Congratulations, Chiranjib and Shwetha for the scheduled wedding in June this year. It is heartening to note how you both are working towards not only planning your wedding but also the finances post that. A small advice: money is one of the top reasons for discord post marriage, so be sure that you work collectively when it comes to finances. A simple way around this issue is to establish an open dialogue to help you ensure a long and happy marriage.

You both seem to have done a good homework by answering some important questions like understanding your financial goals, financial habits and things like combining your finances or managing them separately. This effort will go a long way, because most often new couples find it hard to talk about money or they feel embarrassed about issues like debt or lack of credit. Keeping your household finances and investments in order is all about maintaining discipline and following a predetermined strategy.

Follow the plan

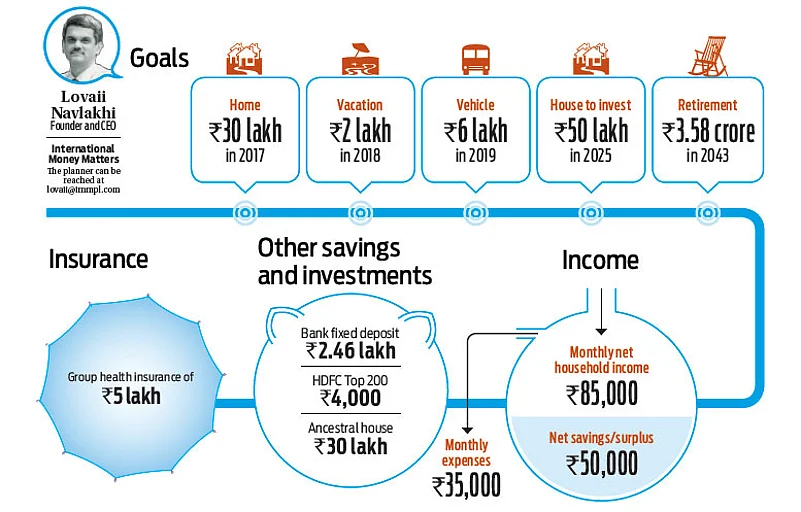

Our planner has laid out a roadmap for you, which is in line with your financial state, comfort and risks. By following it, you will reduce a lot of stress around money issues and get time to enjoy each phase of your life as the goals that you have listed materialise. One aspect that you need to plan for, which has not been listed, is children. Agreed, it is too early in the day to think of that, but do keep in mind that the birth of a child will completely alter your finances. What came as a surprise while going through your financial details was the absence of a life insurance policy. Nothing wrong with it at all, as long as you think that you did not need one if you did not have any financial dependents (Read: When you need life insurance). However, as you are stepping into greater responsibilities, it is advised that you take on a life insurance policy at the earliest and keep reviewing it as your financial goals are fulfilled and new ones add up. In the same manner, our planner has suggested that you take adequate health insurance policy and add other members of the family as your family grows.

While you are starting your financial journey on a clean slate, it is essential to understand that for wealth creation you need to have exposure to equities. A relatively less risky route is to invest in mutual funds and we suggest you invest from the OLM Elite list. To make your investments tax efficient, you could start by investing in tax planning funds as these will allow you to claim tax deductions on investments up to Rs. 1.5 lakh under Section 80C and expose you to the workings of mutual funds.

For retirement, you can also consider the NPS, which has an additional investment window of Rs. 50,000 that qualifies for exclusive tax deduction. Suggest, one of you at least start contributing towards this scheme to ensure that money is being saved exclusively for your retirement. Overall, based on your current stated financial needs, you are on course and can achieve all that you have listed. A final advice: no two people have the same ideas and philosophy about money and investing, so it is important to determine upfront what is important to both of you. Once you do that, then you can start making better decisions about your money and investments as a couple.

A Plan to act upon

Emergencies

- Set aside 4-6 months of household expenses to begin with

- Set aside Rs. 1.5 lakh-Rs. 2 lakh in a bank fixed deposit or liquid funds

- Continue maintaining Rs. 2.1 lakh of your FD towards contingency fund

Insurance

- Rs. 75 lakh life insurance for Chiranjib and Rs. 50 lakh for Shwetha

- Purchase independent health cover of Rs. 3 lakh each that allows you to reduce your dependency on the company sponsored cover with top up of Rs. 5lakh already available

- Recommended to purchase critical illness cover of Rs. 10 lakh each

- Likewise, take a personal accident cover of Rs. 40 lakh and Rs. 25 lakh for Chiranjib and Shwetha respectively

House for self occupation

- You are staying in an ancestral house in which you have 1/3rd share, understand how and when this will come to you before you plan the purchase of your own house

- Reinvest a portion of the FD after setting aside what you will need for the emergency fund

- Continue investing in the mutual fund you have chosen to build corpus for this goal

- Fund 20 per cent of the goal amount through down payment and balance through a home loan

- It is recommended that you invest Rs. 27,415 from April 2015 till April 2017 in short term investments to create funds towards down payment

Vacation

- Start investing Rs. 7,464 in a monthly

- SIP in short term investments.

Vehicle purchase

- Recommended that you fund 50 per cent of the goal value and raise the balance through a vehicle loan

- Start an SIP of Rs. 5,423, increasing it by 15 per cent each year from April 2015 till April 2019, the year when the purchase is to happen

House for investment

- As there are no other stated goals after the purchase of the vehicle, a large portion, to the extent of 70 per cent of the property purchase, can be met through self-funding

- To accumulate the required corpus, you need to start a monthly SIP of Rs. 13,871, increasing it by 15 per cent each year starting April 2019 till April 2031 in diversified equity funds

- For the balance, it is recommended that you take a 10-year home loan

Retirement

- You will need Rs. 1.53 lakh every month starting 2043, which translates into Rs. 30,000 in today’s value

- In order to meet inflation-linked expenses for 20 years post retirement, a corpus of Rs. 3.5 crore will be needed by the two of you

- The corpus has been calculated for 20 years post retirement instead of 15 years due to increased life expectancy in India

- After adjusting the rental income from investment property, the corpus required would be Rs. 2.4 crore

- Use the EPF contributions to fund retirement requirement, assuming your contribution towards the EPF will continue until your retirement.