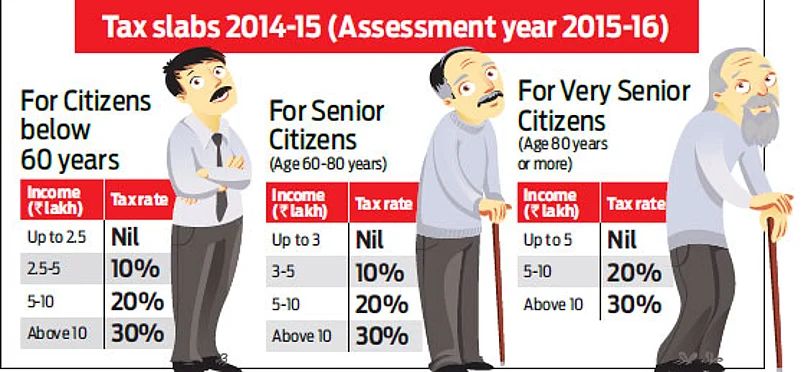

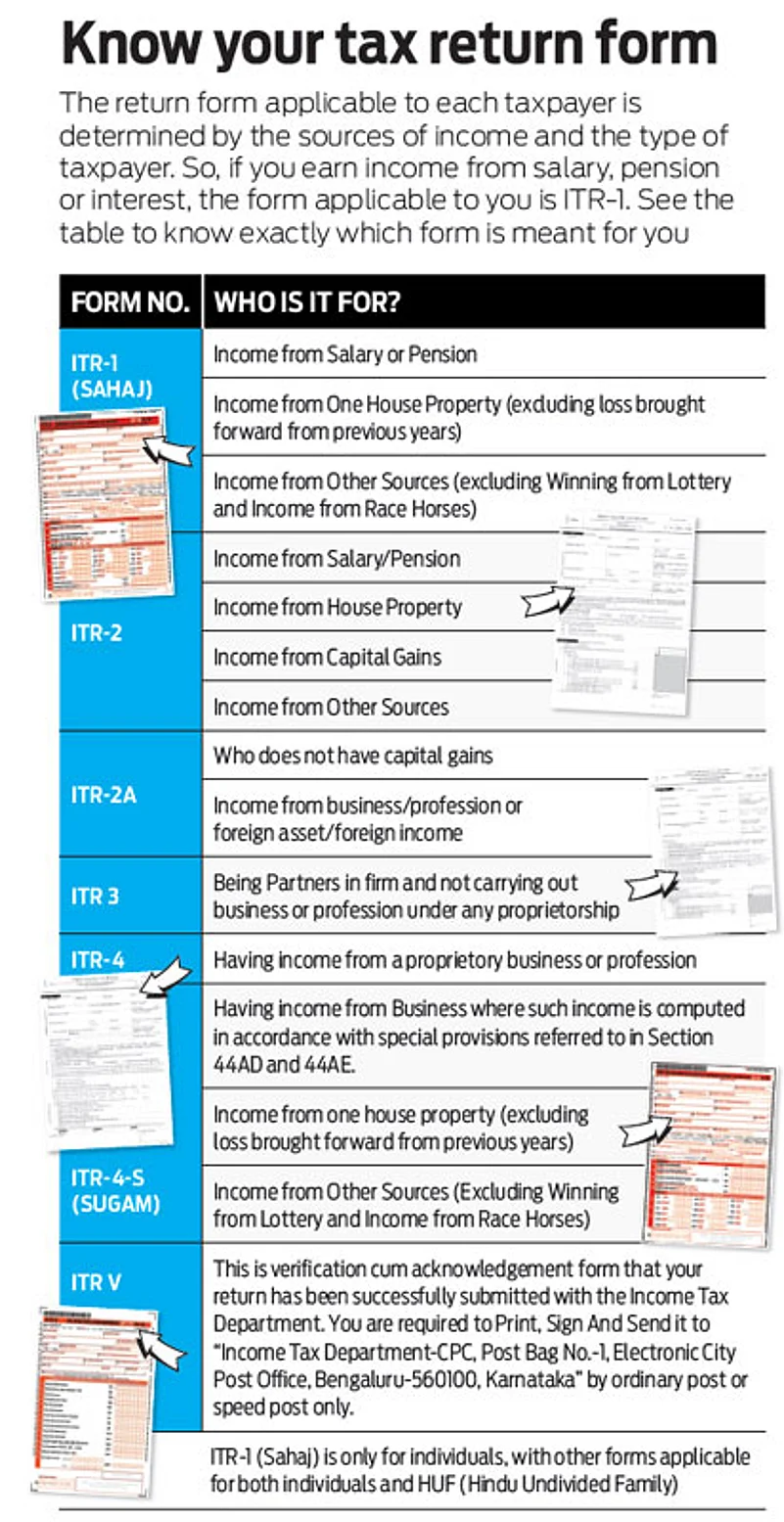

We are back into that time of the year when people try to figure out all the paperwork associated with filing income tax returns. Over the years, e-filing of returns has become popular, which means one need not necessarily require the services of a chartered accountant or tax return preparers anymore. If you have all the necessary papers handy, you are ready to file returns on your own. But first understand the income tax bracket you fall in and next, look for the applicable tax return form that you need to fill to ensure your income tax returns are ready to be filed.

