cent in 2018-19.

During 2018-19 life insurers issued 286.48 lakh new individual policies, out of which LIC issued 214.04 lakh new policies and private life insurers issued 72.44 lakh policies. Private sector achieved a growth of 5.61 per cent in the number of new policies issued against the previous year, LIC achieved a growth of 0.31 per cent.

Source: IRDAI