For 24-year-old Sonal Gupta, her iPhone 6 is the lifeline to stay connected with friends, family and the world. Not a day begins without checking on messages and emails or using features that have become part of her life. “I am not sure how many hours, forget days, I can stay without my phone,” she says, emphasising how important her phone is to her. She is not alone. Scores of Indians start their day checking updates on their phones, be it Facebook, WhatsApp or just emails. Smartphones have become such a rage that their sale in India shatters new records every quarter. According to a 2014 Gartner report on smartphones, India is the world’s fastest growing smartphone market.

With so much of our lives riding on the smartphone, it is natural to skip a heartbeat each time the phone falls or a drop or a splash hits the gadget. We cross our fingers and hope that our precious gadget remains functional after all these ‘mishaps’. The stakes just got higher with Indians having upped the ante by lapping up smartphones that cost Rs. 35,000 upwards, what could be the price of an average laptop or a tablet. “It is not just my personal life, a lot of my business gets done with the phone and I can ill afford to lose or have my phone damaged and be out of order for a few hours,” exclaims Jaipur-based Rakesh Pratap Singh, who is a handicrafts and furniture exporter.

With all the convenience and features, these devices come with other side effects—smartphones are expensive to repair and the costs can add up quickly if they get damaged. Since damage without insurance often comes with a hefty price tag, insuring your phone is a smart investment. Thankfully, there is easy and convenient insurance available to ensure your smartphone does not cost you a bomb to repair if something goes wrong with it or it is lost. However, like all insurance policies, these too come with their share of exclusions and limitations.

Smart cover option

Insurance for mobiles is not a recent phenomenon; it existed earlier too, but was not so prevalent and came with conditions that favoured the insurer more than the insured in case of a claim. “Earlier you had to insure your house or office to get your mobile and laptops insured, which effectively meant you had to have insurance for a whole lot of other things to qualify for an insurance on your phone,” recounts Singh. It is for this reason that most corporate and businesses could insure gadgets like laptops and mobile phones for their employees, but if the employees were to set off taking insurance on their own, they would find it a tough task.

“We identified the huge gap in gadget care solutions and with our insurance offering, we are converting warranty into guarantee,” says Govind Uttamchandani, managing director, SSK Group of Companies. The company is one of the many insurance providers on smartphones, and a leading player in the LED business. Like any other insurance policy, by paying a simple annual premium, mobile insurance can safeguard the phone from accidental loss, theft or damage.

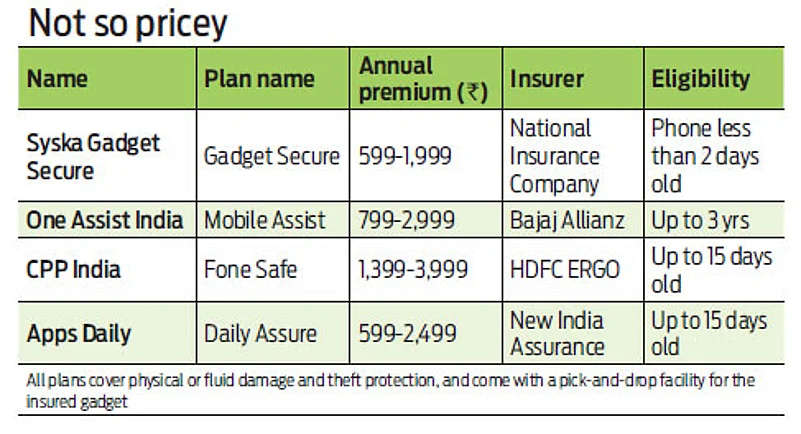

Mobile insurance is widely provided by mobile retailers and gadget-selling stores. General insurance companies offer mobile insurance in collaboration with companies like Syska Gadget Secure, Apps Daily and CPP India to insure your phone against theft, and physical or fluid damages (See: Not so pricey). Additionally, these insurance schemes offer benefits like online backup for phone data, virus and spam protection, real-time tracking facility in case of theft and a lot more.

Cover and Claim

What you will need to take mobile insurance is the phone bill or purchase invoice. Some insurers also insist on seeing the phone, either in person or through pictures of the phone. “My phone’s insurance cost is Rs. 1,750, for which the insurer will reimburse 80 per cent of the repair cost if something happens to the phone in the first six months and 50 per cent in the next six months,” says Gupta, while simultaneously checking her phone for updates.

The claims process is cashless for repairs at the time of damage, with a pick-and-drop facility offered in select areas. You can also get the phone repaired from authorized centre and reclaim the cost from the insurer. In case of loss of phone, you will need a copy of the police complaint to raise the claim. Each insurer has a different set of rules; make sure you go through them before raising a claim.

Like every other insurance, this too comes with exclusions, the most important one being claim denied in case of loss of phone from an unattended vehicle or due to personal negligence, such as leaving your phone in a public place. If you have a high-end phone, you should definitely consider insurance; as for others, the choice depends on how frequently they change their phones and their smartphone usage.