This year, the last date for filing without any penalties is August 31, which leaves plenty of room to file your returns without rushing into it. And, if you are discerning, you will have time to evaluate your tax liabilities last year and be better geared to manage your taxes this year. You can use the time in hand to assess what you did with tax savings a year ago, and plan taxes for this year with little introspection. By following such an exercise, you would not only be on top of your tax savings and investments, you will also be in a better position to plan your taxes in the current financial year. So, make a start by planning for tax savings this year, as you file your tax returns for the previous year.

Checklist

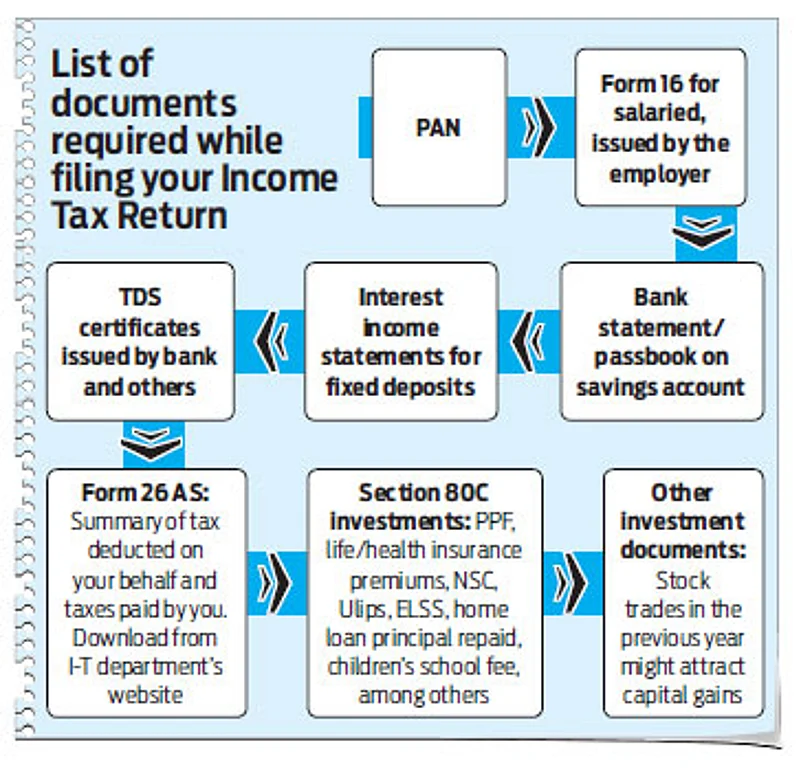

Ensure that you share the right bank account details including the bank account number, type of account (savings or current), and the bank’s IFSC code. Declaring these fields correctly is crucial, especially if you are claiming a tax refund. This is because the tax refund is directly credited to your bank account. Likewise, ensure that you quote the right permanent account number (PAN), as mistakes related to it are liable to penalties. The PAN is your tax identification number used for correspondence with the tax authorities and, therefore, declaring an incorrect PAN could cost you dearly.

In case you have losses from investments, you can carry forward them. There are schedules which require details of how losses have been set

off and against which source of income, and if the loss could not be set off in a year, whether it has been carried forward or not. To complete these schedules correctly, one needs to be aware of what losses are allowed to be set off and from what income. For example, while house property loss can be set off against salary income, the same cannot be done in case of capital loss. The list of precautions can go on but to cut a long list short, be sure of your sources of income, investments and taxes deducted at source (TDS) or paid by you during the financial year. Maintaining a file for your taxes and a calendar with tax due dates will go a long way in keeping your apprehensions at bay.

Filing online

Filing tax returns online is easier than you think. Do explore the income tax department’s website (https://incometaxindiaefiling.gov.in/)for tax filing, as it will help you find out how much tax you need to pay and how to file your returns, and even pay taxes online. However, the problem that you are most likely to face is the complicated manner in which the income tax department’s e-filing website is designed.

You are in all probability going to be intimidated by just the looks to delay filing returns or look for other avenues to file your tax returns. After all, the website interfaces could be overwhelming and confusing, unless you are a seasoned tax payer familiar with everything needed to file taxes.

To get started, you will need to register yourself, with your PAN being your user ID. Next, check your tax credit statement in Form 26AS, which indicates the taxes deducted by your employer, the TDS through Form 16, which should tally with what Form 26AS states. Make sure these statements match, because if they do not, you are inviting notices from tax authorities in the future.

Look for the download menu, and choose the tax return form for assessment year 2015-16, which is for financial year 2014-15. Now, download the Income Tax Return (ITR) form. The next step is to fill in all the necessary details by looking into details of your Form 16 and bank statements, as applicable to you, depending on the tax return form applicable to you. Use the tax return preparation software, which has Excel interface to manoeuvre to calculate tax that you need to pay. Finally, enter the tax challan details in the tax return form before you click the validate tab.

You can now generate an XML file and save it on your computer and then upload the same along with digital signatures if need be. After all of this, you will see the website flash a successful e-filing notification, which means the process is complete. Finally, the ITR V will be generated, which you need to download and send to the income tax department’s Bengaluru office by post within 120 days of filing your return online and you are done with tax filing.

Yes, the income tax department’s website is intimidating, which is why several others have latched on to offer easy-on-the-eye portals to help you do the same at a cost which ranges from Rs.200 to Rs.500.

For instance, ClearTax, H&R Block, Taxsmile and Taxspanner are some of the options to explore, if you are filing online for the first time, considering the online as well as offline help that they offer. These websites also have chartered accountants and tax return preparers on their rolls, who can assist those taxpayers who find filing tax returns on their own difficult. With all this information, you are well equipped to make tax filing not only easy, but a fruitful experience.