You could sense that a bull market was in the offing. In 2000, the technology bubble had bust. Three years of a lacklustre market had stock prices drifting lower, irrespective of whether it was old economy or new economy. In 2004, I could sense that the market was rebuilding value and will see a period of great growth ahead.

I was looking for new sectors to bet on. Technology had done well in 2000; I didn’t think it was going to do well in the next round. I realised that we were going to be a consumption-led economy. It was about India coming of age, young people asserting their freedom to go out and enjoy life rather than the sedate India I grew up in the 70s.

I looked at stocks that would benefit from this consumption-led growth. That’s when liquor stocks caught my attention. Liquor business is one of those recession-proof businesses. People will always drink, in good and bad times. Across the world, these were valuable businesses because they were consistent cash machines.

There were two companies I was eyeing at that time. One was Shaw Wallace and then there was McDowell which later came to be known as United Spirits. I decided to go with McDowell since the promoter was in India; the Shaw Wallace promoters, the Chhabrias, were living in Dubai. Besides, I got some extra comfort in McDowell as it also had relatively attractive valuation. It was available at a market cap of Rs.200 crore. So, you were getting 50% of India’s liquor market for Rs.200 crore. It seemed like a steal.

I had studied the liquor business of San Miguel in Philippines, Singha Beer in Thailand, Suntory in Japan, Pernod Ricard in France, Cinzano in Italy and Jack Daniel’s in the US. The valuations of these businesses were way higher. But this company was trading really cheap in comparison; I thought I couldn’t go wrong.

The important question was: why buy now? Why not 10 years back? The stock was available for 40 bucks 10 years back as well. As an investor, you need to look for triggers for change. Mcdowell seemed to have one. At that time Vijay Mallya was known for his flamboyant lifestyle and was known as ‘the king of good times’. The tech boom created new czars and left him far behind. He had seen the valuation that tech companies with good corporate governance standards commanded. We knew that sooner or later, he would realise that not having the best corporate governance had cost him despite having a great business. We knew this would change.

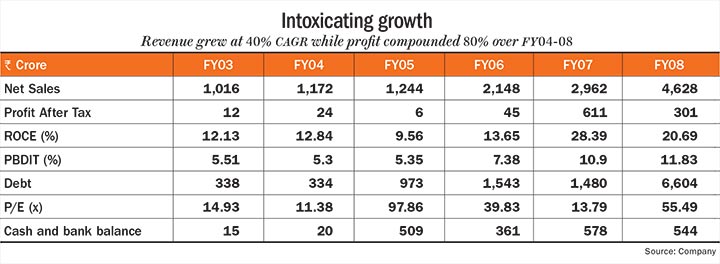

In FY04, the company had a consolidated net profit of Rs.24 crore. But, it was difficult to assess the company based on the numbers. The problem with poor corporate governance is that you don’t get an accurate set of numbers. But we knew the runway for growth was huge.

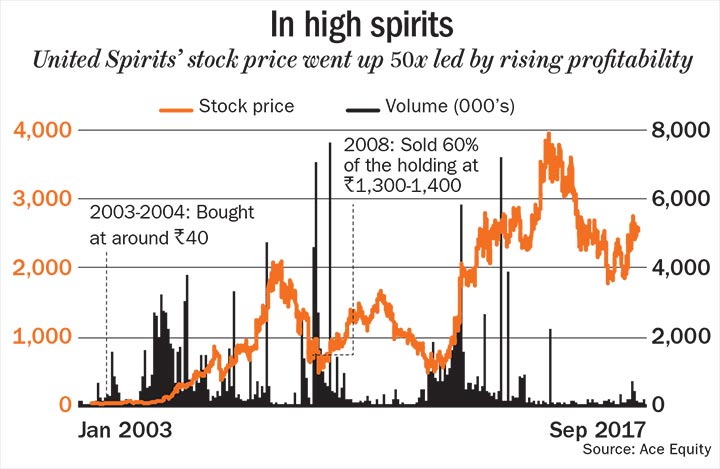

Now, what if both my bets on growth of the business and improving corporate governance didn’t work out? It was a risk I was willing to take. At Rs.200 crore, I was not going to lose a lot of money. The company was paying Rs.2 dividend, so I had a 5% dividend yield. Sometime in 2003-2004, we bought around 1% stake in the company for Rs.2 crore. For every 100 bottles of liquor that was sold, one was mine!

McDowell was an unloved stock. Everybody ridiculed my investment decision. Typically, the greatest multi-baggers in the stock market come when you are all alone. When everyone thinks you are an idiot for following your idea, then you should know you are probably onto something! Everyone said Mallya will never change. But they were wrong.

At some point towards the fag-end of 2004, the stock went up to Rs.100-110 and then I realised that Mallya was changing. He was getting external advisors and the results started showing. Credit Lyonnais had come out with a buy rating on the stock.

