Technology is redefining the way Indians consume products and services. And where financial intermediaries have not been able to reach in the last couple of decades, fintech company Sqrrl has—by using technology. The new-age fintech start-up seeks to help young people save and invest across small towns. In less than a year it has shattered several myths; a key one being that Millennials don’t invest or save.

Sqrrl has discovered that Millennials do want to save, but they just don’t want to do it through traditional channels. A classic example of this is Pratik Kumar Das, a 27-year-old lawyer in Pahartoli, Assam. He found Sqrrl, an online investment platform, on the Google Play Store, while searching for investment apps. He says: “I was looking for an app that could help me invest in mutual funds and I found it on the Play Store and the ratings were very high. For the last few months, I have been investing `5000 per month.”

Founded by Samant Sikka, Sqrrl is keen to make Millennials save and invest. Says Samant, “the relationship of Millennials (people born after the 1980s) with money is broken, thanks to an ecosystem that encourages spending rather than saving.” Having spent nearly two decades working in different financial services firms, Sikka realised that existing institutions and intermediaries are unable to help young Indians save and invest. He says: “I realised that physicality of the distribution business and return on time invested (ROTI) was a problem. But, we at Sqrrl believe that someone had to attempt to solve this problem and enable young people to save. We want to help this generation save, invest and prosper.”

Currently, in India most financial intermediaries are focused on the top 15 cities and the category of people who already have the wherewithal to understand and invest. In financial services parlance this is the ‘Stay Rich’ category. But, there are thousands of young Indians who would like to ‘Get Rich’ and Sikka’s fintech start-up wants to cater to these first-time investors. And to help these savers, Sqrrl is going beyond the 15 major cities.

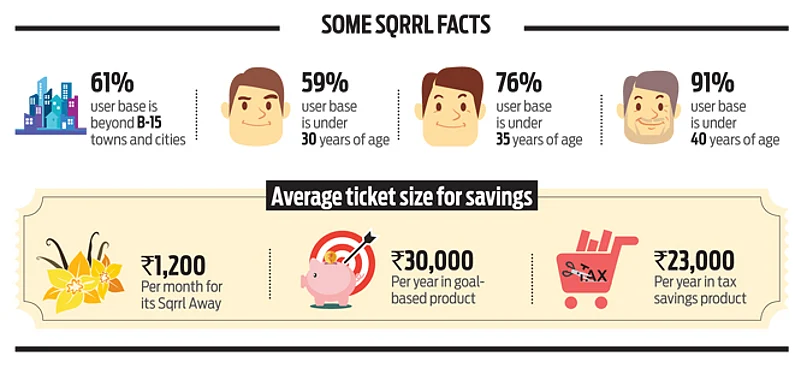

Sikka’s start-up was one of the 23 start-ups selected out of 1,200 for the Reliance GenNext Hub, an accelerator programme run by Microsoft and Reliance Industries. In a short span of one year, Sqrrl has 28,000 users and 23 per cent of these users are first-time investors. The process of investment is paperless. Over the next five years, Sqrrl is targeting three million users. This start-up eventually wants to morph into a digital bank.

Like all other digital platforms, Sqrrl is also following the FMCG (fast moving consumer goods) model to engage with consumers. The platform uses technology to solve a problem, while it seeks to satisfy the customer in the moment. Citing the example of Amazon, Sikka says: “If you look at Amazon or any other online shopping portal, then it puts the consumer at the centre of everything. The product, choice of payment, and delivery is as per the convenience of the consumer. But this is not so for financial services.”

Also, Sikka believes it is a misconception that Millennials don’t want to save. Research done by Sikka’s team shows that they would like to save, but they don’t understand it. Also, they don’t trust the intermediaries. Just as other things can be automated, Sqrrl seeks to automate savings and make it hassle-free for customers. While it has a website (www.sqrrl.in), if investors have to invest, they will have to download the app. Sqrrl has tied up with 15 funds, accounting for 92 per cent of the asset management industry.

And instead of throwing hundreds of mutual funds at young savers and expecting them to choose, Sqrrl has made it easy by breaking their offerings down to three simple products.

For instance, Sqrrl Away helps tuck away small amounts of money every month, which goes into a liquid fund and earns more interest than a savings bank account. The company has a partnership with only one liquid fund for this product.

The other product that Sqrrl offers is Bring Your Own Dream (BYOD). This is a goal-oriented savings product. So, if a customer wants to save for a holiday or a new gadget or future expense, then this product helps them achieve it by parking money in mutual funds. Sikka says the product is powered with an open architecture asset allocation algorithm. Finally, the other product the company offers is called Axe Tax, which helps people invest in tax saving instruments.

Sqrrl is helping young India save and invest, using new-age tools, and ride the data boom in India.