If you are a discerning term life policyholder, you would have ensured that you are adequately covered for. But, rarely even such policyholders have considered how the proceeds on their death would work for their financial dependents. The standard practice among policyholders is to take a policy, which pays out a death benefit, which is lump sum in nature. Nothing wrong with it, as that is the only way in which life insurance benefit has so far been transferred. However, there is a school of thought which foresees lump sum payout on death of the policyholder as a problem for the dependents. After all, not everyone has the financial acumen to handle large sums of money on their own. Says Suresh Sadagopan, Founder, Ladder7 Financial Advisories: “In many families, the income earner (usually the male) is also the person who is managing the money. In his absence, the lady may find it difficult to invest it correctly and set up an appropriate income stream.” This is an outcome that is seldom considered by the primary policyholder and is an area of opportunity that life insurers have started to explore.

The possibility of a lump sum payout causing financial havoc on his family prompted Bengalurubased Saurov Bora, a medical practitioner, to take a term insurance policy in which, in case of his death, the policy will payout his financial dependents a lump sum as well as a monthly payment. “I have a policy which pays out a lump sum and was also looking for something that would work for a regular monthly cash-flow,” he says. Evolution of consumers of life insurance is a step towards product development resulting in structuring of the death benefit into regular payouts than lump sum.

Lump sum or regular pay?

The beneficiary basically has two choices regarding payment of life insurance proceeds: to receive the insurance proceeds all at once in a lump sum, or to receive the proceeds in a series of smaller payments like an annuity over a period of time. There are pros and cons to both, and ideally one will be better off choosing a combination of both the options. For example, if you want your beneficiary—spouse— to receive payments for a decade before your children are financially secure, the monthly payout is better. However, if you are servicing a loan, the lump sum is a better option to retire it immediately on your demise.

Sensing the opportunity, several life insurers have launched products with death proceeds that can be commuted as lump sum or annuity or a mix of both. “We allow the nominee to choose the mode of payout i.e. lump sum or income at the time of claim,” says Aalok Bhan, director of product solutions & customer marketing at Max Life Insurance. The practical benefit of annuity over lump sum, especially in cases where the beneficiary is not financially savvy, is the influence of family and friends, who take it on themselves to help deploy the lump sum benefits. “Such people may invest the lump sum wrongly or swindle it,” feels Sadagopan.

The emotional trauma aside, the nominee may not have the acumen to use the policy proceeds judicially. “Many people might come and reque s t for a loan knowing that you have received a lump sum amount but is better not to give loans without analysing your situation,” suggests Kartik Jhaveri, director, Transcend Consulting, a Mumbai-based financial advisory. He further recommends a mix of lump sum to meet the immediate financial requirements and monthly payouts.

