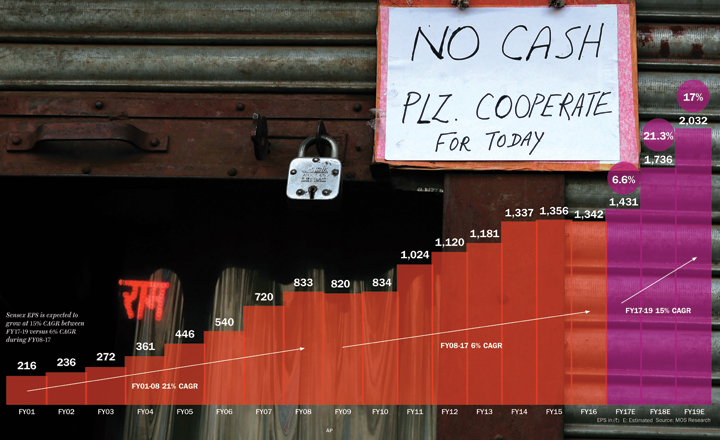

FY17 had begun on a very positive note — thanks to a normal monsoon after two years of consecutive drought, 7th Pay Commission awards, and softening interest rates. The narrative was shaping up well till the second quarter of the current fiscal. But then, the big D made its mark in the middle of the third quarter and overturned the applecart. Post demonetisation, the earnings recovery expected in FY17 was thrown out of the window as the Street was swift in lopping off growth in various sectors. Now, the market is looking at another muted year of Sensex EPS growth. Several sectors — automobiles, consumer, private banks, and NBFCs are expected to report multi-year low earnings growth in FY17. Telecom, technology, and utilities are expected to be hit by sector-specific issues. The good news is that, given the lower base of FY17 (especially in 2HFY17 due to demonetisation), analysts are pencilling in a sharp 21.3% rebound in FY18. Given the number of variables that are going to come into play during the year, the visibility of FY18 growth is hazy, as several moving parts are around GST implementation, pace of re-monetisation and consequent restoration of trade normalcy.

Great Expectations

Analysts expect a bounceback in Sensex earnings post demonetisation

Opening

Opening