Caution could be Pankaj Tibrewal’s middle name. The Senior Equity Fund Manager at Kotak Mahindra Mutual Fund says they are paranoid about bad balance sheets and run a mile away from companies with corporate governance issues. In the current market, he is betting on a leaner corporate India’s impressive recovery over 2022 and 2023 with specialty chemicals industry and manufacturing taking off, and real estate picking up. From such a conservative fund manager, these seem highly optimistic predictions. He tells Outlook Business why he stands by these views

Caution could be Pankaj Tibrewal’s middle name. The Senior Equity Fund Manager at Kotak Mahindra Mutual Fund says they are paranoid about bad balance sheets and run a mile away from companies with corporate governance issues. In the current market, he is betting on a leaner corporate India’s impressive recovery over 2022 and 2023 with specialty chemicals industry and manufacturing taking off, and real estate picking up. From such a conservative fund manager, these seem highly optimistic predictions. He tells Outlook Business why he stands by these views

Is there a feeling, after the pandemic, that market leaders are gaining disproportionate market share and therefore profits, and therefore valuations? What does this mean for mid- and small-cap investing?

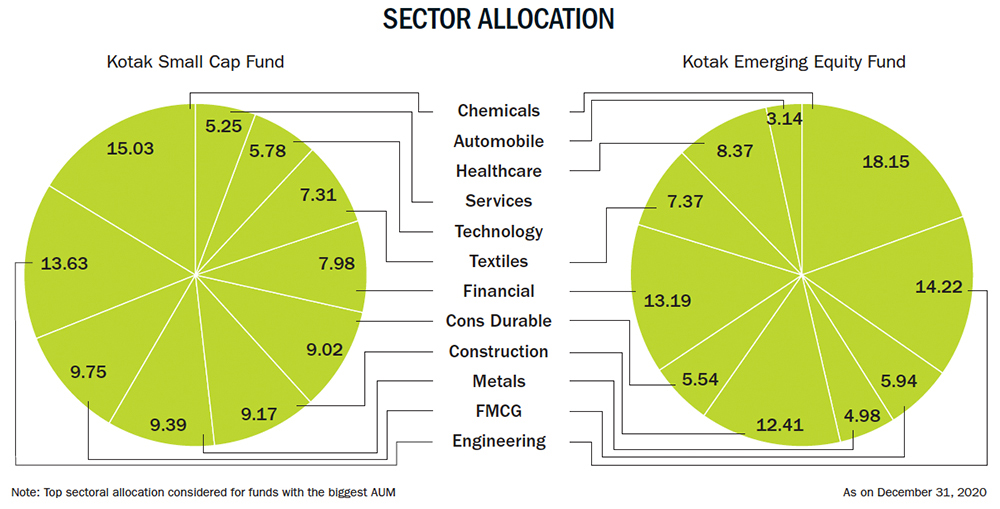

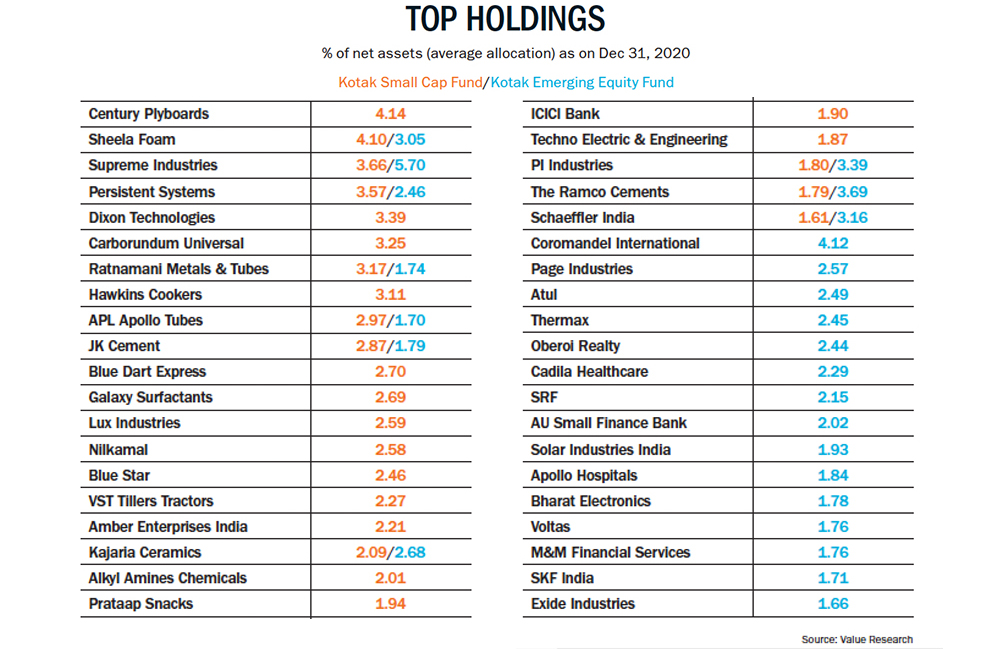

One of the themes we have been advocating for the last couple of years, post demonetisation and goods and services tax (GST) rollout, is that big will get bigger. Post-pandemic, it has become clearer that companies with strong balance sheets and cash flows will weather a crisis better. But, the myth is that bigger companies mean only large-caps. We did an interesting exercise, in which we studied companies ranked 101 to 650, according to their market cap. We were surprised that more than 50% of them are market leaders in their respective segments. So, there is a large universe of category leaders in the mid- and small-cap segment across sectors. For example, in the entire home-building segment, except for cement, none of the categories leaders are large-cap. This is true whether it be tiles, plyboards, wires and cables or consumer durables. If you put your money in these category leaders, which are mid- or small-cap, your money would have multiplied quite a bit and outperformed the market.

Most fund managers say they take a bottom-up approach. But with mid- and small-caps, isn’t it difficult to take high-conviction calls on individual companies?

We don’t label any company as large-, mid- or small-cap, but as great, good or gruesome, based on the quality of business and management, and finally based on valuation. Good and great businesses are those which generate a return on capital (RoC) higher than the cost of capital, thus giving a higher return on invested capital for longer periods of time. Secondly, a business needs to have a competitive advantage, such as better distribution or a superior product. Once these two criteria are met, we try to figure out the growth opportunity in the sector. If the company is a large fish in a small pond, it will be limited in how much it can grow.

When we evaluate the management, we rely more on historical data than forward-looking data. A leopard cannot change its spots. In this qualitative check, we interact with the ecosystem in which they operate, such as talking to vendors, customers and ex-employees, and try to understand the culture and intent of the company. Finally, with valuation,  we want growth, but at a reasonable price.

we want growth, but at a reasonable price.

We are focused on minimising our mistakes and don’t try to be No.1 in any category; instead, we focus more on consistency. Gruesome businesses, we won’t touch.

