Mumbai, January 3: The main purpose of buying a life insurance plan is to provide financial security to your loved ones in case of your sudden demise. It will give you peace of mind besides various benefits like, future financial security in your absence, tax benefits and financial planning for various stages of life.

There are 24 life insurers in the market offering life insurance plans with varied features and benefits. When it comes to choosing the best out of these life insurers one has to keep in mind while buying a life insurance is the claim settlement history of the insurer. Understanding the claim settlement ratio will help to measure the insurer’s reliability as higher claim ratio indicates possibility of your future claim being settled by the insurer.

Claim settlement ratio in life insurance refers to the number of claims that the insurer has paid following the death of policyholders. For instance, if a life insurer has a claims settlement ratio of 98 per cent, it means that the insurer pays 98 out of every 100 claims filed when the policyholder dies.

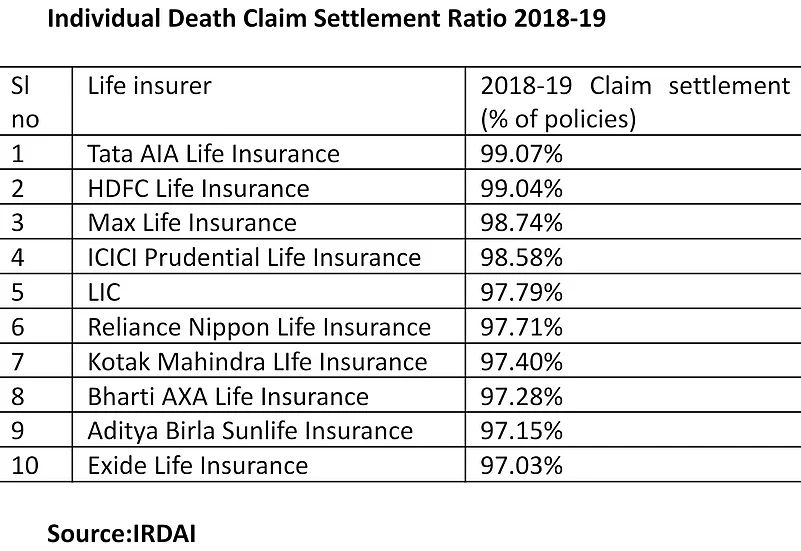

According to a recent Insurance Regulatory and Development Authority of India, (IRDAI) annual report in 2018-19, the life insurance companies had settled 8.43 lakh claims on individual policies, with a total pay-out of Rs 17,365 crore. The number of claims repudiated was 6,372 for an amount of Rs 539 crore and rejected was 3,697 for an amount of Rs 25.18 crore.

As per the IRDAI claim settlement ratio 2018-19 data, LIC was at 97.79 per cent as at 31 March 2019 when compared to 98.04 per cent as at 31 March 2018. For private insurers, claim settlement ratio had increased from 96.64 per cent during 2018-19 when compared to 95.24 per cent against the previous year.

Before buying any life insurance plan most of the individuals check the features, benefits, past claim settlement ratio and financial strength of the insurer. The most important thing to do while buying a life insurance plan is to provide accurate personal information. This will help the insurer to determine actual premium based on the personal information and no room to reject the claim and this will also help to settle the claim at earliest.