If you have a scalable business, you can make your revenues grow much faster than the investments required to make it grow. For instance, you could invest ‘X’ amount in sales, marketing, R&D and so on, to multiply your revenues and customers in multiples of ‘X’ and, where your business allows you to do that, it can be called scalable. This is one indicator that anyone interested in putting money in your start-up will look for. Actually, the scalability factor is pretty high for start-ups in the e-commerce space compared to the brick and mortar models.

Moreover, technology has enabled many businesses to scale up at a faster rate than before. For instance, MakeMyTrip, a travel portal, was able to add more hotels and travel services to its offerings and reach out to more customers by adopting newer technologies. Besides, an e-commerce venture tends to be location agnostic, which gives a boost to a scalable model.

So, an e-commerce company like SnapDeal or Flipkart, with the necessary backend technology in place, can ship its products across a larger geography. Needless to say, the vast discounts and the larger product portfolio only add to the benefit. Likewise, a taxi-aggregation service, once it has its technology and processes in place, can add more taxis to its fleet and expand into newer locations. Some of India’s biggest successful start-up stories, such as MakeMyTrip, Ola and Flipkart, have exactly done that.

UPSCALING OPERATIONS

The right time to scale up is only when your start-up has already met a few conditions. You need to have an established proof of concept and a business that is covering its costs and is earning enough to be profitable. Your processes need to be well established and you should already know what has worked successfully and is likely to continue working. Another way to find out if your start-up is ready to scale up is to ask yourself if your sales are increasing consistently and if you can increase them further by replicating what you are doing.

Remember, those funding you will look for scale before parting with their funds and you need to demonstrate your scalability. One such venture on an expanding spree is Oyo Rooms, the network of branded budget hotels led by Ritesh Agarwal, which, in March 2015, had over 200 hotels in 10 cities. It plans to expand to over 2,000 hotels in more than 50 cities by end 2015.

Says Agarwal: “Our business model is asset-light, which helps us scale up rapidly. Moreover, our processes are so streamlined that we can add a new hotel to our network within a week of signing the agreement.” Oyo’s business is like that of the taxi aggregator Uber, which does not own any cab of its own, but has a network of cabs with drivers available for people to use.

It’s a similar story with the three month old healthcare start-up, Zoctr, a pan-India home and tele-health company that provides a comprehensive portfolio of home-based medical services, including long-term intensive care, chronic care and wellness, and health check-ups. At present, it serves 1,000 patients across Mumbai, but has plans to expand to 12 cities across India in a year and reach out to over a lakh patient.

Most importantly, before you scale up, firm up on a model which does not need too much tweaking. For instance, Carnation, promoted by former Maruti Suzuki CEO Jagdish Khattar, has changed its business model more than once and is still nowhere near to clarity. Of course, Khattar is lucky with funding, as he has an established track record and funders have faith in him. But a smaller start-up would not be so lucky if it does not have a clear scale-up possibility. For that matter, premature scale up can actually kill your start-up.

SCALE VARIATION

Scaling up would mean different things for different start-ups. The founders need to have a well thought out and realistic vision of where they want their venture to reach in the future. The measurement matrix would differ, too. It could be in terms of the customers it wants to have, the locations it wants to expand into, or, how it wants its revenues to multiply.

Take the case of iPay, a hybrid e-commerce platform that taps consumers who are unaware of e-retail and, allows them to buy online and pay offline. It offers an e-inventory by the name of ‘Business in Box’, which is uploaded on a tablet and connects the consumers to e-sellers through local retailers. At present, iPay works with over 3,700 retailers in Andhra Pradesh and Telangana. In the next phase, it plans to expand to four states and reach out to 25,000 retailers. Founder Krishna Lakamsani’s vision is to convert 200 sales on the platform every second from the current single sale every 1.93 seconds.

If you are looking to raise funds to scale up, which a start-up will have to do in most cases, investors would require you to have a well laid out plan and a clear idea of how you plan to execute it.

