Retirement is not an individual decision, it is a decision that you need to make with your spouse and family. While it is tough to decide when you want to retire, it is tougher still to choose where you want to retire. Our working lives are such that we tend to have explored several cities before figuring out where to retire, but that should not be a reason for you to postpone the planning process.

In the following, you will see the benefit of starting early when it comes to retirement, the various ways by which you can accumulate your retirement corpus, use the corpus in a tax efficient manner and also explore various benefits that are available only to senior citizens. On a lighter note, the last page of this edition is also dedicated to the senior citizens, with a collage of pictures of them.

Before you start flipping over to the story, here is a simple way to gear up to retirement—start saving for retirement right now. Once you start, all you need is to increase your contribution and fine-tune the plan to generate retirement income when you need it the most—in retirement.

You must be joking is a typical response one gets from a 20-somethingwhen asked about their retirement plans. When we first start out in the workforce, retirement often seems a long way off and is least of our priorities. After all, most of us will have a career spanning30-35 years, or even more. Rising longevity has meant that, for all practical reasons one will need to work significantly longer to build a sizeable corpus to see through the retirement years. The fear of out living your retirement savings is a real risk that one faces today, given the volatile stock markets, high inflation and low interest rates; in the midst of advances in healthcare.

The reality, however, is that as time goes by, we get caught up with buying a home, raising a family, and doing all the things that make life rewarding. All these financial activities result in planning for retirement being pushed to the backburner, as near-term financial goals super-cede the long-term ones. Says Sunil Subramaniam, CEO, Sundaram AMC: “The moment one starts earning a regular income, they should start retirement planning. The earlier, the better because the power of compounding can come to aid that much more”. In your 20s, you have your first proper job with a proper salary, and even though retirement may seem a long way down the future, the mandatory contribution to the provident fund scheme is a good option to take seriously and get used to.

Take the case of Delhi-based, 34-year-old Raj Kumar as an example. He worked in the US for close to a decade and experienced the benefits of starting early with retirement savings. “The way it was in the US, you ended up mandatorily contributing to a mutual fund type of investment for retirement. It resulted in understanding the importance of equities as well as investing regularly for retirement,” he says. Contributing to your retirement plan is one of the best ways to give yourself long-term financial security, regardless of your age.

The earlier, the better

Generally speaking, the sooner you start saving, and the more you save, the more money you could have set aside when it is time to retire. In addition to helping contribute to your future financial security, there are also benefits you can enjoy today when you participate in your retirement plan. Moreover, when it comes to investing, time can literally be money. This is particularly true with respect to an investment process known as compounding. Compounding is what happens when the money you save (in a savings account, a mutual fund or the provident fund) grows and that increased amount remains in your account to be reinvested to potentially earn even more.

When it comes to saving for retirement, most tend to wait. Many actually delay the start as they feel they have plenty of time. The advantage of starting early on the other hand, however small a start it may be is far better than the impact the cost of waiting can have on your retirement balance. “Someone in their 30smay not have an idea of the exact expenses after retirement which makes it difficult to estimate expenses at this stage. In such a situation, one should compare income to expenses and go with 75-80 per cent of the current income figure to save for,” advises Hemant Beniwal, CFP, Principal Financial Planner, and Ark Financial Planners.

Mumbai-based couples Soniya and Bhaven Doshi have fairly different risk profiles, but when it comes to saving for retirement, both agree that it is a priority for them. “I seriously started looking into retirement planning only a few years after I got married in 2011,” says Soniya. In contrast, Bhaven has been planning for retirement from the day he got his first pay cheque. “My dad educated me on the investment opportunities from tax saving and retirement perspective, which I feel is the best way to approach planning for retirement,” he says. The two are very concerned about their retirement and ensure that it is one financial plan that they wish does not go wrong.

To address the dilemma of how much you need in your 20s and30s, make sure that you are saving a significant part of your income towards retirement. The approach needed is of income replacement in this stage. So, if you are earning Rs.1 lakh a month, think of inflation adjusted figure that you should invest towards when you retire 25-30 years later. Likewise, when you are in your 50s, you would be in a better position to know of your essential expenses, which will help you save and invest to build a corpus that can take care of the expenses you will incur in retirement by way of expense replacement calculations.

