If you fear income tax, rest assured, the Prime Minister is well aware of your concerns. A few months ago, PM Narendra Modi asked tax officials to remove fear of harassment from the minds of taxpayers and focus on five pillars of administration—revenue, accountability, probity, information and digitisation (RAPID). Taxpayers should be proud that their contributions go into nation building, yet, most treat tax savings as a chore. The last quarter JFM (Jan-Feb-Mar) syndrome is used smartly by financial services companies that have products in which you can save and invest to claim tax deductions.

Sadly, the diligence shown by taxpayers in choosing a smartphone or a year-end travel plan by endlessly trawling the net is something that they never use when it comes to their annual tax planning. At 26, Mohnish Panchal comes across like any average taxpayer till he informs about having exhausted his tax savings limit under Section 80C. “I used the limit by putting money into PPF and insurance and am satisfied,” he says. Nothing wrong but if he had given some thought he could have done a lot better.

Year-long exercise

Accept the fact that you cannot avoid income tax. And the sooner you start accepting that money will be deducted from your salary towards tax deductions, the better it is. Not only will it make you use tax savings meaningfully, it will also help you with your overall finances. You should refrain from buying life insurance, which seems to be the most sought-after tax saving option, without understanding its use.

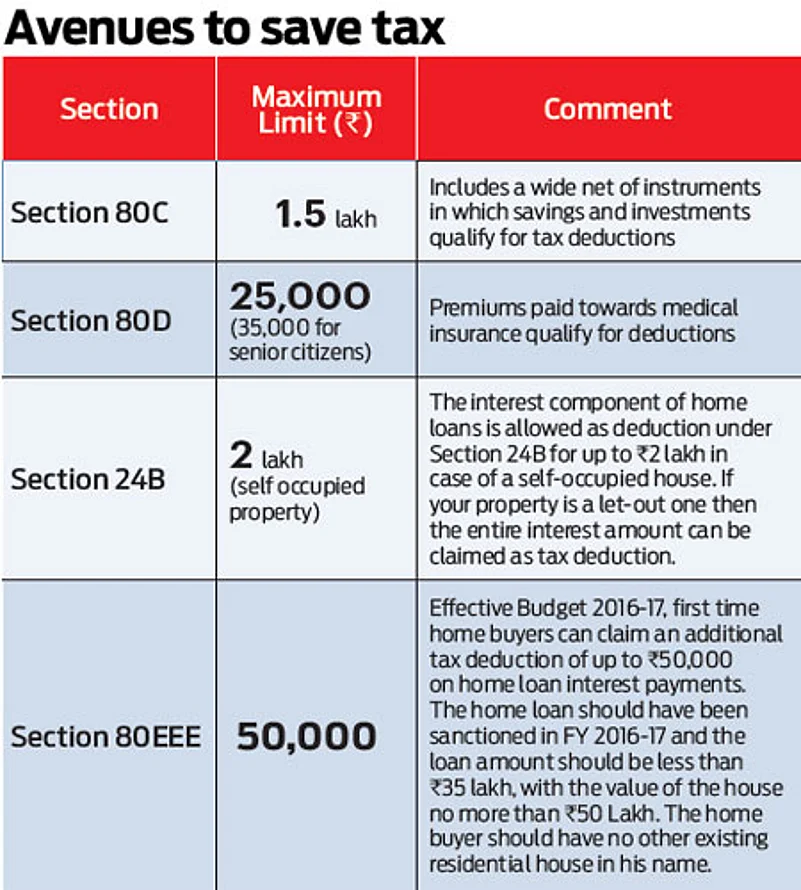

The window to save tax is the same whether you earn Rs 2.5 lakh a year or Rs 2.5 lakh a month. All taxpayers can save taxes up to Rs 1.5 lakh annually under Section 80C, which allows one to claim deduction on savings, select expenses and also investments. The first step towards befriending income tax is to use this wide range of instruments by parking your money to suit your needs.

Salaried taxpayers wake up to tax savings sometime between November and January, when the office accounts department starts asking for proof of tax savings, lest they start deducting it from their salary. “You should think about saving tax at the beginning of the financial year. You cannot act in a haste and buy a few random products to fulfil the Section 80C deductions,” says Hemant Beniwal, financial planner. If planned well, your income tax planning can be very effective, if not, it could turn out to be a mess.

