As yet another year comes close to an end, for most of us who are salaried, the tax-saving avenues beyond the mandatory provident fund deduction seems far away and the last thing on one’s mind. Even though the tax-saving season will come to an end in March 2016, now is still a good time to take a look at your financials and fine-tune your tax-planning strategy. We explore a few last-quarter tax-saving options, which will help you save as much of your hard-earned money as possible.

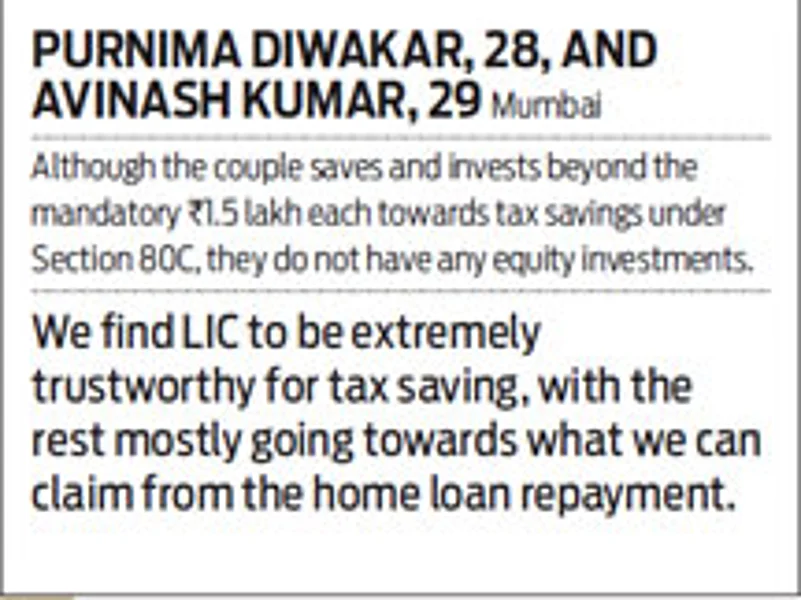

There are several tax-saving opportunities that exist for taxpayers from standard deduction towards house rent allowance (HRA) and travel expenses by way of conveyance allowance to medical reimbursements. However, the bulk of action is visible within the ubiquitous Section 80C under which you can save and invest money to claim income tax deductions. Says Mumbai based Purnima Diwakar: “I go with savings in LIC, which I trust and find easy to understand compared to other tax-saving options that are available.” Broadly, within the range of various tax-savings options under Section 80C, the ones that are tilted towards savings and investments can be divided into those that have market-linked returns and those that have fixed returns.

PROBLEM OF PLENTY

The choice under Section 80C includes your contribution towards provident fund (PF), which is the monthly amount deducted from your salary as your contribution towards the Employees Provident Fund Scheme or Recognised Provident Fund. There is also the investment in public provident fund (PPF), where the account matures in 15 years and one has to save at least Rs.500 each year. You can also purchase National Savings Certificates (NSCs) from the designated post offices.

In fact, premiums paid towards a life insurance policy qualify for deduction under Section 80C, as specified in the policy. You can also claim your

children’s tuition fee paid to any school, college, university or other educational institutions situated within India (for the purpose of full-time education of any two children), including payments for play school, pre-nursery and nursery. You can also deposit money into five-year deposit schemes in post offices and banks as well as Senior Citizens Saving Scheme, if you are in that age group.

Then there is the principal repayment on loan for purchase of house property— payments of installments or part payments or repayment of loan taken for buying or constructing residential property.

This year, also included is deposits into Sukanya Samriddhi account for a girl child. The amount deposited earns an interest of 9.2 per cent, and the interest is fully exempt from tax. A minimum of Rs.1, 000 must be deposited in a year. Receipts on maturity from the account are tax-free.

Among the market-linked products to claim tax benefits are unit linked insurance plans (Ulips).

