At 23, Kolkata-based Saikat Chakraborty, exhibits the maturity of a seasoned traveller and professional. He is a frequent flyer,

flying out of Kolkata at least twice a month. That’s nothing very different from scores of other travellers except for the fact that he does it more smartly: he uses a co-branded credit card to book tickets, and earns reward points in the form of miles.

“For the past two years, I have been using the JetPrivilege HDFC Bank Platinum credit card, with annual spends of over Rs.3 lakh,” he says. He earns miles even on his non-airline transactions. “I get 5 per cent discount on base-fare for all flight bookings on the Jet Airways website,” he adds.

The easy availability of credit cards and, consequently, the increase in credit card transactions has led to a number of card users making the most of cards by way of value addition, mainly through co-branded credit cards.

Take for instance, 35-year-old Sohini Gupta from Kolkata who uses a Citibank Indian Oil credit card. She says, “I drive a lot and felt that such a card would give me benefits every time I refuelled, and it does.”

Value addition

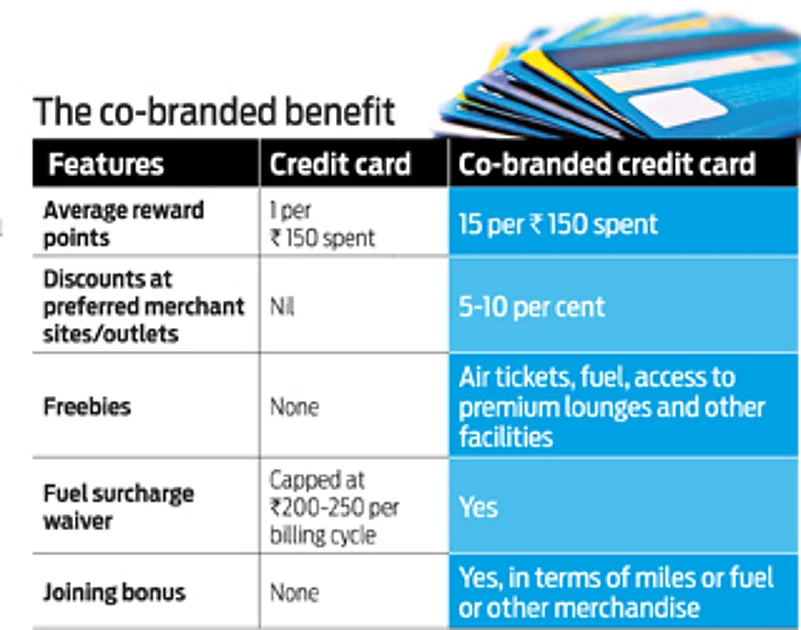

Co-branded credit cards typically involve three players—the issuing bank; Visa, MasterCard or American Express as the card network, and lastly, the value-adding partner such as airlines, store chains and oil companies. The extra benefits from such cards typically include access to airport lounges, exclusive sale previews and exclusive privileges.

The cardholder usually gets the benefit in the form of additional points earned on card usage, especially on the co-branded element. So on fuel purchase, the cardholder earns more points on his Indian Oil co-branded credit card, just the way he would earn more air miles (Jet Mileage points) on his Jet Airways co-branded credit card.

Says Anil Ramachandra, EVP and Head, Retail Unsecured Assets- Credit Cards & Personal Loans, IndusInd Bank, “In a good cobrand, the cardholder gets greater value from a brand or service, which the customer already likes and aspires for while the credit card issuer gets a customer who is active and highly engaged with the credit card. The partner brand gets a customer who is strongly connected to its services and uses it extensively.”

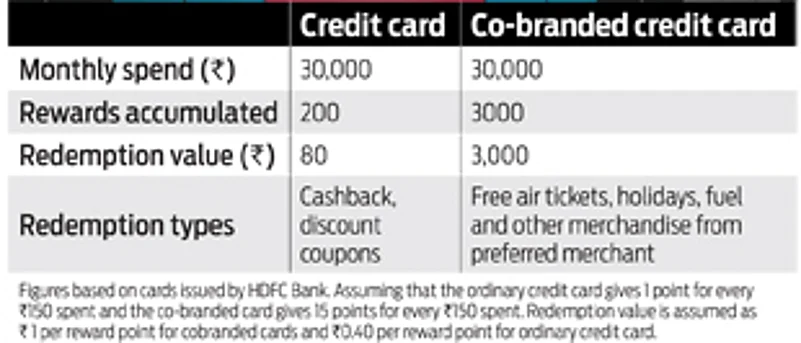

It is for this reason that among the discerning cardholders, a co-branded card holds more value than a plain vanilla card—which has no bells and whistles—and even better than the cashback feature offered by many card issuers.

To cash in on their popularity, most banks and card networks have co-branded cards to cater to an evolved card using audience. So, if you are a brand loyal consumer and spend quite a bit of money on your favourite brand, co-branded card is the perfect choice.

“HDFC Bank and Jet Airways have loaded the co-branded card with various benefits, including base fare-waived tickets, discount vouchers, bonus joining miles and, in addition, on all spends the customer receives JP miles,” says Parag Rao, business head-cards, payment products and merchant acquiring services, HDFC Bank.

Says Chakraborty: “The JetPrivilege HDFC Bank Platinum Credit Card came with great features, including 4,000 JetPrivilege (JP) miles when I was issued the card.” He earns 5 JP Miles for every Rs.150 he spends on the card and 15 JP miles for every transaction he makes on www.jetairways.com.

IndusInd Bank has a similar card. Says Ramachandra: “With the Jet Airways IndusInd Bank co-branded credit card, cardholders can earn up to 16 JP Miles for Rs.100 spent on specific spends categories.” The benefit for the cardholder with the accumulated miles is that it can be redeemed against airline fare or one could opt for the holiday offered under the Jet Privilege programme.

For the past four years, Gupta has benefited from her co-branded Indian Oil card which earns her 4 Turbo Points for every Rs.150 spent at any authorised Indian Oil outlet across the country, and 2 Turbo Points for every Rs.150 spent at groceries and supermarkets and, 1 Turbo Point for every Rs.150 spent elsewhere, such as shopping, dining and more. “I can redeem the points with fuel worth `1 for each reward point, which ensures I get great mileage out of the card,” she says.

There are also banks that provide gift vouchers equivalent to the joining fee on these cards. Freebies include fuel surcharge waiver and accident insurance cover. The latter is also offered on ordinary credit cards. The HSBC MakeMyTrip credit card offers free flight tickets as bonus gifts when the bank issues you the card. The HDFC Bank Platinum Times card offers 25 per cent discount on movies and 20 per cent on dining.

To lure spenders, such cards also throw in free merchandise on joining their credit card programme. But these cards do come with checks and balances—the rate of interest on late payment on these cards is higher than that on ordinary credit cards. There are other limitations too, like in case of the SBI IRCTC co-branded card; you need be the traveller when booking the tickets to take the benefit of discounts and accumulate points. In the case of IndusInd airline card, higher reward points accrue on international travel when flights originate from India. Where it hurts is the annual fee or joining fee on co-branded cards, which can go as high as Rs.1 lakh, such as in the IndusInd Bank Pinnacle credit card, which offers associated benefits from Jet Airways and Oberoi Hotels. Besides, reward points have a finite life and need to be claimed within specific time frames, post which they lapse.

Yes, co-branded cards provide value; but it is only for those who can milk it well, which is why one should not blindly go for one without understanding its workings and benefits. Perhaps that’s why Indian spenders typically prefer cashback cards to co-branded cards, which have more fans following for the instant gratification. Our advice: tread with caution when opting for a co-branded card.