The packaged foods industry is at an inflection point in India and one segment that can be a big beneficiary of the conversion from loose sales to packaged sales is basmati rice. Not just in India, basmati is gaining acceptance all over the world, including countries such as the US, UK, Australia, New Zealand, besides the traditional export market of West Asia.

Though we have a few listed basmati rice processors, most of them are debt-laden and saddled with huge working capital. Of the pack, the one company that stands out, in our view, is Chaman Lal Setia Exports. It’s a small company with less than Rs.500 crore market cap. However, if one can get the four basic pillars — business, management, financial performance and valuations — of a stock selection right, it’s much easier to analyse and make money in small cap stocks.

I like the company on several fronts including the way its operating performance has shaped up over the years, aided by an increasing focus on exports, rising share of branded sales under the “Maharani” brand, induction of third-generation promoters and well- managed working capital.

King of rice

India accounts for over 70% of the world’s basmati rice production and the rest is accounted for by Pakistan. Basmati is unique to the region. In fact, “basmati” is protected under “The Geographical Indications of Goods (Registration & Protection) Act, 1999” of India, which prevents any rice grown outside of the Indo Gangetic area from being called basmati.

Among the food grains exported from India, basmati is an important commodity. On the back of both improvement in realisations and strong growth in volumes, basmati exports have shown an astounding CAGR of 27% from Rs.2,800 crore in FY05 to Rs.27,600 crore in FY15. While basmati rice is consumed across the globe, West Asia accounts for 75% of India’s exports. Of late, China, too, has been importing Indian basmati rice.

Besides exports, basmati also accounts for 75% of the branded rice market, which is driven by the convenience of procuring clean rice packs from stores, rising income levels, urbanisation, and growing brand awareness. Given that unbranded basmati (loose basmati) still accounts for 74% of total basmati sales in the country, the potential to tap the conversion (consumer uptrading) is huge.

Seasonal blips

Like any other commodity, basmati paddy is also vulnerable to cyclical price fluctuations. During the procurement season of FY13 and FY14, there was a steep rise in paddy prices from Rs.18,000/MT in FY12 to around Rs.37,000/MT in FY14, owing to strong demand overseas. But the subsequent two seasons were not so good, owing to excess supply and weak demand.

The situation is, however, expected to improve now on account of two factors: supply of basmati paddy is expected to moderate as farmers are likely to shift away from basmati, given the non-remunerative prices in the previous two crop cycles. Further, with a rebound in crude oil prices and Iran lifting the import ban on rice from India; exports are likely to improve.

In safe hands

Before we move on to operating performance part, it’s important to ensure that those running the business should have their interests aligned with those of minority shareholders. In case of CLSE, it’s an owner-operated business with Chaman Lal Setia and his sons at the helm of affairs, holding over 70% stake. The company has also seen induction of third generation promoters who have been actively scouting for new export markets.

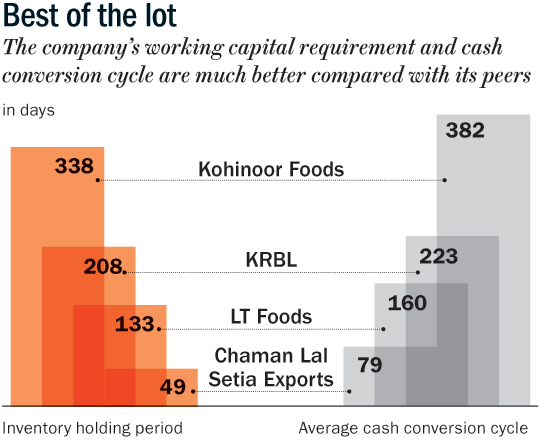

In India, companies engaged in rice processing are all laden with huge amounts of debt. This is because processing and sale of rice is a capital intensive business; more so, in the form of working capital needs given the ageing process for both paddy and rice. However, there is minimal benefit of holding excess paddy inventory because the aged paddy prices are determined by the next year’s paddy prices.

As far as Chaman Lal is concerned, it’s among the more efficient rice processors. The company processes and trades in basmati rice in the domestic and export markets. It has a paddy unit in Karnal (Haryana) and Amritsar (Punjab) with a processing capacity of 14 tonne per hour. Given the excess processing capacity in the country, the company hasn’t expanded its capacity for long and, instead, it has focused on procurement of semi-processed rice rather than storing and ageing paddy for long. On the other hand, rice processors such as REI Agro, Usher Agro have suffered immensely on account of holding excess inventory.

On the growth front, despite no major capex the company has seen its sales clock 17.5% CAGR over the past six years. This has been achieved on the back of growth in both volumes and realisations. In FY16, sales were lower in comparison to FY15, despite more than 27% increase in volumes as realisations declined. But what is interesting to note, that barring FY16, from FY10 to FY15, the company could consistently maintain its operating margins in the range of 7-9%. In FY16, the margin expanded to over 12%, on the back of expansion in gross margin to 29% from 20% in FY15. We believe the decline in realisation against much higher decline in procurement of paddy and semi-processed rice, managed to boost the margin. It remains to be seen if the company is able to sustain the high gross margin of FY16 or reverts back to the previous level of 21-22%.

Importantly, the company’s working capital requirement and cash conversion cycle are much better than other rice processors. In recent years, Chaman Lal has managed to reduce its inventory days from 80-90 days to 35-50 days. Similarly, debtor days have fallen from 120-130 days to 60-80 days. As far as return ratios are concerned, RoE and RoCE are in excess of 15-20%.

Fresh harvest

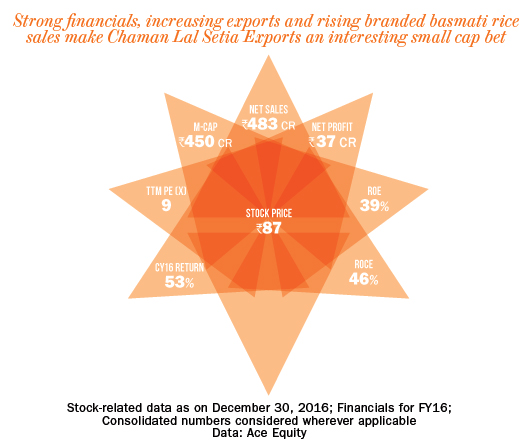

The company’s market cap is Rs.450 crore and its enterprise value is Rs.320 crore with a cash of around Rs.40 crore (as of September 2016). For the trailing twelve months, the stock recorded a PAT of Rs.37 crore and EBIT of Rs.55 crore. Based on which, the stock is trading at 9.73 times trailing 12-month earnings and an EV/EBIT multiple of 5.82 times. We, hence, believe that the valuations are reasonable both on an absolute and relative basis compared with 18 times TTM PAT for KRBL. Given that Chaman Lal is an efficiently managed business, it is best placed among its peers to make the most of the growth in the coming years.

The writer does not have a position in the stock but has recommended it to clients