Plenty to choose from

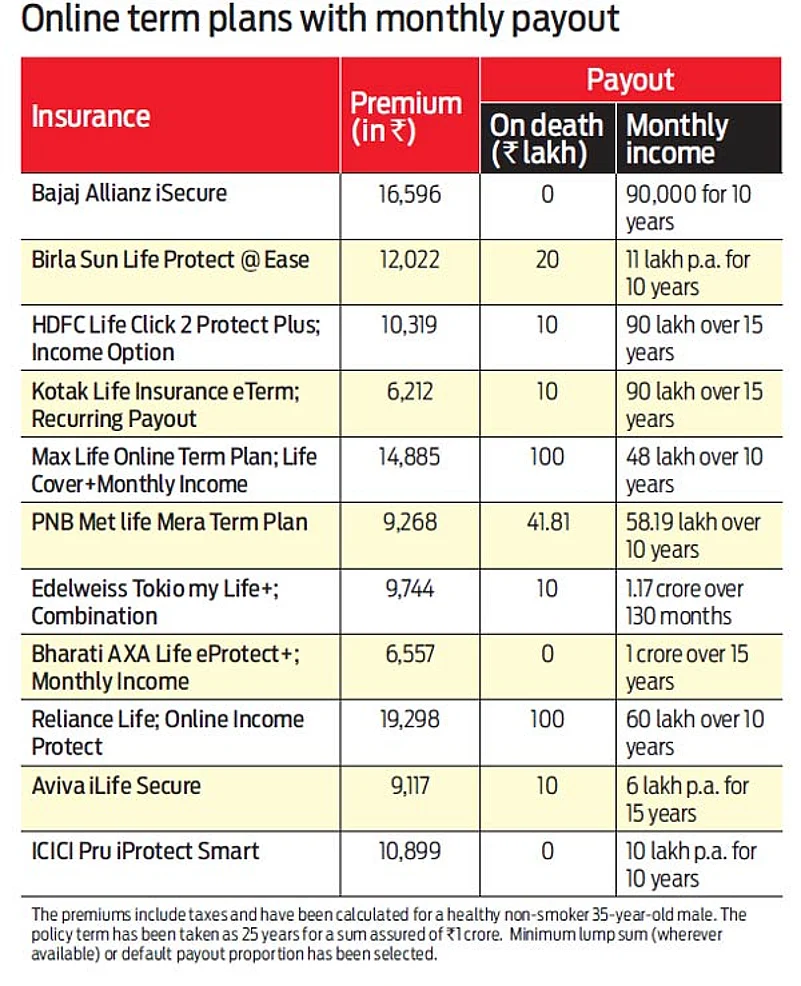

Several insurers are offering policy proceeds in the form of monthly payouts (See: Online term plans with monthly payout) or with a mix of lump sum and monthly payouts. For insurers, structuring death payouts in such a manner is not an impossible task. However, the financial merits of such payouts rest on what a comparable lump sum would earn and pay. “The annuity payment option is considerable only if the insurer is paying something extra for delaying the payouts; the return should be at least 8 per cent,” suggests Jhaveri.

A simple analysis of the monthly payouts does not make them financially attractive, but these policies score on convenience and assured payout than anything else. On their part, insurers defend the financial unattractiveness to the fact that the tenure of most term plans is usually between 10-40 years and the annuity payouts are made for 10-15 years after the death of the policyholder. “We are guaranteeing at the commencement of the policy (now) a 10-15-year interest rate on death which could take place, say, 40 years from now,” explains Srinivasan Parthasarathy, senior executive vice president, chief & appointed actuary, HDFC Life. What this means is that you as a policyholder will know today what your dependents will receive every month for a fixed 10-15-year phase when the policy benefit kicks in.

The complexity of prevalent interest rates, longevity, inflation and other economic factors collectively add to what your beneficiary gets paid each month by way of the monthly payout option in these policies. Where the policies score is by not limiting the benefit payout to the life of the beneficiary, but extending the same till the nominee’s heir. Moreover, though the payout is like an annuity, the monthly income received is tax free like every other lump sum policy proceeds. There is clear outcome when it comes to comparing lump sum or annuity payout, but to leave your financial dependents with peace of mind, you should opt for a policy that offers a combination of the two, or better still, have a policy that addresses the lump sum needs on your death and another for the monthly cash-flows.

When regular payouts score

Income, health and your financial acumen tilt towards annuity payout over lump sum. The only time when the annuity may not be useful is when your dependents already have sufficient sources of income, making the monthly payout from your policy less attractive.

Health: The longer your dependents live, the better off they are with the annuity. If you are married, you would want to take your spouse’s potential longevity into account and bet on annuity over lump sum.

Risk: Reliability of cash flows is extremely important—a steady monthly payment regardless of what’s happening to your investments is an assurance that many would love to live with. The assured payment each month is not only predictable, it takes away the risk of deploying the lump sum to earn similar returns.

Convenience: Managing a lump sum takes careful planning, budgeting and discipline. In comparison, a defined monthly payment eases your life and leaves the worry of money flowing into your bank account each month under check.

aakar@outlookindia.com