You can also invest in equity linked savings scheme (ELSS), which is a type of equity mutual fund in which investments qualify for tax deduction under Section 80C. These funds have a three-year lock-in period. You can also contribute to notified pension fund offered by mutual funds and National Pension System (NPS).

TAXPAYER CONCERNS

Irrespective of one’s age or risk profile, the propensity amongst most taxpayers is to explore the fixed-return option. The bias towards fixed-return savings is two pronged—most taxpayers find these less risky and the assured returns seem far easy to accept than market-linked returns. “I had a PPF account that matured and trust the straightforward NSC-type option for its simplicity and ease of handling,” stresses 54-year-old, Delhi-based advocate Meenakshi Singh. She falls in the 20 per cent tax bracket and recounts her not-so good experience of investing in an ELSS.

The lack of confidence in exploring equity-oriented tax savings is mostly due to lack of knowledge as many wrongly think investments in ELSS reflect the stock market movements. “I have savings in LIC, post office schemes and insurance, which exceed the Rs.1.5 lakh limit,” says 26-year-old Ghaziabad-based Parijat Pande. Though he is thinking of putting money in the NPS, it is more to do with the additional tax deduction of up to Rs.50, 000 that one can claim by putting money in this long-term retirement savings plan.

Another bachelor, like Pande, has no equity exposure with his tax savings. “I am comfortable with insurance and PPF, and my company covers for medical insurance, which means I don’t need to put money in a health policy to save taxes,” says Bengaluru based 22-year-old Mohit Srivastava. Both these youngsters do not realise the potential benefits that an equity-linked tax-saving option can offer to their finances in the long run besides helping them optimise their tax liabilities in every financial year. For instance, if Rs.1.5 lakh is invested each year as part of tax savings for 30 years, at 9 per cent annual returns, which is marginally higher than what the fixed-return tax-saving instruments pay, the cumulative Rs.45 lakh invested over this time will be worth Rs.2.28 crore. However, if the same amount was put in an equity-oriented tax saver, earning even a marginal 3 per cent more at 12 per cent, the wealth it would create works to over Rs.4 crore, not to forget the tax-saving benefits in this period.

“The home loan repayment takes care of most of the tax savings other than the mandatory insurance and PF contribution,” quips 29-year-old Avinash Kumar, Purnima’s husband.

Not yet 30, the couples have managed to use their tax savings judiciously towards repaying their home loan. If it had been planned well in advance, the duo could have borrowed to optimise their respective tax liabilities and, at the same time, repaid their home loan.

SMART TAX PLANNING

Where most taxpayers go wrong is by focusing on tax planning as an activity in isolation. Tax planning is an essential part of financial planning, as efficient tax planning enables you to reduce your tax liability to the minimum. This is done by legitimately taking advantage of all tax exemptions, deductions, rebates and allowances while ensuring that your investments are in line with your long-term goals.

The first step towards optimising your taxes is to list out the essentials that you have to meet; for instance, there is little room for manoeuvring if you are salaried on the PF contributions. Deduct the annual PF contribution from Rs.1.5 lakh to know how much more you can deploy towards tax savings. If you are servicing a home loan, prioritise to claim the most towards this financial commitment. If you have children who are studying, utilise the money towards their tuition fee to reduce your tax liability.

Once these essentials are taken into account and you are still left with money to save taxes, check your life insurance needs and buy appropriate term insurance and nothing else. This type of insurance will protect your family and dependents in case of exigencies. If you are still left with money to save taxes, deploy the sum towards an equity-oriented option, preferably the ELSS for its short lock-in, though you can stay invested in the scheme like another open-ended diversified equity schemes.

You must also take health insurance for yourself and your family, for which you can claim tax deductions under Section 80D. From this year onwards, you can claim additional tax deduction of up to Rs.50, 000 under Sec 80CCD(1B) towards contribution in the NPS. Having seen the benefits of aligning your financial plans to tax plans, you can choose the most suitable tax-saving instrument. The more prepared you are, the better off you will be especially if you are worried about owing money to the tax authorities, who are very efficient in collecting taxes.