Since the scrapping of Rs 500 and Rs 1000 denomination notes on November 8, social media has been agog with rumours, conspiracy theories and ‘informative’ posts. Will you be under the tax radar if you deposit more than Rs 2.5 lakh? Will the tax evader pay 200 per cent penalty? Outlook Money gets experts to bust some of these common misconceptions.

1. Cash deposits of up to Rs 2.5 lakh will not invite any scrutiny even if the source is not disclosed

Finance Minister Arun Jaitley’s statement that cash deposits under Rs 2.5 lakh would not invite any scrutiny by the income tax department has led people to believe that they can freely deposit this amount without any repercussions. Ordinarily, this could hold true, particularly for homemakers, daily wage labourers and senior citizens who prefer to save in the form of cash to meet their regular or emergency expenses. However, this does not mean that everyone with unaccounted cash will get a blanket exemption.

Expert View: “The intention is to not trouble those people who ordinarily don’t have taxable income and keep their savings in cash. However, if any other person, be it a salaried individual, or a trader, professional or businessman deposits this much amount in his/her bank account, such a person can definitely be questioned if the deposits don’t match the disclosed income,” explains Amit Maheshwari, partner, Ashok Maheshwary & Associates LLP, a tax consultancy firm.

If you draw a total income of over Rs 50 lakh, you need to be careful when you make cash deposits. All such taxpayers were required to disclose their networth in the asset-liabilities schedule (or schedule AL) while filing their tax returns this year. “Such tax-payers should be mindful of the cash in hand they may have disclosed in that schedule. If the difference is substantial and unexplained, it could give rise to queries from the income tax department,” says Vaibhav Sankla, director, H&R Block, a tax consulting firm. Conversely, all those who can explain their deposits need not fret. “Tax authorities can question where they find the deposits you make are disproportionately higher than the income declared by you or your spouse (in case of home-makers) over the years. As long as they can explain the source of income, small depositors need not panic,” says Kuldip Kumar, partner and leader, personal tax, PwCc,” says Kuldip Kumar, partner and leader, personal tax, PwC.

2.

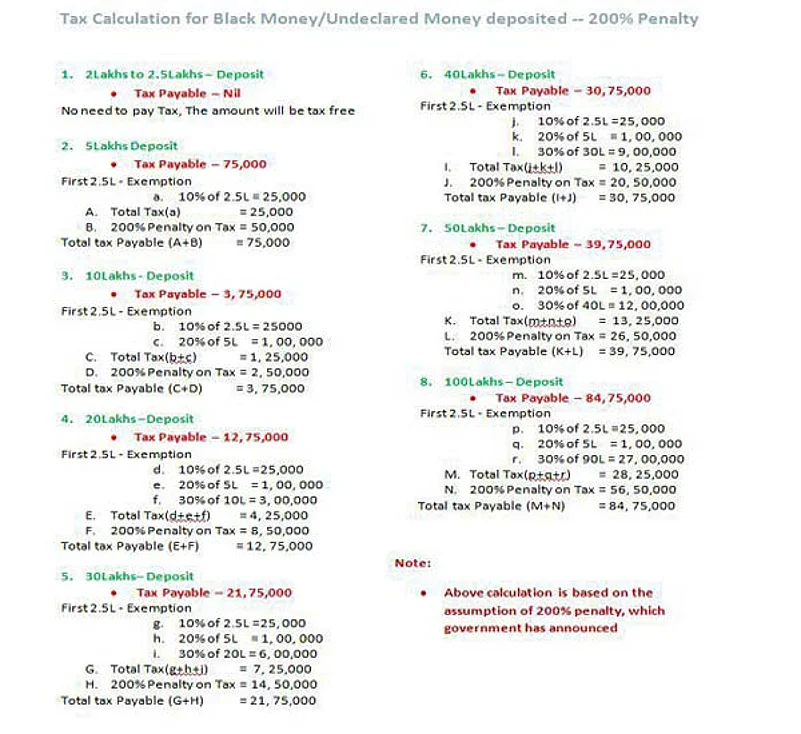

This chart demonstrating the impact of the 200 per cent penalty on tax payable of 30 per cent in case of discrepancy in income declared, as announced by government officials, has gone viral over social media platforms, particularly WhatsApp.

