It’s over a month since the government announced demonetisation of Rs 500 and Rs 1000 notes and suddenly the whole debate has changed towards shiting towards digital form of payments. While cash is still inadequate in banks and ATMs, adopting digital form of payments has sort of become a norm for most of us.

This sudden push towards digital payments has opened huge opportunity for banks and digital wallets companies and that is evidently clear from the hoard of e-mails and SMSs the banks have been sending or the front page advertisements we have been seeing.

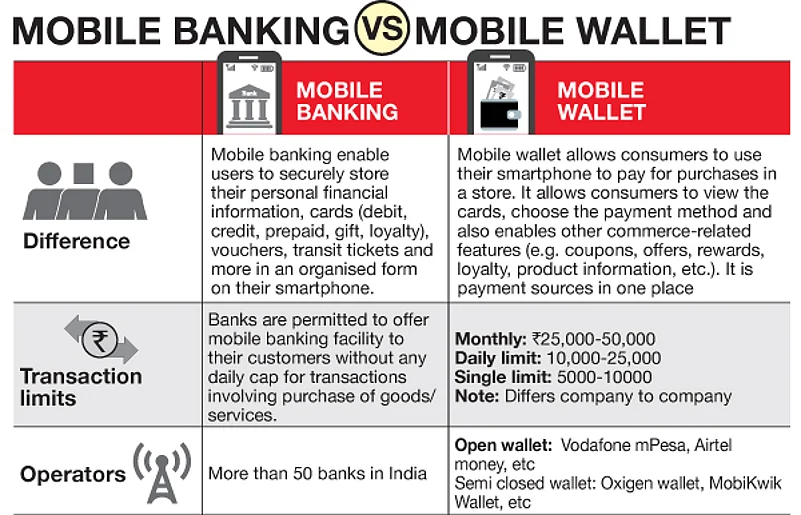

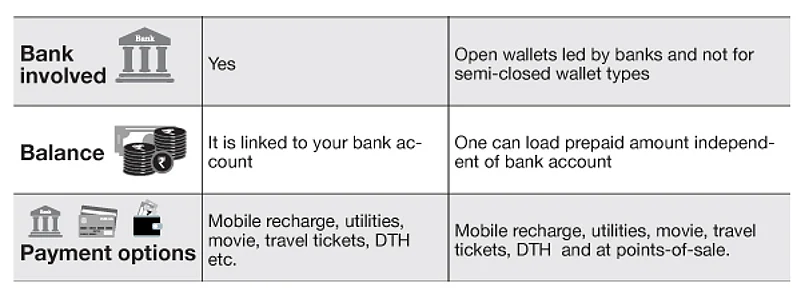

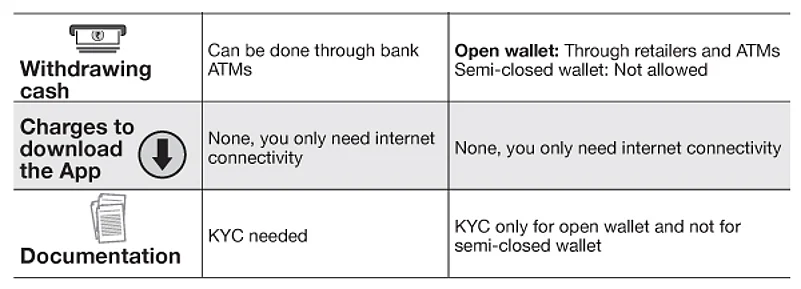

Banks have been battling it out with the mobile wallets for a very long time. So we decided to settle the debate once and for all and have listed the major differences between mobile banking and mobile wallet based on different parameters.

himali@outlookindia.com