Gone are the times when long queues in banks and them closing early on Saturdays needed harried discussions. India’s banking sector has come a long way in realising and achieving feats that were left to one’s imagination. Automation has reached a stage where banking no more needs humans to do things that once were their prerogative.

Many today will not believe that till a decade ago, most people would rush to the bank every month, and some every week to deposit or look at their bank balances. A lot has changed with the advent of app based transactions; life seems easier. Indian banks have undergone a sea change since demonetisation and the development of apps and other cashless digital features, redefining the way one banks. The changes have occurred at both back-end and frontend operations.

Enter robots

Robots and humanoids are changing the face of banking with the emergence of virtual reality and artificial intelligence. There are several humanoids today managing various automated tasks at bank branches on their own. These interfaces can answer more than 125 subjects related to banking that are commonly sought by account holders. Information regarding account balance, interest rates on home loans, deferred payments or possible charges to be incurred on fixed deposit closure among others are some of the queries to which these answer with aplomb.

“Effectiveness of artificial intelligence (AI), machine learning, robotics and cognitive automation in direct proportion bestow rise in the quality and quantity of training data that the systems are exposed to. The conditions are ripe for India to emerge as a leader in AI. Some of the major areas of application of AI in the banking and financial services sector include early detection of financial risk and systemic failures, and automation to reduce malicious intent in financial systems, such as market manipulation, fraud, anomalous trading and reduction in market volatility and trading costs,” said PwC and the Associated Chambers of Commerce and Industry of India (ASSOCHAM) in a joint study on Artificial Intelligence and Robotics.

Convenience is a tap away

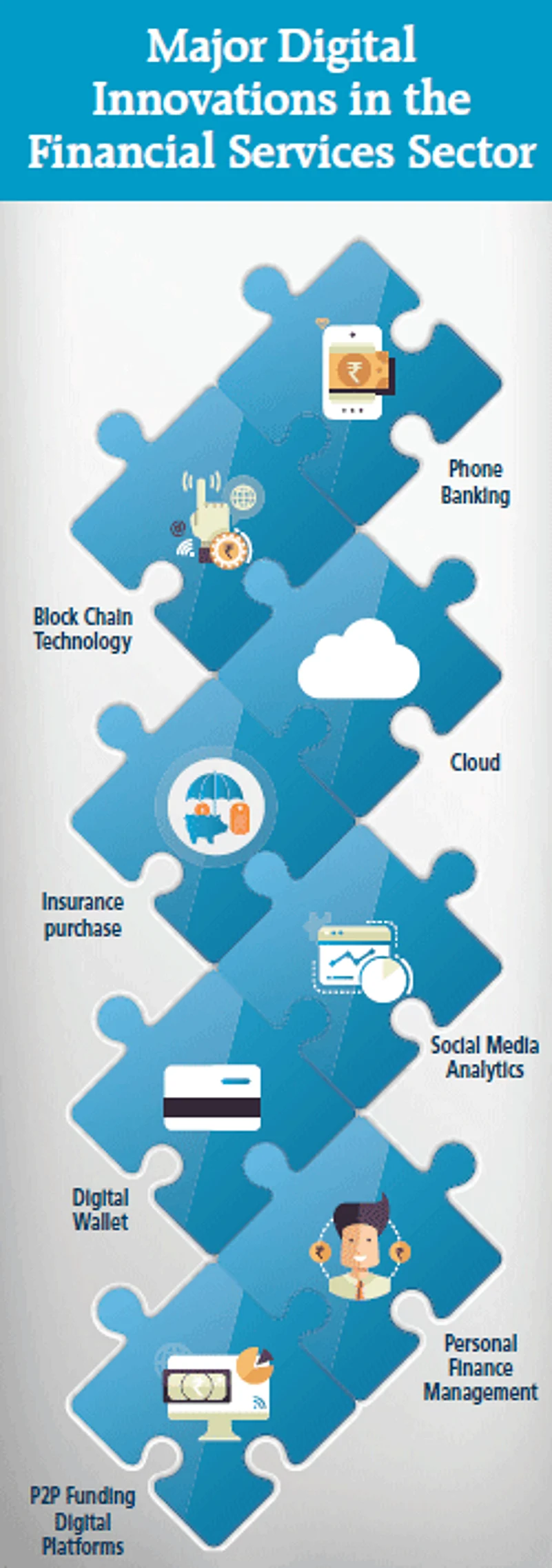

Applications and mobile based transactions are not the only vintage to be revamped, financial products such as health insurances, mutual funds and other investment options offered by banks have also seen a change in terms of the way they are sold and marketed. Be it booking flight tickets, ordering a pizza or just shopping online, you can do everything from your Smartphone, because once your bank details are stored, you have the key to explore all that you wish to transact on.

No wonder today flight bookings, shopping and buying movie tickets have all moved online through the Smartphone because it is possible to transact for these services through one’s phone. The list of transactions does not end here—one can also invest, saver and insure oneself digitally. Insurance is without a doubt the most widely owned financial instrument by Indians and premium payment is almost fully shifted to the online mode in case of many insurers. Even policy purchase has gone up digitally.

Not only the young, even senior citizens are fast finding it convenient to transact through the digital medium. The very fact that one need not look for the time to engage in a financial transaction has meant that one can use the digital interface to manage their monies. Credit also goes to banks and insurers who are using technology to enable hassle-free services for customers on their smartphones.

Safety

Compulsory registration of KYC is one of the indicators that banks are now starting to move towards responsible as well as responsive relations with its consumers. Talking of the new age form of banking, one cannot ignore peer to peer lending groups that are starting to make their presence felt in the online credit and lending space. Already, credit score companies are using the digital medium to arrive at the score based on one’s digital footprint, a lot of players are helping banks with the much needed technology to understand the consumer behaviour and need for credit.

Banks no more are the boring traditional money centric bodies. They are starting to redesign themselves because times are fast changing and the Indian banking sector has left no stone unturned in marching to the tunes of the same. It is probably time we not only start realising the benefits of these facilities but shred our hesitations and begin using them for our enhancements.

Money transfer

Today, the UPI is the cheapest method of fund transfer and because of its low cost, the UPI has the potential to promote the non cash transactions of small amounts. The kind of transactions that are possible through the UPI has reduced the dependency on cash. Although, card payment, net banking and mobile wallets are widely used; the UPI scores with its low value transaction, next to nil charges and smooth transfer of fund. With the advent of UPI, several people have reduced their trip to the bank ATM.

Moreover, the UPI is a safe route to financial transactions. For instance, most of us avoid using online transaction and card payment because it asks for the bank account details. For card transaction, you give card details which include card number, validity period and CVV number. In similar vein, net banking transaction exposes your bank account details.

Due to these concerns, card and online payment is not a popular thing. However, the UPI solves this problem.

Payment through the UPI does not require the card details or bank account details. You only have to give the virtual payment address; virtual payment address is similar to our email ID and is easy to remember. The fast paced changes in banking are not only challenging conventional banking, they are also increasing the usage of digital banking, which is making banking and transactions convenient and safe on your smartphone.

Advantage UPI

Not everyone uses the card for payments. Not everyone uses netbanking for the online payments. People are reluctant to use the non cash methods because of security concern. In such a context, the UPI is more secure than the present mode of transaction. While transacting through UPI, you never share your bank account details. You do not enter your credit card number or CVV. You only give a virtual payment address which does not give any clue about your bank account.

Also the authentication takes place at your smartphone. It is done by punching the two different PINs. You can easily make it discrete while typing at your smartphone.

- Available 24/7

- Single app to access different bank accounts

- Single click authentication

- No timeout scenario

- Secure virtual ID