Over the past two to three years, we have seen global private equity (PE) companies buying out listed, Indian midcap companies. There was, for example, Advent buying into DFM Foods, Blackstone buying Essel Propack and KKR buying out the founders of JB Chemicals (a Nepean Capital investee company).

As a result, most of these companies have seen a re-rating since there is a perception that companies having PE funds as owners/management are as good as ones managed by MNCs, in terms of governance, because of which their stocks trade at a premium compared to their local peers.

One such company is SeQuent Scientific, a Nepean Capital portfolio company. It was carved out from Bengaluru-based Strides Arcolabs and, within just eight years of its founding, it has emerged as India’s largest animal-health company. With annual revenue of over $200 million, SeQuent is among the top 20 animal health (API and formulations) companies globally. Animal health APIs account for 35% of its top-line with the balance coming from formulations. The company employs over 1,700 people; has plants in India, Turkey, Spain, Germany and Brazil; and its products are sold in over 95 countries. In fact, SeQuent has the only USFDA-approved animal health facility in India. Over 90% of its revenue comes from overseas markets with Europe being its largest market, accounting for 55% of revenue. In FY15, to grow their global presence in animal health, they had rebranded this vertical as Alivira Animal Health.

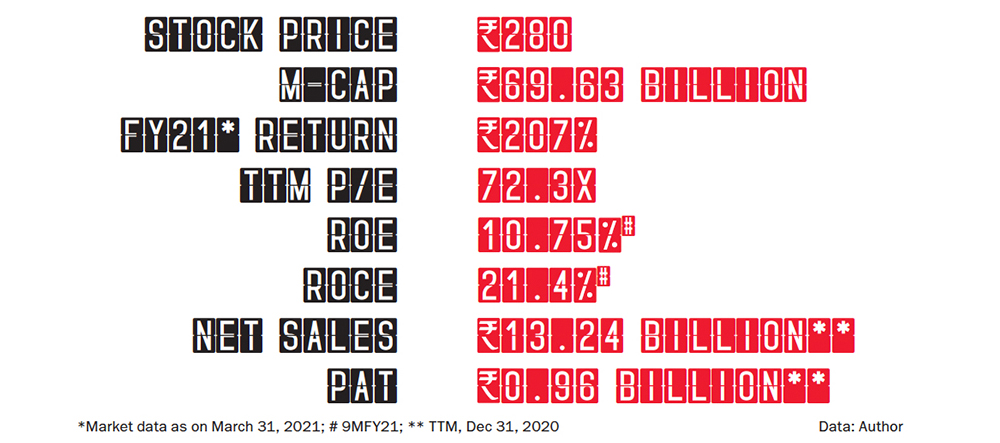

Last August, the Carlyle Group, which has a history of successfully investing in the Indian healthcare space, took control of SeQuent Scientific from the previous owners for Rs 86 a share (current price is Rs 246). This is Carlyle’s largest control deal to date and its first investment in animal healthcare globally.

This is expected to drive their vaccine strategy, an area where they do not have any presence yet, as well as growth in new geographies such as US and China, which are large, untapped markets. Carlyle has already shown evidence of adding value as SeQuent sold its equity holding in Strides Pharma for Rs 1,537 million to the former promoters. It used the proceeds to acquire the residual 40% of Provet, one of their high growth and profitable subsidiaries in Turkey. SeQuent also pared down debt, both actions adding to its bottom line. Carlyle is expected to help use its global healthcare network to help grow the company’s business. Moreover, the US, which is the headquarters of the Carlyle Group, is the world’s largest animal-healthcare market, but accounts for less than 5% of SeQuent’s revenue today.

Improving Financials

SeQuent is expected to continue driving stable 15% growth, CAGR on the top-line riding on the 5% industry growth, 5% from new product launches (injectable launch in the European Union, EU, which has a $350 million addressable market) and 5% from entry into new geographies such as the US. They have already appointed a US head of sales, Alan Kelly, and have filed for injectables with a $500 million addressable market.