Expert view: “Basic exemption and slab rate will not apply for the cash deposits you make now. If it’s under Rs 2.5 lakh, it will not invite any scrutiny by the income tax officials, as announced. However, if you deposit a sum of say Rs 10 lakh, questions will be raised,” says Vaibhav Sankla, director, H&R Block. If you are not able to explain the source of this cash, you will have to pay tax at the maximum marginal rate of 30 per cent, provided you disclose the same in your tax returns next year. "As per section 69A, if a tax-payer is unable to explain the source of any money, jewellery or other valuables, it will be added to her income for the year. Section 115 BBE provides for a flat rate of 30 per cent to be levied on this income,” adds Sankla. Besides, a retrospective action from the government cannot be ruled out.

“Moreover, it is entirely possible that the government will retrospectively amend tax laws to charge tax at a rate much higher than 30 per cent. Do note that if you do not intend to disclose the same when you file your returns next year, the 200 per cent penalty on tax payable will come into force,” he says.

3. Pay tax at the special rate of 30 per cent, convert black into white

In such cases as explained in (2), many would assume that paying a tax at the highest slab rate is eminently preferable to inviting action. However, it is unlikely to be that simple.

Expert view: The government had come up with the Income Disclosure Scheme (IDS) that closed on September 30, where tax-payers could rest easy after paying a 45 per cent tax on their undisclosed income. “It is unlikely that the government will let tax-payers who have not availed of the IDS get away with only a 30 per cent tax now. There exists a possibility that they will retrospectively amend tax rules to impose tax at a rate much higher than 45 per cent,” says Sankla.

4. Buy gold, flight tickets, escape attention and tax net

In the last few hours of November 8 until mid-night, many individuals rushed to exchange their cash hoards for gold at a huge discount. Reports suggest that many may have paid between Rs 40,000-50,000 for 10 gm gold with a market price of around Rs 31,000. Some also used cash to book business class flight tickets.

Expert view: "Buying gold is the worst possible decision many individuals seem to have made in panic mode," points out Sankla. Let’s take the example of someone who wishes to salvage his undeclared cash worth Rs 1 lakh. Firstly, by paying an amount much higher than the market price it commands, he would have already booked a 50 per cent loss. Then, there will be the loss he would incur if the value of gold were to go down, as it is expected to in the coming days. "Overall, he would be taking a hit of close to 60 per cent. And, despite all the legwork, he would still be left with some cash, which will have to be ‘regularised’," says Sankla.

Likewise, depositing Rs 2.5 lakh in your bank account and managing the balance cash pile by paying huge sums to clear old property tax dues and booking high-cost, business class airline tickets will not bail you out. “All these transactions will be tracked and you could be questioned. In such cases, your Rs 2.5 lakh cash deposit will not escape taxman’s microscope. Be mindful of the repercussions of all steps you take in this situation. Most transactions leave a trail.

5.Deposits greater than income will attract 200 per cent penalty on tax applicable in all circumstances

The government’s decision to impose a 200 per cent penalty on the tax payable on cash deposits of over Rs 2.5 lakh has unnerved many tax payers. However, those who have made the required disclosures need not be concerned, say experts.

Expert view: The penalty, limited to 200 per cent of the tax payable, is levied under Section 270A of the Income Tax Act. “If the person who deposits cash and then pays due taxes and declares all such deposited cash as income for FY 2016-17 or has already declared in previous financial years, this penalty cannot be levied as it is only for the under-reported or misreported amount,” says Maheshwari. You need not be concerned if you have duly declared it as part of your income and paid the taxes applicable. “There are also rumours that the 200 per cent penalty is on cash amount deposited but it will be levied only on the tax amount,” he adds.