As an engineering student from Bhopal in the late ’80s, Neelesh Surana had a faint idea of how the stock market functioned. But he wasn’t immune to the IPO frenzy that was sweeping every nook and corner of the country. Tapping in, Surana ended up making tidy gains in a market, which was then riding high on the Harshad Mehta factor, albeit on a modest sum. Today, the 46-year-old manages Rs.2,700 crore in assets at Mirae, the South Korean financial major that entered India in the fateful year of 2008.

On completing his engineering, Surana landed up at Blue Star but soon realised that the job wasn’t half as exciting as he had thought, and finally quit to pursue his MBA from IIM Indore. After that, Surana shifted base to what was then Bombay in 1994, briefly working for Ashok Leyland Investment Services. He later on moved to research at a boutique broking firm, Dimensional Securities, followed by a stint with the institutional arm of IL&FS Investment from 2000 to 2003. But it was at ASK Investment Managers that Surana cut his teeth in fund management.

While he initially joined ASK as an analyst, it was in their PMS division that he learnt the ropes of fund management. Under Bharat Shah, the CEO of ASK, Surana learnt how to sniff a business opportunity, value businesses and the importance of return metrics in the context of growth. “Coming from the myopic world of sell-side, it was an interesting phase of learning under Shah,” says Surana, who quit ASK after five long years to join Mirae in 2008.

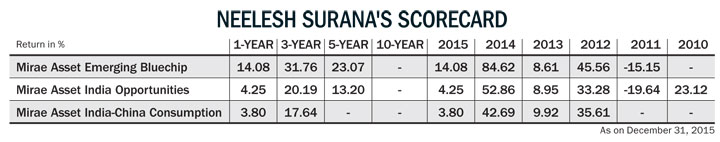

Given the long learning period and vast experience gained along the way, Surana has done a pretty good job in managing money, posting a return of 13% at the India Opportunities Fund vis-a-vis 6% by the BSE 200 Index over the past five years. With 300 stocks under coverage, Surana’s bottom-up approach lays a lot of emphasis on management and attaches even more significance to the nature of the business.

“You can be subjective about the management, but not about a business. If you look at a company’s past 10-year financials you can determine if it is good or not and whether the free cash flow is making a decent return on capital employed. Even in a business like commodities you can have a moat if you are a low-cost producer like Hindustan Zinc or Tata Steel (standalone), which can fetch you decent money in worst times and good money in better times. If the return on investment over a cycle is 15-20%, it’s good business, while a lower single-digit RoCE, which is below the cost of capital, is an inferior business,” says Surana, whose favourite book on investing is Common Stocks and Uncommon Profits by Phil Fisher.

In mid-2008, when the first fund was launched, Surana bought into ancillary major Amara Raja Batteries, which was a distant number two to the market leader Exide Industries. “We bought the stock when it was a follower and in this case you couldn’t have purely judged the management based on its past track record. Here’s where the market tends to reward you if you are able to identify delta return on investment and a change in management which cannot be properly quantified,” says Surana.

The fund bought close to 4 lakh shares in July 2008 when the stock was trading at around Rs.41. As he kept meeting the management, Surana’s conviction in the business grew and the fund loaded up on the stock, increasing its holding to over 9 lakh shares by May 2009, even as it tanked to a low of Rs.16 in March 2009. “If we didn’t take disproportionate weightage earlier it didn’t mean we weren’t convinced about the investment, but it was more of a conscious decision to safeguard the portfolio against undue damage,” explains Surana.

The bet paid off, with the stock going on to become a 50-bagger at the current level of Rs.825. In a two-player market, Amara Raja very quickly managed

to gain market share from 20% in FY10 to 40% by FY15, with its return on capital employed improving from 22% in FY09 to 38% in FY15. “A well-managed company will have better capital efficiency and they tend to be better in the same sector,” says Surana, who has since cashed in and pared the position to 5.3 lakh shares.

In pharma we trust

Another sector Surana is betting big on is pharma. “The sector has seen significant wealth creators and over the past eight years, we have been overweight. The best part is you don’t have to compete with each other because the opportunity size is huge,” he adds.

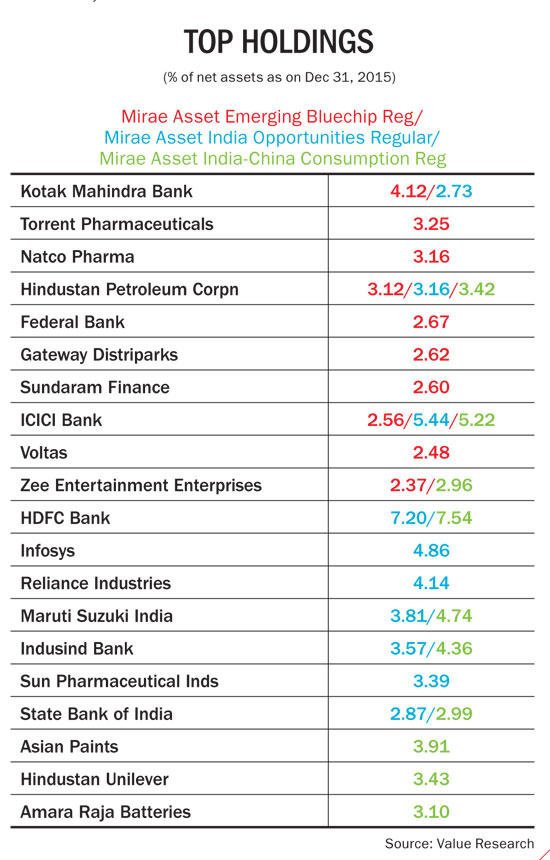

Surana as on date holds close to 10% of assets in Natco, Torrent and Sun Pharma. In the case of Natco, which Surana picked up two years back, the Hyderabad-based company has moved up the value chain from being a bulk drug manufacturer to emerge as a leader in the domestic generic oncology market. It commands a 30% share thanks to a portfolio of 26 products to treat diseases of breast, brain, bone, lung and ovarian cancer. While the domestic business remains the cash cow for the company, Natco is now looking to tap into the US market with niche filings.