For entrepreneur couple Moksh Juneja and Aditi Juneja, the annual tax planning exercises starts and ends with PPF, life insurance and medical insurance. “Right now, saving tax is not a priority. I prefer parking my money where I can get maximum returns,” says Moksh. His choice of instruments to save taxes tells a very different story in comparison to what he has stated.

The penchant for fixed return instruments is well known, which could be due to the tilt towards such products within the tax saving basket. The savings options, which earn a fixed return, include contributions to the mandatory Provident Fund (PF), PPF, savings in five-year fixed deposits, five-year post office term deposits, National Savings Certificate (NSC), Sukanya Samriddhi Yojana and the Senior Citizen’s Savings Scheme.

Many taxpayers tend to ignore the available options towards investments like those in unit-linked insurance plans (Ulips), equity-linked savings scheme (ELSS), contributions to the National Pension System (NPS) which has an additional window of Rs 50,000 to be claimed as tax deduction, and home loan principal repayment which also qualify for deductions.

The best option

When you have plenty to choose from, the chances of bias setting in selection are high. In her book ‘The Art of Choosing’, Sheena Iyengar writes: “An abundance of choice doesn’t always benefit us...The expansion of choice has become the explosion of choice, and while there is something beautiful and immensely satisfying about having all this variety at our fingertips, we also find ourselves beset by it.” The choice when it comes to using the mandated Rs 1.5 lakh towards tax savings cannot be better described. It also does not come as a surprise why people predominantly opt for life insurance even if not for the right reasons—risk mitigation.

Like most other things in personal finance, the answer to the best tax plan will vary from person to person. There is also a role that each tax saving option can play in your financial life. “Life insurance is a sound long term financial solution. The simple advice that we would give is—please start early. This most critical solution for your needs demands a disciplined approach much early in your life so that over the years you build a good corpus,” stresses Anuj Mathur, CEO, Canara HSBC OBC Life Insurance.

The opportunity to create wealth and at the same time save taxes is a potent combination that taxpayers can smartly deploy. A financial instrument that provides this feature is the ELSS. “ELSS is among the few eligible equity-based tax saving product which also comes with a lower lock-in period of three years vis-à-vis five years for most others in the Section 80 list,” says Sanjay Sapre, president, Franklin Templeton Investments—India. There are several ELSSs to choose from, and each adopts a different investment approach, providing taxpayers to select a fund that suits their risk profile. The shortest lock-in compared to other tax saving options makes it an automatic first choice investment vehicle for tax savers.

Making tax savings work

It is one thing to save tax and another to make it work for you. Tax savings that you get on the EMIs repayment on a housing loan is one way to not only build a financial asset but also make tax savings work for you. “Impetus to affordable housing through tax benefits announced in the 2016 Budget is making it possible for several taxpayers to own a house,” says Sanjaya Gupta, MD, PNB Housing Finance.

Another route that can help you create a corpus for your golden years is the National Pension System (NPS). The fund options within the NPS and the additional tax deductions available on contributions to this instrument make it a strong retirement planning tool.

Savvy tax savers use every rule in the book to make every rupee that they pay as tax work for them, without avoiding taxes. A simple way to do so is to create an HUF (Hindu undivided family) account, which allows them to save additional sums. With the HUF, you basically create one more entity within the family which can benefit from the money deployed towards tax savings in them. The HUF as a concept is easy, but venture into it only if you see merit in it and can manage the compliance element of filing tax returns under the HUF.

Instead of getting bogged down by the many choices that stare at you when planning taxes, sit back and think of your financial needs and how you could use tax savings to achieve them. Not only will you be able to reduce your tax liability, you will be able to benefit from the dual advantage of tax savings and realising your financial goals. More choice is not always better, but neither is less, according to Iyengar. So, choose tax saving instruments that you understand than getting myopic with blindly tax savings.

The optimal amount of choice lies somewhere in between infinity and very little, and that optimum depends on context and culture. “In practice, people can cope with larger assortments than research on our basic cognitive limitations might suggest,” Iyengar writes. As a taxpayer, make sure you maximise the opportunity that comes your way towards meeting your long-term financial needs than get obsessed with utilising the Rs 1.5 lakh you need to save and invest to reduce your tax liability. This approach creates the smart taxpayer who tastes the best of both the worlds: tax savings and meeting financial goals.

NPS versus EPF

The debate over the National Pension System (NPS) being better than the age-old Employees provident fund scheme (EPF) can be never-ending, depending which of the two you are contributing to. One aspect that is clearly emerging is that the government is pushing for more people to opt for the NPS, given the tax benefits available to an NPS subscriber over the EPF.