If you wanted to grow, and retain 50% market share back in 2005, you needed capital to set up small factories. Liquor business was a state-oriented business, so you needed to set up factories in every state. Meanwhile, competitors were putting money in expanding their capacities. So, he woke up. He is a very shrewd man. If you met him at analyst meets, you’d have realised that he knew his business well.

Mallya managed to raise capital. Between FY04 and FY08, he raised debt of Rs.6,269 crore taking his total debt to Rs.6,604 crore as of FY08. Mallya also managed to premiumise his portfolio with brands such as Antiquity, Royal Challenge, McDowell’s Signature, McDowell’s No1 and Director’s Special Black. In 2005, McDowell acquired Shaw Wallace to become the second largest liquor company in the world. Post the amalgamation of eight spirits companies including Herbertsons and Triumph into McDowell, the company was renamed United Spirits in October 2006. In 2007, the company acquired Scottish spirits maker Whyte & Mackay. The acquisition plugged the missing gap in the company’s portfolio by giving it a strong presence in the Scotch whisky market.

Thanks to both its organic and inorganic growth initiatives, the company’s revenue grew 40% CAGR over FY04-08, while profit grew 80% CAGR over the same period. The company saw a turnover of 3.8 crore cases of alcohol, growing 23.6% CAGR from FY04. The price went up 50x from the time we bought it — from Rs.40 in 2003-2004 to Rs.2,000 in 2007-2008. There was a brief period in early 2003 when the stock fell below our purchase price to Rs.33. But, it didn’t test my conviction as I had done my math. I bought a bit more at Rs.33.

We always knew that he would sell his stake in McDowell at some point. But, because he had got into airlines, IPL, Formula One racing and other things, it kind of forced his hand. He was running out of cash and the only way he could stay out of trouble was by selling something valuable that he owned. Diageo was obviously the best match out there. At best, I thought he would sell a 26% stake. He had already done that in United Breweries, another company I owned. He had sold some stake to Heineken group there.

By then the 2008 bear market started and I realised the dream run would end. So we liquidated 60% of our position at about Rs.1,400. The valuation had gone from Rs.200 crore to Rs.25,000 crore in 2008. The business didn’t justify that kind of valuation.

However, I continue to hold 40% of my original position. From the levels where we exited the stock, the share price went down all the way to Rs.600-800 post-financial crisis. My bet that he would sell part of the business eventually played out in 2012. The British spirits maker Diageo, which was looking to increase its footprint in India, picked up 27.4% stake (including 10% preferential allotment) in United Spirits. Post the open offer, Diageo would own 53.4% stake in United Spirits. The stock rallied back to Rs.4,000 in April 2015 amid hopes that Diageo would bring in higher corporate governance standards and further premiumise the company’s brand portfolio.

So, my investment style is to look for good businesses, look for some trigger for change and buy them cheap. Good businesses take care of themselves. The struggle is at the entry point. Is this a cheap enough valuation? I don’t tend to worry about quarterly performance. I tend to worry about broad industry dynamics. For instance, look at the whole migration from internal combustion engine to electric vehicles. Why would you want to be in an auto ancillary company that supplies to the internal combustion engine whether it is radiator caps or fuel pumps today? But, when it comes to liquor business, I don’t see a technology that can replace drinking in the next 10 years.

My lesson is that as investors, we need to train our mind to judge, to take risks and make bets, rather than go for the comfort of the numbers. This is an 8 P/E stock with 3% dividend yield and 15% return on equity (ROE), I am going to buy it. No. Typically, this kind of analysis might be good for institutional investors, but when you are looking to hit the ball out of the park, you have to bring some X factor into the stock. You typically find the X factor in unloved stocks when you connect the dots and see a trigger for change. Judgement is what market rewards you for. One regret I have with McDowell is that I didn’t buy more. Had I invested Rs.10 crore to buy a 5% stake, it would have been worth Rs.1,000 crore today.

It was 2001. The tech boom was fading away. However, another boom seemed to be waiting in the wings — the telecom boom. The Vajpayee Government was undertaking several reforms to improve telecom connectivity in India. In the first phase of these reforms — 2000-2003 — the telecom sector was opened up for private players.

Additional licenses for basic services were issued. License fees were slashed. National long distance and international long-distance services were opened up to competition. The idea was to bring down the costs of making a phone call and improve the tele-density in the country. It used to be so prohibitively expensive to make a phone call.