In backing his calls, Surana doesn’t mind going against the tide. One can always get stocks that are cheap but to find contrarian opportunities is not as easy, he believes. For example, “Good companies pass through tough times when the short-term is impaired but long-term prospect is intact.” In other words, in periods of distress, there is a good chance for investors to buy into good companies at an attractive valuation.

In 2011, when the country’s biggest passenger car maker was bearing the brunt of a strong yen, the stock fell to Rs.900. As per estimates, every 1% appreciation in yen was impacting Maruti’s earnings per share by 2%. Surana, however, bought into the stock, which has since quadrupled to Rs.3,500.

“I don’t shy away from taking contrarian calls because the market can get myopic even about good companies, and if your time frame is longer, then you have to back your conviction and bet against the crowd,” says Surana, who continues to hold the stock in his portfolio.

The challenging phase that Maruti went through then is now being played out in the case of Sun Pharma, after a run-in with the US FDA over the company’s Halol plant and integration issues with Ranbaxy. “Sometimes the market punishes a stock for an event where there is ambiguity, and because there is ambiguity, there is double counting — that results in lower valuation.” A scenario where everything is rosy and price is more than value is the worst situation to be in, he feels. Surana says that it is much better to not have a rosy outlook and get a stock at an attractive valuation.

Surana’s fund, itself, has increased its exposure to Sun Pharma to 3.39% of assets from 2.91% in January 2015. This, after the stock fell from a high of Rs.1,200 in mid-2015 to Rs.700 by end of the year. “There could be further downside, but that’s why you have to keep risk-adjusted weights in the portfolio,” says Surana.

Businesses that generally don’t make the cut for Surana are those engaged in commodities or in consumer businesses such as spirits. “Commodities in general are not good, unless the company has a moat. For example, Tata Steel on a standalone basis looks attractive but because of the Corus issue, it’s now trading as a mid-cap. The point I am trying to make is there can be tactical opportunities but per se the commodity business is not good,” says Surana. In the case of spirit companies, Surana’s view is that these are more like FMCG companies where there is no pricing power. “They don’t have the core consumer traits of having the freedom to price the product. In fact, a lot of delta in price hikes goes to the government in taxes, which has seen an irrational increase over the past 10 years,” he adds.

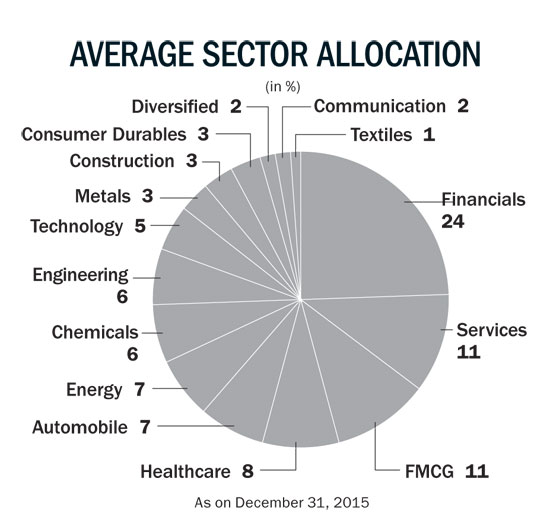

Though the fund follows a bottom-up approach, financials constitute 24% of assets, largely spread across HDFC Bank, ICICI Bank, IndusInd Bank, Kotak Mahindra Bank, SBI and Federal Bank. The exposure to Kotak is by virtue of the fund’s holding in ING Vsysya Bank, which was taken over by Kotak. The skew towards private players is largely because Surana believes that as banking becomes increasingly consumer-centric, state-owned banks will find themselves marginalised.

“The other issue with PSU banks is that there is still no clarity on the quality of their books, even if today I am paying 1.5x price to book. If banks such as Kotak can raise fresh money at 3.5x book isn’t that self-explanatory,” asks Surana. Going ahead, Surana believes within the consumption story, it will be the retail banking franchise and discretionary segments that will continue to do well, driven by triggers such as improving incomes, the recent pay commission hike and changes in consumer habits.

Following a bottom-up unfortunately means you cannot have names from the infrastructure space as almost most all players have cash flow issues. “Many of these businesses don’t generate the sort of free cash or return on equity that we would ideally like to have, besides we also avoid companies where we don’t have a comfort level with the management,” explains Surana.

The sharp correction over the past four-and-a-half months has made valuations reasonable, feels Surana. “I believe the margin of safety is high and over 15% in the next five years is quite possible, provided one is in the right pocket of stocks. Having said that, return will not be linear,” says Surana. Coming from a fund manager, who made his debut during the worst phase of the Indian market and managed to generate 15% tax-free return, you just cannot disagree.