Although the EPF is mandatory for employees earning up to Rs 15,000 a month in the organised sector, many employers insist on EPF contributions for all their employees. As your employer matches the statutory EPF contributions, many employees assume this sum is in addition to their salary, which is not the case. In these times of cost-to-company (CTC), contributions by both employers and employees are clubbed in the CTC.

In comparison, the NPS is voluntary but several employers are finding merit in the scheme and offering it to employees as a choice over the EPF. The tax benefit through retirement contributions by way of putting money into the NPS adds up to Rs 2 lakh in a financial year instead of the Rs 1.5 lakh limit in case of the EPF. Further, the NPS, unlike the EPF, is flexible—you do not need to invest each month, you can skip contributions for a few months as long as you make the once-ayear minimum contribution. The additional Rs 50,000 tax rebate available when putting money in the NPS has got many takers to the scheme.

Says Delhi-based Manu Agarwal: “I fall under the NPS as a Government of India employee. I was unhappy with the contributions initially, but with the additional tax benefit, I have increased my contribution, which is earning well.” The additional tax benefits have increased the number of takers to this scheme. “Post the additional tax benefit of Rs 50,000, the number of retail customers in the NPS have approximately quadrupled on a cumulative basis,” says CV Ganesh, COO & business head—digital channels, HDFC Securities.

Tax Shelter

Owning a house is every Indian’s topmost desire and dream. That it is becoming affordable with a push by the government is evident by the additional tax benefits that are available to first time home buyers in the affordable housing space. “I took a home loan in 2010 and have used both the tax savings available on principal repayment and the interest component,” says Rajat Yadav.

The banking background gave him the necessary edge to understand what he was to gain by going in for a home loan. His Rs 25 lakh loan costs him Rs 24,00 in EMIs and he is already 6 years into the loan, with another 9 years to go before it comes to an end.

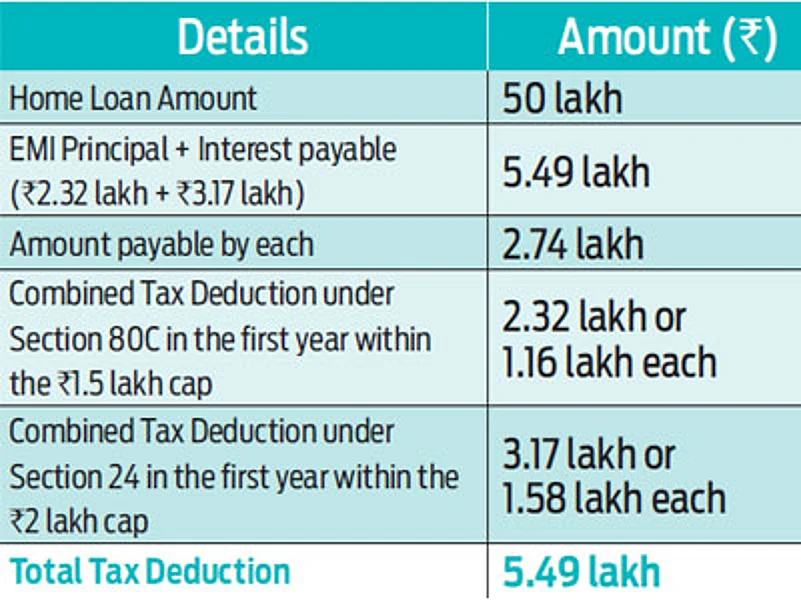

As the home loan repayment has two components— principal and interest—there are tax rebates to be claimed under both heads. You get a deduction of home loan interest repayment under Section 24 of the Income Tax Act and a deduction of the principal amount under Section 80C. “As my wife is also employed, we went in for a joint home loan, we both are able to claim the tax benefits,” Yadav explains.

Joint loan advantage

Suppose Mr X and his wife take a joint home loan of Rs 50 lakh with equal shareholding and both are in the highest tax bracket of 30 per cent. Assuming the loan is for 20 years, at 9.25 per cent interest, their combined tax exemption is Rs 5.49 lakh each year. If only Mr X had taken the loan, he would have got an exemption of only Rs 3.5 lakh (Rs 1.5 lakh under Section 80C and Rs 2 lakh under Section 24). However, by going for a joint loan, they are able to get an additional benefit of Rs 1.95 lakh.