Flight tickets, visas, clothes, daily essentials, money – the list of must-have paraphernalia in your luggage while travelling abroad is long. Then, there are other, less-talked-about items that occupy no space in your baggage, but are simply indispensable to your overseas trip – travel cards, insurance and international calling tools.

While travel is for leisure, it can also be a source of anxiety due to the fear of unforeseen, adverse situations like medical emergencies, baggage loss or flight cancellations. To mitigate these risks, a travel cover is a must. Now, if you are travelling to Schengen countries, you cannot but buy a travel cover as it is mandatory. However, it is wise to buy one even when you are visiting other countries.

Why travel insurance

Apart from the regular reasons mentioned earlier, the fact that the world has now become a riskier place is one of the key triggers for an increase in demand. "After the recent terrorist attacks, more and more people are looking for terrorist cover. Further with uncertainty in weather conditions leading to sudden flooding and snowing conditions, covers like missed connection and delay in flight, alternate stay are most sought after," says G Srinivasan, chairman, New India Assurance, which has been witnessing a growth of 10-15% in sales every year. Bajaj Allianz has registered sales growth of 8% even for countries like the US and Canada, where travel insurance is not a must.

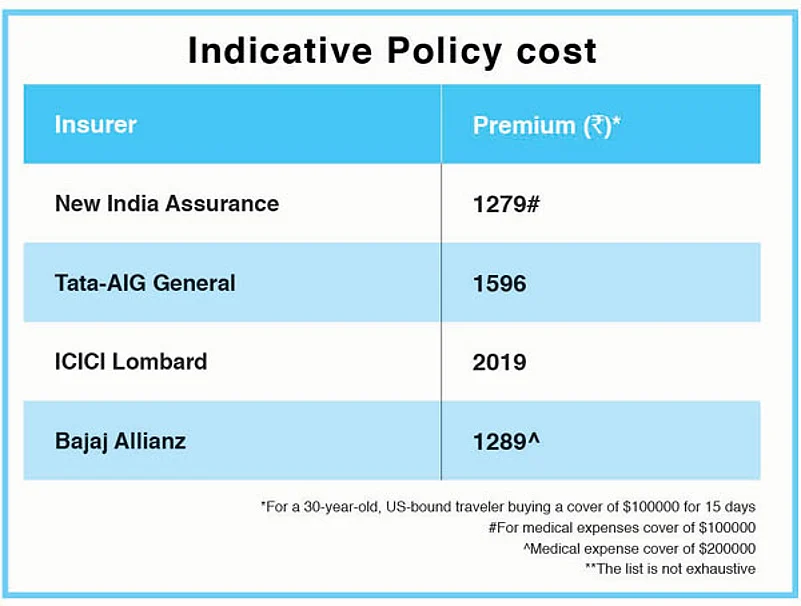

Clearly, a travel insurance policy can offer great comfort on overseas sojourns. However, blindly buying a policy without adequate research can prove to be counter-productive. Even though it is possible to buy a travel policy in a few clicks, it makes sense to take time out to read the term and conditions rather than completing the process in a hurry. Premium and ease of buying apart, you need to ensure that your policy covers certain fundamental risks. Protection against medical emergencies and personal accident form the core of such policies. Healthcare costs are prohibitively high in foreign countries, making this cover a must-have. “The insurance plan will also take care of any additional expenses incurred, in case the individual had to be evacuated back to home country for medical care,” adds Abhijeet Ghosh, head –travel Insurance, Bajaj Allianz General Insurance.

Then, there are other risks that may not cost as much but are capable of derailing your travel plan. “Check if your policy covers loss of passport, other documents and baggage, trip delay and cancellation, financial emergency assistance and cancellation for hotel and airline,” says Parag Gupta, Chief Underwriting Officer, Bharti AXA General Insurance. Also, ascertain whether legal expenses incurred due to third party liability are covered. Non-monetary aspects too deserve attention. “The service provider network must be robust and should ensure hassle free cashless services globally and all assistance should be provided by the appointed service provider, including translation services in certain countries of travel,” points out Srinivasan.

Exclusions to know

While buying a travel insurance plan can contribute towards a stress-free holiday, bear in mind expenses that are not payable to ensure that your peace of mind is not disturbed. The chief exclusion pertains to treatment of pre-existing diseases – that is, ailments that you were suffering from before policy inception. Such illnesses will not be covered except in case of a life-threatening emergency. “If a person travels against the advice of his doctor and falls ill abroad, the same too is not payable,” adds Srinivasan. Similarly, pregnancy and related expenses will not be paid for either.

In addition, your policy could also come with a deductible of $100 – the initial amount you have to pay up before the insurer chips in with the balance. “Cosmetic surgery is not covered, unless it is medically necessary as part of treatment for accidents or burns while traveling,” says Gupta of Bharti-AXA. If your trip features adventure sports, do remember that your policy is unlikely to foot the bill from any injury arising out of such activities. “Partial loss of items in checked-in baggage and loss of passport if it is left unattended in public and not reported to police within 24 hours are also not covered,” says Gupta. In other words, any expense that is a result of your negligence will not be eligible for claim settlement. “The policy will not cover any loss incurred due to fault of the policyholder. For instance, if the policyholder suffers losses or injuries due to intoxication with drugs or alcohol, the medical expenses for the same will not be covered under travel insurance policy,” says Ghosh of Bajaj Allianz.

International Calling Tools

Be it business or leisure trip, you simply cannot do without making calls back home to assure your family of your well-being or share travel tales. However, international call and roaming rates can be roadblocks to smooth-flowing conversations. International travellers can typically choose between local SIM cards bought upon landing, destination SIM cards purchased from operators like Reliance Communications, Uniconnect and Matrix Cellular before flying out, international roaming packs and so on. Currently, telecom majors Vodafone and Airtel are offering international roaming plans with huge discounts on data as well as calls. Perhaps your best bet is to rely on WhatsApp calls as far as possible, provided you have access to wi-fi networks at your hotel or place of work abroad.