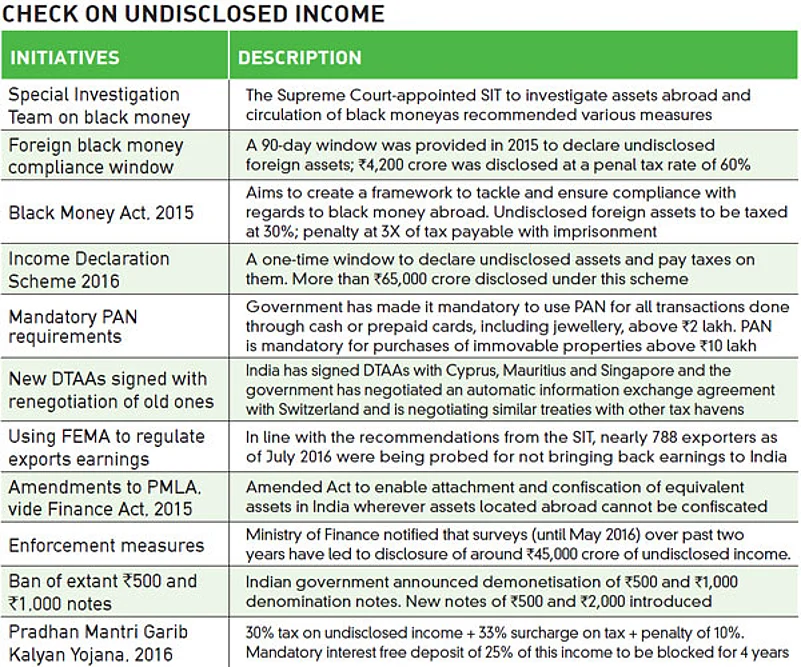

By the time you read this, the 50-day pain would have ended or it would have more or less subsided. There were plenty of jokes going around last year about the RBI being the Reverse Bank of India and the government not having a plan in place, and hence the need for over 50 notifications to make the demonetisation drive work. In recent years, the government has taken several initiatives which were aimed at curtailing the role of black money in the economy. The impact of the raids and unearthing of hidden money has definitely instilled the fear, especially on count of evading taxes or hoarding money.

Yes, there are numerous theories on how old black money has become new black money or the many debates on the amount of black money that got back into the banking system being too little. A definite takeaway from the move is that it will not be easy to hoard money and to evade taxes in the future. The numerous avenues offered to people to come clean with their unaccounted for money by the government is clearly indicative of its seriousness in solving this problem.

Digital payments

The plan to reduce dependency on cash in the economy was laid some years ago, but the real intent was made clear on February 29, 2016 when the Ministry of Finance came out with cabinet approved guidelines for the Promotion of Payments through Cards and Digital means. Soon after, on March 8, 2016, the RBI came out with a concept paper on Card Acceptance Infrastructure. Both documents set the blueprint of making India less cash dependent for economy’s efficient functioning. The unified payment interface (UPI) from the NPCI was the next step towards making an indigenous payment system for India, which was cost effective and brought all the players under a single platform.

The UPI is an app, which is a payment solution that empowers a recipient to initiate the payment request from a smartphone. It facilitates virtual payment address as a payment identifier for sending and collecting money and works on single click to factor authentication. The UPI enables both ‘Push’ and ‘Pull’ money transfer through smartphones.

Yes, mobile wallets have been in vogue for some years now, with their popularity soaring on the back of demonetisation drive. But, these too had their limitations, as one needs to be KYC-verified to fully use them as a wallet. Such teething troubles still exist, which will even out with time. What has been heartening over the past two months is the massive increase in the use of plastic and e-wallets resulting in both consumers shifting to make digital payments and vendors in accepting them.

To make cash-less a success, payment infrastructure needs to go up, and incentives need to be provided for people to make the switch from cash. One of the impediments to move to digital payments has been the charges imposed when using digital payments. However, the government stepped in to withdraw surcharge, service charge and convenience fee on card till December 30. Ultimately, there will be a cost to go digital, just the way today one pays a convenience charge at airports when taking a flight. Unless the cost of moving to digital is not addressed soon, cash will remain the preferred mode of financial transaction.