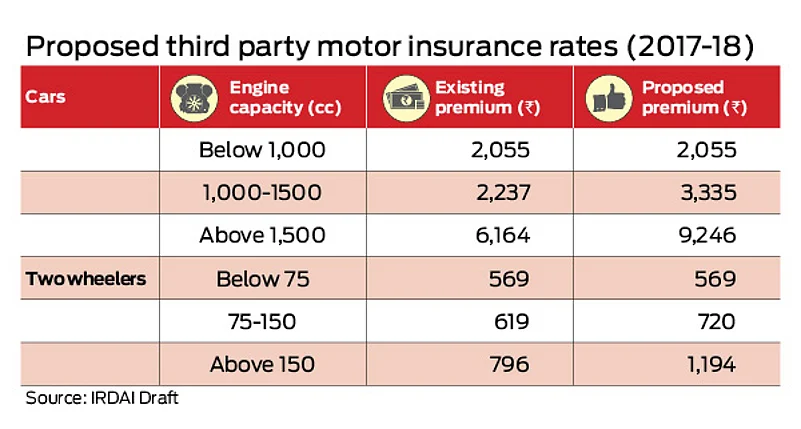

Come April and vehicle owners could face the pinch of paying higher premium on the liability only insurance cover, which is mandatory for them to ply their vehicles on road. The insurance regulator – IRDAI has released an exposure draft on revision in the rates for 2017-18, which spares private cars not exceeding 1000 cc by suggesting a status quo (See: Third party cover). For other categories, the increase in rates goes as high as 50 per cent. The IRDAI has sought views and comments from stakeholders on its website till March 18th.

According to IRDAI, the rates proposed have been arrived on by an analysis of the data provided by the Insurance Information Bureau of India. The data pertains to the “experience period consisting of accidents years from 2011-12 to 2015-16 in respect of gross written premiums and amount of claims paid up to March 31, 2016,” said the IRDAI release. There is also change in rates for two wheelers, with no change in premiums for vehicles in the sub 75 cc engine category. An increase in rates is inevitable and it is only a matter of time before the IRDAI notifies the change and insurers start increasing the rates.