Let’s take your last point first, valuation. In your Emerging Equities Fund, barring a couple of names, there are no companies that trade below 30x earnings on a trailing basis. How do you justify these prices? Do valuations guide your exits as well?

You are right that, when you are looking at the trailing P/E, nothing in our portfolio looks cheap. But we are seeing the largest gap in many years between the trailing EPS and forward EPS. The third quarter of this fiscal has been the best quarter in many decades for corporate India. In the broader market, that is of 1,000 companies, in the second quarter, market reported almost Rs.1.7 trillion in profit though the expectation had been somewhere around Rs.900 billion and Rs.1 trillion. Corporate India has come out far stronger than what we all expected during June-July-August. That’s why there is such a chasm between trailing EPS and forward EPS. For next year, market is expecting growth of 25 to 30%. If companies deliver that earnings growth in 2022 and 2023, then the market does not seem too expensive.

Secondly, many of the companies in our portfolio have delivered earnings growth that they have not delivered in the past five to 10 years. That is because post-pandemic these category leaders have actually become stronger and leaner in their cost structure. A lot of them have reset their margins.

As for valuation, I see growth as the horse and valuation as the cart. If the company can deliver higher than market growth, or higher than industry growth, the valuation seldom becomes cheap. I have made errors in the past of selling businesses very early on.

On the selling strategy, I have a few guidelines. One, looking at balance sheet and cash flows gives me an indication whether the company is moving in the right direction. If it is not, we get jittery. Any corporate governance trouble is a red flag for us, it is non-negotiable. I think of myself less as a fund manager and more as a risk manager because, in India, stock picking is overrated and portfolio construction is underrated. Portfolio sizing becomes important. If after a strong performance, a stock becomes a large portion of my portfolio and doesn’t fit my risk matrix, I would like to take money off the table.

You have large exposure to specialty chemicals. How do the growth runway and valuations look now?

Specialty chemicals is still small in India and there is huge, untapped potential. Earlier, India used to be competent in chemical engineering but now we are getting better at chemistry too. Many companies are working with global companies to innovate molecules, as opposed to earlier when they would focus only on low-cost production after a molecule went off-patent. This is a structural shift. In this decade, we may see at least two or four multinational, chemical companies emerging out of India.

What is worrying is that many commodity chemical companies are clubbed together with high-end, specialty chemicals companies. Also, after the five-year run, we do need to consider that valuations are no longer cheap for the sector as a whole.

What are the other themes you are betting on?

There are two to three themes we are playing. One is of big getting bigger, so we ride the sectoral leaders in each and every sector. I think there is a high probability of real estate making a comeback. Over the last six to seven years, this sector has remained subdued. In fact, in the last few years, contribution of household to gross capital formation – which is essentially you and me buying real estate – has been low. My sense is that, with interest rates at its lowest in the last two decades, and everybody realising the value of a house post-pandemic, there is a genuine demand building for real estate, especially on the residential side. If this happens, a large number of home-improvement companies, which is a large sector, will benefit. Mind you, real estate is a large centrifuge with 250 industries revolving around it.