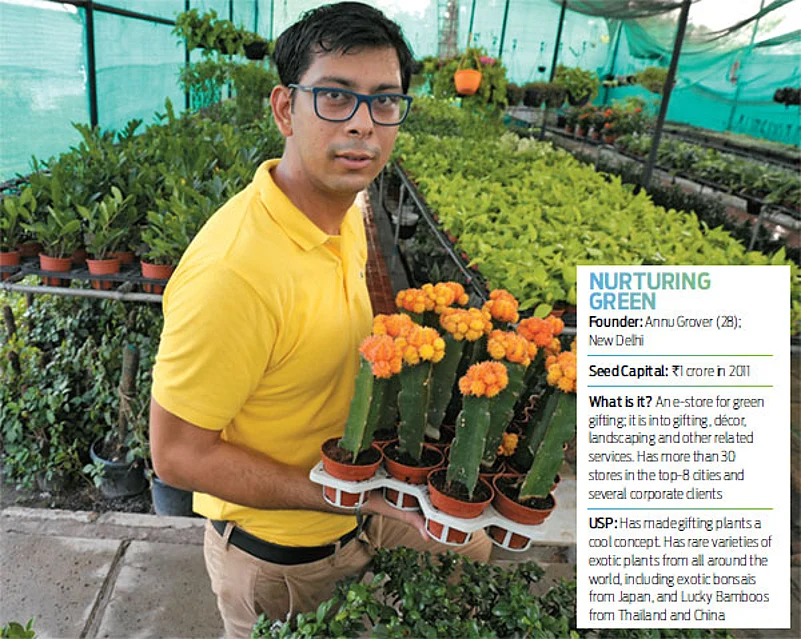

For Nurturing Green, an online store for green gifting, which has more than 30 stores in the top eight cities and several corporate clients, founder Annu Grover has his plans laid out for the next 24 months. He says: “We are looking at organic 2.5-3x growth rate and will be a 150+ strong team by next year-end. We will be expanding the franchisee channel across India and also ramp up the e-commerce reach.”

RAISING FUNDS

Ideally, a start-up should bootstrap till it has its unit economics established and have established systems and processes in place. To scale up,

substantial new investments will need to be made in hiring more manpower, investing in technology, enabling the system to handle more customers, and so on. Obviously, such expansion needs a massive inflow of funds. So, external funding becomes crucial for any start-up’s survival. Luckily, investors, too, want to invest in start-ups that have the potential to grow and so, would be willing to invest in your start-up.

Says Lakamsani, who has bootstrapped iPay till date and is now in the process of raising Series A funding from external investors: “This is the right time to approach investors as we can showcase real time the numbers that give an idea to measure future growth and execution capabilities of the team.”

In some cases, scaling up could mean building a large user base before implementing revenue models.

Nurturey, which offers ‘digital tools’ to support parental needs, has several thousand users in 40 countries. Their next milestone is to have one million parents signed up on their platform.

Says Tushar Srivastava, co-founder, Nurturey: “If a product doesn’t have immediate revenue streams, then it is critical for the entrepreneurs to demonstrate the traction, scale and user engagement in the business. If investors are convinced that a start-up can do well on those three parameters, raising funds should not be very difficult. Several start-ups have proven that once a product has a large base of engaged users, revenue streams can be developed.”

Eventually, execution matters most when it comes to a successful scale up of your business with the funds you have. Nurturey, which has already raised one round of equity crowd funding, plans to use the next round of funding to drive scale and user engagement. Broadly, they plan to invest 50 per cent of the funds in product development and 50 per cent in marketing to acquire users and drive engagement.

For Zoctr, response time is important. Says Nidhi Saxena, founder: “We expect to invest heavily in technology enablement, including remote monitoring, telemedicine and IT infrastructure to be able to serve our customers effectively.” She is closing in on a second round of funding to meet her expansion plans. She also plans to double her manpower going ahead, which is equally necessary for scaling up and to succeed.