Single income with five dependents, including parents and children, puts Bengaluru based Tapan Sharma in a tight spot, which is reflected in his monthly cash flows leaving very little at the end of each month. The Sharmas are also in that phase in life when there are many financial needs to meet; putting them under financial risks which, if not addressed early, can offset their future goals.

The family should take a moment to sit down and carefully evaluate their situation. The family should start by determining its financial flows by making a budget that it needs to follow meticulously. This process will help them prioritise expenses and eliminate unnecessary spending. They should carefully examine all their expenses and determine which are the most important, and do away with expenses that are avoidable. While it might not be much fun to cut out some of the things the family is used to, it might be necessary to keep them from slipping into an even deeper financial hole.

Finding extra money

Ideally, Tapan should have some money set aside as emergency corpus, especially when he is the sole earning member with too much riding on his income. Add to it that he is servicing a loan, which significantly eats into Tapan’s income as a monthly commitment, which will stay for another 15 years. He does not have significant savings to act as a buffer in a crisis and that is something he needs to fix right away. Likewise, Tapan is grossly underinsured and needs to start adding to his insurance cover—life and health—to be in a position for his family to handle eventualities.

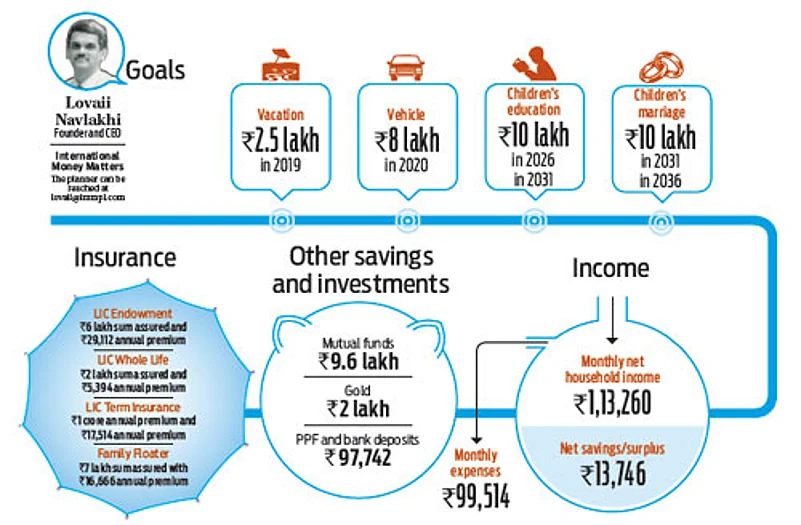

The upside, when looking into his finances, Tapan has investments in mutual funds worth Rs.9.6 lakh. There is also Rs.7 lakh in his EPF account and Rs.57, 742 in PPF savings. However, his finances are stretched because of home and personal loans of Rs.4.5 lakh. While the EPF balance may be tempting, Tapan will need this for his retirement and it should be set aside to meet that goal. He should utilise his current mutual fund investments to create an emergency corpus and use some of the remaining to foreclose his personal loan. Professionally, Tapan should look at increasing his income each year for the next five years by at least 10 per cent to meet his future financial goals. Likewise, some of the goals need to be pared; for instance, instead of Rs.15 lakh for the children’s education, save Rs.10 lakh; reduce the expense on a new car and vacation.

Most importantly, Tapan’s wish to retire early is practically impossible. His financial commitments are such that he will not be able to retire before he turns 60, to maintain his desired lifestyle. He should stay put, review the goals that are still some years ahead and start increasing his monthly savings to make it work for him in meeting future goals.