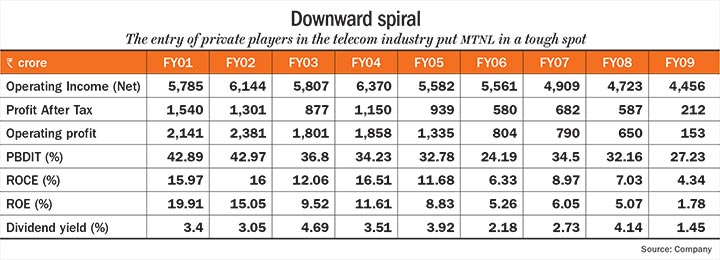

MTNL was the dominant player with a market share of 14% and its subscriber base stood at 4.3 million as of March 2001. People were still using landlines. Cell phones had not yet penetrated in the country. I expected MTNL with its early advantage to benefit the most from the reforms that were taking place in the telecom sector. MTNL already had an allocation of 12.5 MHz spectrum which was clearly on the higher side when compared to the prevalent subscriber related spectrum allocation norms. Our bet was also that the government could privatise MTNL.

Another fact that drew me to MTNL was the huge real estate the company had. The company has so much real estate that you could get your money from the market cap many times over. The stock was trading at 7.68x its FY02 estimated earnings and had a market cap of Rs.9,443 crore. That was my margin of safety.

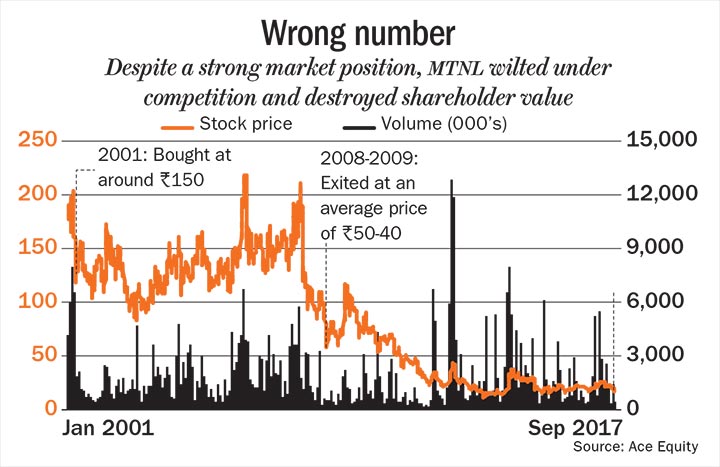

I was certain that the business would do well. The tele-density was just 2 per 100. It was hardly anything for a country as vast as India. We all knew that it had to go up. I thought the entire industry will grow and everyone including MTNL will increase their share. I bought the stock around Rs.150 in 2001. The stock was around Rs.200 in 2000. I got seduced by the falling price.

As Bharti Airtel, Idea and Reliance entered the telecom sector, they weaned away subscribers from MTNL with attractive schemes. These private players were aggressive and hungry for growth. I thought MTNL would fight back, but it was swept away by the tide of the private players. MTNL didn’t seem to be able to withstand the competitive intensity. Its market share in terms of subscriber base went from 14% as of March 2001 to 1% as of June 2008 as private players gained market share and subscriber base. The return on capital employed (ROCE) declined from 16% in FY02 to 9% in FY07. Its operating margins slipped from 43% in FY02 to 34% in FY07, reflecting the fall in tariffs. Revenue declined 24% from Rs.6,143 crore in FY02 to Rs.4,940 crore in FY07.

There have been several cases in the past where incumbent players are caught unawares when market dynamics change suddenly. For instance, the dominant players in the photography market — Kodak and Polaroid — went bankrupt after digital cameras took off in a big way.

By 2008-end, the share price had corrected 47% from my purchase price. By then, it had become clear that MTNL had lost the race. I should have realised it way back, but it was pure ego that prevented me from realising that I was in a value-trap. Since I had done so well with PSU stocks, I thought I knew them pretty well. I had made good money with my bets in Bharat Electronics, Bharat Movers, Container Corp, HPCL, BPCL and IOC. I exited most of my position in MTNL at Rs.40-50, 67% below my purchase price, in 2008-2009. I still hold some meaningless position in MTNL, hoping that the government could monetise its real estate assets.

The mistake people make is that they sell their appreciating assets and put in that money in losing stocks which they don’t sell. So, the losers stay in their portfolio. You are watering your weeds and cutting your roses.

Investing lesson

I had made money in so many PSUs, I thought I had figured it out. Like an ostrich I kept my head in the sand and didn’t look around to see what was happening. It was a basic failure of competitive analysis. Around 2004, I had a pretty good idea that my bet wasn’t working out. It is what you say about second marriages — triumph of hope over experience. So, make mistakes, but one that you can afford. I could afford to make a mistake in MTNL because I had taken no leverage. I had paid for the shares from my chequebook. If you take leverage, it kills you both ways. You are not only losing capital, but also money that you have taken in debt. I also learnt that just because something is cheap, doesn’t mean that you need to buy it.