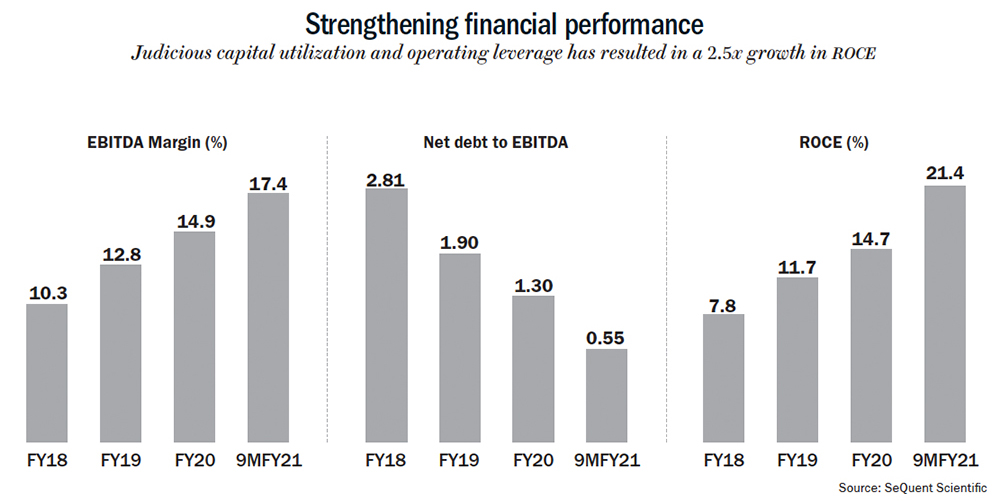

We believe the company will demonstrate ~200bps in margin expansion over the next four to five years through better product and geographical mix, new higher-value product launches, and operating leverage from both formulations and the API business. One of the strengths of this industry is high EBITDA-to-cash conversion with SeQuent converting typically 80 to 85%.

The company reported stellar Q3FY21 results with revenue up by 13%, EBITDA by 34% and net profits by 83%. EBITDA margins rose nearly 300 bps YoY to 18.2%. SeQuent also announced that they have 35 new formulations under development and plan to make 10 filings in the US over the next three years. While the company’s net debt-to-equity fell to 0.55x from 2.81x in FY18, its ROCE rose to 21.4% from 7.8% four years ago (See: Strengthening financial performance).

Barriers to Entry

The animal-health space is not only regulated but is also a tough industry because it has to mind varied nuances particular to a region. There is variability in species within each geography and there are varieties of dosage forms, such as oral, injectable, powder, spot-on and pour-on. Human health, in comparison, is more homogenous. The larger part of the industry worldwide is serviced by branded generics, where the supplier has to build a brand with the veterinarian or the end-consumer (for example, the animal husbandry department).

The value add is having the last-mile reach and making small but material changes in the generic drugs to enhance its ease-of-delivery for the end-consumer, such as increasing the shelf-life of a medicine vial after it has been opened. SeQuent has been successful in building this business across the EU, emerging markets, Turkey and Latin America via value-accretive acquisitions. Further, API-supply contracts made with global animal-health leaders and a recent contract win with Zoetis (a spinoff from Pfizer) to distribute their product in India are a testament to SeQuent’s strength both in product quality as well as last-mile reach in the animal health space. With Zoetis, it is a multiyear partnership for marketing around 13 brands and 19 SKUs.

Besides these advantages, the company has top-notch management. There are the best practices brought in by the Carlyle Group but, even more valuable to the company is its CEO Manish Gupta. We place immense faith in Gupta, who has been the company’s CEO since its founding in 2014 and has done an outstanding job steering the company to becoming an Indian MNC.

(Disclosure: We own the stock in our fund, Nepean Long Term Opportunities Fund, but I personally don’t own it.)