Cost of delay

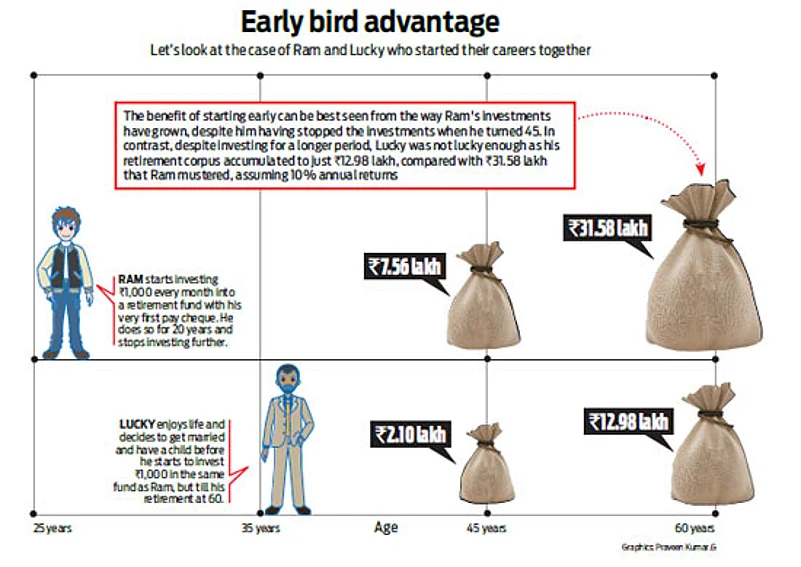

Like every other financial goal, there is a cost of delaying, which could be significant depending on how long you delay. Here’s an example. Two friends, Ram and Lucky start working for the same company at 25. During their first 20 years, Ram saves Rs.1, 000 a month through a retirement plan, while Lucky saves nothing. After 20 years, Ram stops contributing entirely. Meanwhile, after a decade of no savings, Lucky starts saving at age 35, saving that same Rs.1, 000 a month. But unlike Ram, Lucky continues investing till he retires at 60. Ram has put only Rs.2.4 lakh into his account while Lucky has saved Rs.3 lakh. But because Ram started sooner, he has Rs.31.58 lakh in his account at retirement, versus only Rs.12.98 lakh for Lucky, assuming they both earn 10per cent a year on their money (See: Early Bird advantage). That’s the power of time and compounding.

“Treat retirement as a specific goal and invest accordingly. Just like provident fund (PF) is deducted from the first salary, you must start investing in equities via mutual funds from the first pay cheque for a regular and disciplined savings which will help you beat inflation by providing higher returns in the long run,” advises Harshendu Bindal, President at Franklin Templeton Investments (India). In the absence of any form of social security, it’s up to you to ensure that you have enough to maintain your lifestyle after retirement. As one can take higher risk with investments in their early years of working, it is advisable for them to allocate significantly inequities as an asset class to benefit from its ability to beat inflation in the long run.

“Don’t let lack of awareness come in way of your retirement plans. In the absence of 401(k) plan that I was used to in the US, I explore other similar options and have been investing in equity mutual funds as part of my retirement planning,” sums up Raj Kumar. Mutual funds are not the only available instruments when it comes to saving and investing for retirement, there are other options (See: Planning for retirement on page 44) such as insurance and the NPS to suit different needs. Which is why, though the PF forces you to contribute towards retirement, it may not be enough, as you need a retirement plan to have enough money to lead a comfortable life in your 70s and later, without impacting your lifestyle.

It is natural to ask how much is enough when it comes to saving for retirement, but instead of

putting off saving for the retirement because of no clear answer, you should not deprive yourself of the money that you could otherwise save. “Have a casual conversation with retirees to get an insight into the expenses post retirement, mainly to gauge the impact of inflation. They would perhaps give you examples of how day-to-day expenses have grown over the past three to four decades since their first employment. These discussions could provide greater insights into the importance of retirement planning,” advises Bindal.

If you have already started saving, you’re on the right track and should consider increasing

your contribution level periodically to further fuel your retirement savings. If you haven’t started saving through your retirement plan, think about starting off right away, and contributing what you can. Make monthly contributions so that it is in line with your monthly earnings by way of income. This approach will not put undue burden on you to park lump sum into investments from time to time.

Planning for your retirement is a lifelong process, not just something you worry about once you are nearing it. But a good way to start working towards your retirement plan is to set a financial goal yourself and a roadmap that will lead you to it. The inherent advantage of starting early in planning your retirement is that it becomes a habit which pays off in the long run.