The natural result of better health care facilities has been rise in longevity. We live in times when one will be easily living for two decades or more in retirement. Yes, this poses the risk of a retired person outliving their retirement corpus if they have not planned their retirement well enough. It is natural for one to worry about having adequate money in retirement. Contrast this to another reality where scores of young Indians are aiming to reduce their working lives to take retirement in their mid-40s or by the time they turn 50. There is nothing wrong, as long as one has factored all these things at the time of planning.

A simple plan that many in their 60s are adopting these days is to stretch their working life to late 60s and in some cases even their 70s. The reason to do so is to balance the uncertain aspect of finances in retirement. “I worked with the Indian Railways, which ensured I would get pension that is sufficient for me to lead a comfortable life,” beams Delhi-based Surinder Kaur, 61. There are many like Kaur who have started to spend the time in hand to travel and sometimes even explore hobbies that they did not have time for in their younger years.

Although the fact remains that a fat nest egg and good health is a must for a comfortable life in retirement, you can further make it more meaningful by keeping yourself occupied and being happy. Yes, you can set your own schedule and timelines for daily chores, but remember that chances are that you would have got so much used to a routine by the time you retire that more often you will find it tough to adjust to any changes. So before you take the retirement plunge, make sure that you worked out the details, be it the city you wish to move to or the financial plan that will work for you in retirement.

Retiring early

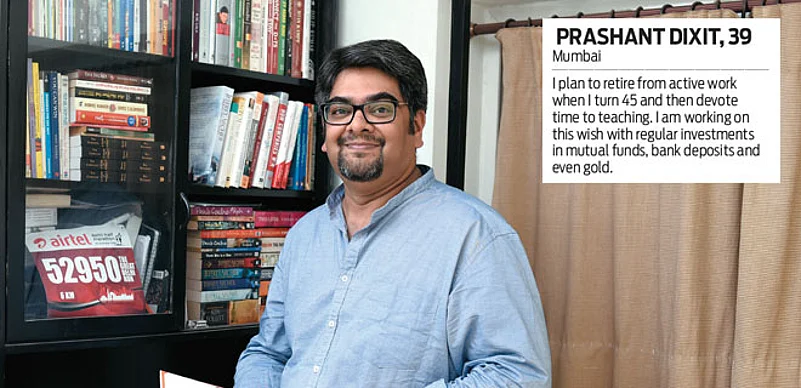

The shift in trends of wanting to retire early is not just for the super rich. There are several others who find it better to get out of the rat race, and take what many like to slot as early retirement. These are people who are not chasing big dreams and are satisfied to make some cuts, while managing a life where they chase to earn to save for retirement dips. “When I initially calculated how much I will need to retire at 45, I realised it would be a huge sum. Today, I think with Rs.1-1.5 crore I will be able to retire from active work,” explains Mumbai-based Prashant Dixit, 39.

Dixit works for Vmax, a mobile technology company as a business head, and is looking forward to a day when he would spend time teaching, even if it is for much less than what he earns today. “The chase should end, and you should have time in hand to get into other hobbies and interests,” he adds. What you need to factor in when you are planning to retire early from your job is to create a corpus for many more years than those you spent working. This is definitely not for you, if you are the sort who lives pay cheque to pay cheque.

Senior plans

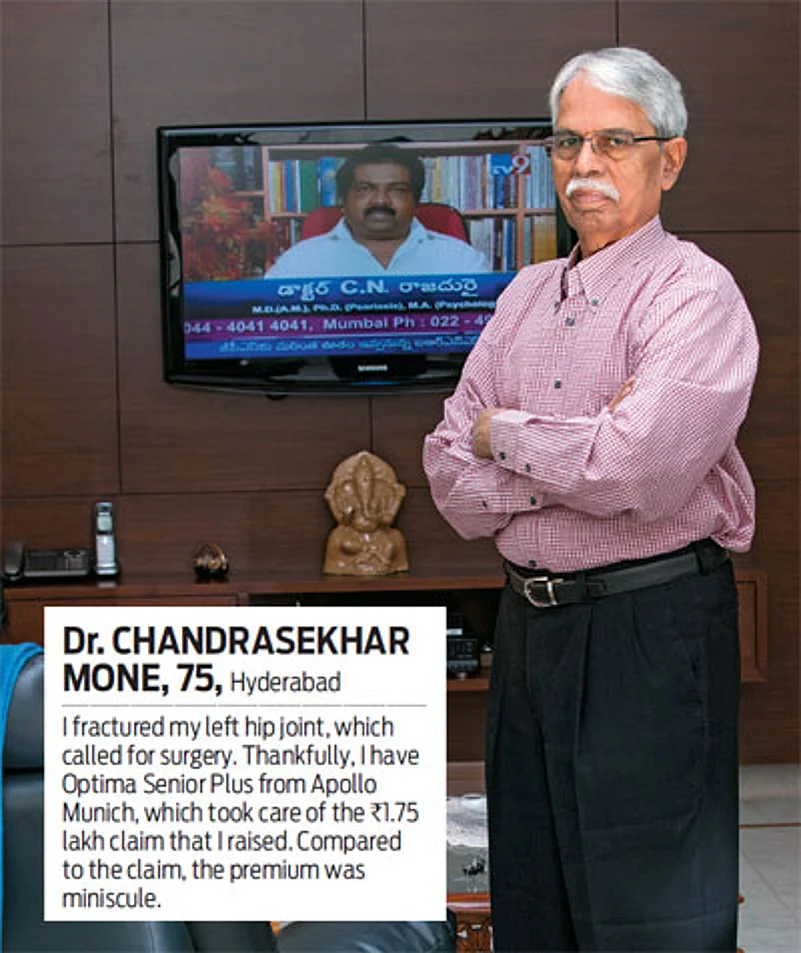

There are several financial instruments that are available only for senior citizens. For that matter, there are special slabs for senior citizens when it

