Atithi Devo Bhava, the age-old adage, best epitomises the future for the over Rs.4,000 crore Indian Hotels Company (IHCL). An iconic name in the hospitality industry, the Tata group company is the indisputable market leader with marquee properties, such as the Taj Mahal Palace, among its vast list of hotels in India and abroad. These properties have hosted some of the most prominent global leaders and personalities from all spheres of life. Some properties such as the Rambagh Palace in Jaipur, and Umaid Bhawan Palace in Jodhpur give tourists an insight into India’s cultural narrative. IHCL owns seven of the country’s top 20 hotel properties. In fact, the iconic Taj Mahal Palace Hotel recently got an ‘image trademark’, making it the first building in the country to get an intellectual property rights protection for its architectural design.

Over the years, given the changing industry dynamics, IHCL broad-based its business model to take advantage of the growth prospects across the travel and tourism value chain. It operates under the brand of Taj and Vivanta — catering to the luxury segment, Gateway in the mid-category and Ginger in the budget category. The group, which currently has 137 hotels with 16,848 rooms, has added nearly 3,000 rooms over the past five years at a CAGR of over 4%.

Course correction

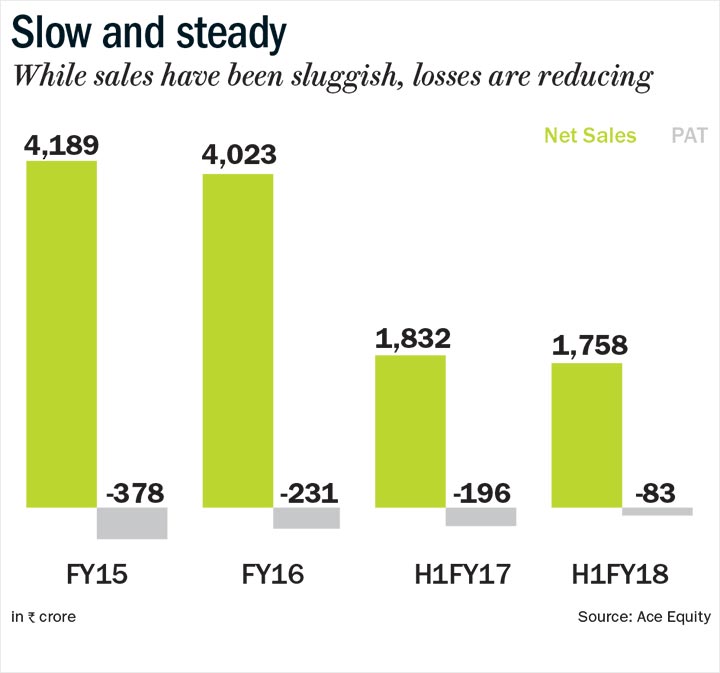

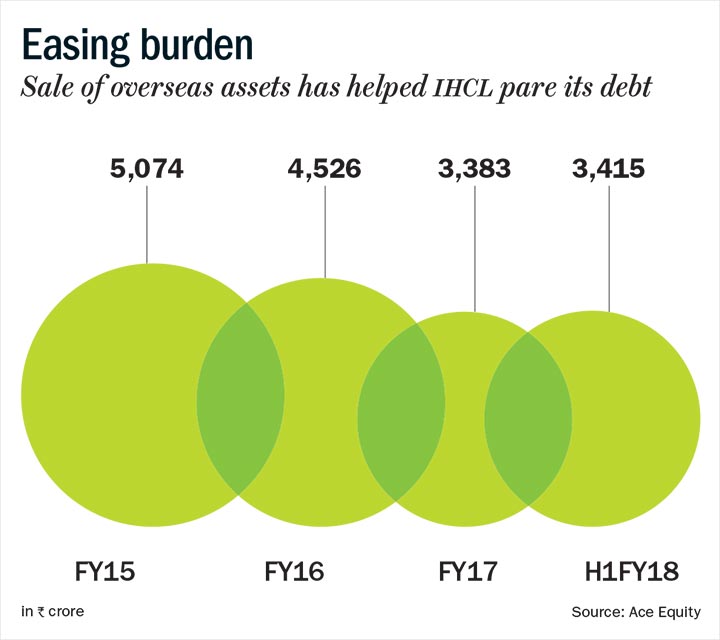

Prior to the financial crisis, IHCL had undertaken aggressive international expansion to establish marquee properties in key geographies. The management has, since then, taken steps to rectify some of the decisions which adversely impacted its financials, primarily owing to a slowdown in the hospitality sector. In FY17, the company pared its debt by around Rs.1,000 crore, including the divestment of Taj Boston for Rs.839 crore. Further, IHCL has created a 100% offshore subsidiary, comprising eight hotels (1,584 rooms) across the US, UK, Sri Lanka and Maldives, that could be used to improve the company’s liquidity position, if the need arises. IHCL, which also has 900 acres of land that could be used to prune debt, is now following an asset-light business model by entering into management contracts instead of owning properties. Going forward, the consolidated debt of Rs.3,400 crore is expected to be slashed further through sale of some assets and proceeds from the recent rights issue. As a result, the debt-to-equity ratio of 1.36x is projected to come down to less than 1x by the end of FY19.

Against such a backdrop, it would be unfair to give a fair valuation for a company which has such priceless heritage properties. The embedded value of the company can be anything that one can imagine given the replacement value of these iconic hotels. However, stock valuation lies in the ability of a company to generate positive cash flows on a consistent basis. The company has lagged on this parameter, which led the stock to underperform the benchmark and peers for several years. Nevertheless, the tide may turn favourable and the company’s initiatives in recent years will help it generate positive free cash flows on a sustainable and incremental basis.

