In these trying times, many companies have been suffering losses while on the other hand, many have used this pandemic as an opportunity to expand their business. This has led to many unicorns in India stepping into the stock market to raise funds.

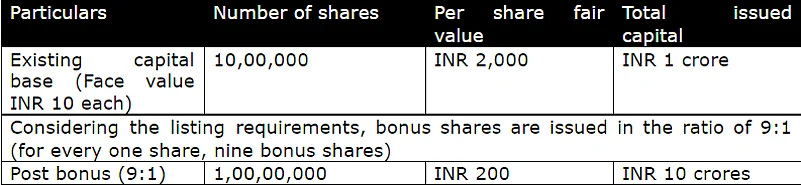

As we are aware, one of the requirements for listing on the BSE includes a minimum post-issue paid-up capital of Rs 10 crores ('listing requirements'). At inception, the unicorns typically do not have a huge capital base. It is only when they intend to list, is the capital base is structured and increased to comply with the listing requirements and to bring down the price per share. This structuring maybe by the issuance of bonus shares.

At the time of IPOs, when global institutional investors sell their stakes, the capital gains tax implication arises. Singapore and Mauritius were the preferred jurisdictions for investment channeling into India. The reason for these jurisdictions to be tax-efficient was on account of the favorable language in their tax treaties with India, wherein on sale of shares of Indian entities, India did not have the right to tax. However, according to the amendment in the tax treaties on shares acquired on or after April 1, 2017, India now has the right to tax such capital gains.

Taxation as short term/long term capital gains

The transferor shall be liable to pay tax on capital gains arising on transfer of equity shares, depending on the cost basis, according to IPO.

If the equity shares are held for more than 24 months, the sale proceeds shall be taxable as long-term capital gains at 10 per cent; and If the equity shares are held for 24 months or less, the sale proceeds shall be taxable as short-term capital gains at 15 per cent.

Let us understand the tax angle with help of an illustration; Assuming, the investor has invested in a unicorn at a per-share price of Rs 100 in 2014 and near to listing, the per-share price is about Rs 2,000:

It is clear that had the investor (from Singapore/Mauritius) exited before the above bonus, there would have been no tax on capital gains of Rs 1,900 per share on account of grandfathering provisions in respective tax treaties (assuming other treaty requisites are complied with ).

Taxability of bonus issue is where the snag arises. The bonus shares may be contended by tax authorities to be fresh issuance of shares on or after April 1, 2017, and hence, not grandfathered under Singapore / Mauritius tax treaties. Assuming an investor holds 200,000 shares, it could lead to tax outflow on about 95 per cent (Rs 36 crores out of Rs 38 crores) of the realized gains in case of a complete exit by the investor on IPO. It seems that aforesaid potential implications may not have been envisaged by investors at the time of original investment.

It would be worthwhile to analyze whether it is possible to take a position that as bonus shares received later based on the original investment made before April 1, 2017, the provisions of grandfathering may be available. This is having regard to the clarifications relating to General Anti Avoidance Regulations issued by the CBDT vide Press Release as well Circular No 7 of 2017 both dated: January 27, 2017. However, if tax authorities do not agree with the aforesaid position, the matter may have to be litigated. A specific clarification by the government on the grandfathering for such bonus shares under the treaties would be a welcome step.

Needless to add, the capital structure has to be carefully looked at and tax positions need to be evaluated by investors seeking tax treaty benefits on exit, as part of the listing.

The author is Partner, Deloitte India, with inputs from Janak Thakkar, Director, Deloitte India & Pragya Paliwal, Deputy Manager, Deloitte Haskins

DISCLAIMER: Views expressed are the author's own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organization directly or indirectly.