comes to paying income tax, including a slab for the very senior citizens who are over 80 years old. In fact, most banks offer a higher deposit interest to senior citizens on deposits that are below Rs.1 crore. These rates are typically 0.5 per cent higher than those available to others.

Likewise, there is Senior Citizen Savings Scheme (SCSS), open to only those above 60 years of age. One can invest anywhere between Rs.1,000 to Rs.15 lakh in this scheme which pays an annual 9.3 per cent return per annum, payable on March 31, June 30, September 30 and December 31 each year. This scheme comes with a five-year lock-in and can be extended for further three years.

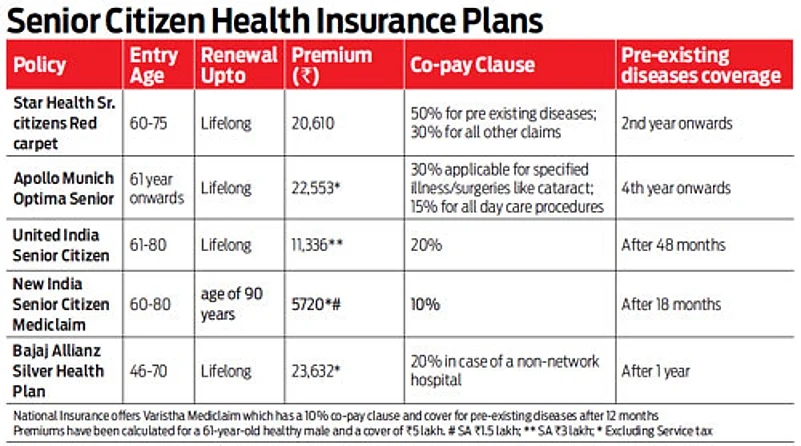

Then there are health insurance plans that are specifically targeted at senior citizens (See: Senior Citizen Health Plans). These plans have been constructed keeping in mind the health-related risks that senior citizens are exposed to. Dr. S Prakash, ED, Star Health and Allied Insurance, says: “For an adequate health insurance cover at an optimal cost post retirement, the individual should start planning before retirement. The entry age for such policies goes up to 75 years at the time of policy commencement.” In fact, with health insurance, understand the other factors like copay, which sometimes is mandatory and entails you to pay a certain percentage or a certain fixed amount of the claim. Although this makes the premium way cheaper and affordable, opt only if you can manage the payment when needed. Again, a factor to consider with these plans is coverage for specific diseases, as age-related health complications are likely to be more prevalent. Where you should focus most is the waiting period to make claims on the policy—look for a policy with short waiting period.

Special benefits

Special concession to seniors is not just on financial instruments; it exists on travel too. The Ministry of Road Transport and Highways has reserved two seats for senior citizens in front row of the buses of the State Road Transport Undertakings. State road transport corporations have discounted fares for senior citizens as well. Likewise, Indian Railways also provides for 30 per cent concession in all classes and trains, and has separate counters for senior citizens to purchase tickets. These benefits are extended to air travel, with Air India providing 50 per cent discount on normal economy class fare in all domestic flights to those over 63 years. Some of the private airlines also extend this benefit to the seniors. State-run telecom service providers, BSNL and MTNL, also provide for discounted tariff for senior citizens.

Retirement commune

Although community living has been prevalent in parts of India for long, it really has taken off in the past decade with more young Indians setting abroad, making it a natural process for their dependent parents to live in the safe environs of retirement homes and communities. Do not mistake these to old age homes. Such communes encourage senior citizens to be in the midst of people of similar age groups. They also help them maintain their lifestyles, without being too much bothered with the day-to-day running of their lives. “I moved into this gated community on the East Coast Road because it was becoming unsafe to live alone in my T Nagar flat in Chennai,” recounts Raghav Chari, 74-year-old retired Southern Railways chief engineer.

Chari and his wife moved into a swanky home which has 100 other residents of similar age group. The community has been built to suit senior citizen living and comforts. It has access to emergency healthcare with a doctor on premises round the clock. “We also have a daily shuttle to the city, so if someone wants to visit Chennai for some work, they can do so and get back easily,” adds Chari who visits his city flat twice a month to collect posts and meet friends in the neighbourhood. The crux of life in retirement is that it gives you time to be happy. It is the stage of life when you can set your own schedule, take long vacations, and put all the money you’ve been saving all through your working life to good use. Make it the most blissful phase of life, for you should not have any regrets, at least not in your retirement.