Not many real estate developers fit into our framework because a large part of their capital is deployed into idle land bank. So we went one step below and added other home material and home-improvement companies.

Not many real estate developers fit into our framework because a large part of their capital is deployed into idle land bank. So we went one step below and added other home material and home-improvement companies.

The larger narrative is real estate picking up over the next three to five years. All these companies have not seen volume growth for the last four to five years but, even in a downcycle, these companies on average delivered much higher return on capital than their cost of equity and maintained healthy balance sheets and cash flows. That shows the resilience of the business.

The second theme is the China-plus strategy and self-sufficiency, related to production-linked incentive scheme (PLIS). This is a powerful scheme, which has the scope of bringing manufacturing back into the country. Our FDI pipeline in March 2020 was about $70 billion, over the past 10 months, it has swelled to $170 billion. I believe that India has a great opportunity to command leadership position in many sectors. Our focus is on companies which can participate if manufacturing capex comes back. The third is financial services. Our sense is that private sector has emerged much stronger both on lending and non-lending side of financial services, and that is where our bets are.

You did talk about staying focused on healthy balance sheets. But, if you are indeed confident of a recovery, why would you not bet on leveraged plays?

We try to avoid leverage, ex-financials. We believe that cycles have become shorter and any company can get caught on the wrong foot if it is over-leveraged. When pandemic struck, we were not unnerved because we were pretty sure that none of our companies are going bankrupt or will face difficulty servicing debt. Honestly speaking, we are paranoid. Even if we deliver couple of percentage points lower, we are okay with it, but we do not want sleepless nights over our investee companies. That has been our core philosophy and it has worked for us for almost a decade now. So, assuming the cycle may be good for the next couple of years, we would still want to stick only to stronger balance sheet companies.

With privatisation on the anvil, are you also looking at public sector banks keenly?

Our preference remains large private-sector banks because they are well capitalised even after the pandemic. They have provisioned well for bad loans, they have a management team with long-term vision and their compensation policy is far more aligned towards shareholder value. Also, over the last couple of years, there have been some dramatic shifts in market share and private sector has gained market share at the expense of PSBs.

We have to be selective while investing in banks because many are so over-capitalised now that they will not be able to maintain their RoE. The golden phase in which banking sector delivered 15 to 20% RoE may be over. The regulator will probably not allow banks to leverage so much and, if that’s the case, as a shareholder, I may not get that required RoE which finally drives valuation.

With NBFCs, we believe that growth is out for some time.

You have a couple of cement stocks. Are these bets on the economic recovery?

We bet on cement for a couple of reasons. Our view is that, for the next three to five years, the supply of cement will be much lower than the incremental demand. Except in the South, where we still have supply surplus, the rest of the regions are operating at 80-90% utilisation. Also, over the last decade, this industry has consolidated extremely well. The top five guys in each of the regions are commanding anywhere between 60-65% market share, which brings in pricing discipline in the region. Also, some of the companies may have diluted equity once or twice over the last 20-30 years, which is phenomenal for commodity companies. What also excites us about cement compared to other commodities is that it is more domestic-market oriented, and thus we can forecast demand, supply and price whereas other commodities like steel are globally driven, especially by China, and therefore forecasts can go haywire.

But, drawing from past cycles, isn’t it tricky? Once the cycle turns, new players are happy to crash the party. So pricing is determined not by efficient and prudent players, but the inefficient challengers.

It is true that, between 2005 and 2010, a lot of companies planned capex expecting a huge upcycle and those capacities finally started coming into play from 2011. Those players had nothing to do with the cement industry. Just about any promoter from any industry was putting up a cement plant funded through debt. Then came the downcycle, and most of them sold their cement plants to the larger companies. Consolidation has been extremely good for the industry and that is why, even during the pandemic, the profitability of cement companies has got reset to the next level. For the last six to seven years, you may have seen 2 to 3% CAGR in pricing, but now you are seeing pricing play a much more important role. Even if cement industry’s demand grows at 5 to 6%, these leading companies will see disproportionate increase in profit because supply will be restricted.

Given that 2020 was filled with turmoil, what has been your biggest learning?

To focus on your core, which is to stick to good and great businesses. Second, is be focused on whatever you are doing. There are a lot of distractions in today’s world and we need to know how to cut out the noise. In April-May-June, a large majority was saying that the world is going down, we will not survive and so on. To take a more balanced approach is something that the pandemic has taught us again. Third is to be lean and agile. Finally, we all know that anything can go wrong, so be very, very humble in everything you do and accept your mistakes.