A renewed sales and marketing attempt by IHCL through digital, loyalty updates, Tajness rollout, PR campaigns, and awards have already resulted in average gross website bookings going up by 22% for H1FY18 compared with H1FY17. Revenue from booking done through mobiles too has gone up by over 184% in the latest quarter. With 11 upcoming hotels, IHCL has reiterated its focus on managed properties besides commissioning of the Taj Exotica Resorts & Spa in Andaman, and the rebid for Taj Mansingh in Delhi. In the current fiscal, the company opened five hotels under the Ginger brand in Mumbai, Gurgaon, Lucknow and Ahmedabad and exited one property under the Ginger brand in Tirupati.

Room with a view

We believe IHCL is likely to outperform in the coming calendar year based on the four broad parameters:

Undisputed Leadership: Over the past couple of years, a number of international hotel brands have entered the Indian hospitality industry, yet IHCL remains the undisputed leader in terms of room inventory and geographical presence. Over the years, it has built a vibrant portfolio catering to different hotel categories, including premium hotels, mid-market hotels and budget hotels. Its share from contract management will continue to increase, raising the possibility of better margins.

Beginning of an upcycle: The period from FY08 to FY15 saw an oversupply in the Indian hospitality sector and that is now coming to an end. A report by Crisil states that the overall supply of premium hotel rooms across the country’s 12 primary destinations grew only 7% compared with 11% average growth over the past five years. The revenue per available room, too, is expected to witness impressive improvement over the next two years. The company is seeing higher occupancy and average room rate, which indicate that better days are in store for the hospitality industry.

Presence in premium and mid-market: Historically, an increase in demand is followed by an increase in supply by industry players. But setting up premium and mid-category hotels requires considerable time (funding, permissions, land acquisition, etc). IHCL’s dominant presence in both the categories will work in its favour.

Aviation PLFs at lifetime high: The Indian hospitality industry’s occupancy levels are closely linked to domestic airline passenger growth. The Indian aviation sector is in an upcycle, the sector is operating at a lifetime high passenger load factor (PLF) of over 85% even as passenger traffic growth rate is clocking over 17% for the past 18 months. This bodes well for the hospitality sector.

Check in

IHCL with its marquee heritage properties is likely to gain the most among foreign travellers who want to get a taste of India’s rich heritage. We believe there is a good visibility for growth in the hospitality industry because of improving macro factors and we are already seeing it in the numbers. IHCL reported a 4% jump in standalone sales of Rs.1,034 crore in H1FY18, while EBITDA improved by 14% to Rs.161 crore. Consolidated loss also shrank from Rs.196 crore in H1FY17 to Rs.83 crore in the first half of the current fiscal. Going ahead, we expect revenue will continue to grow at a healthy clip and, hence, value the IHCL stock at 22x EV/EBITDA for FY19 with a target price of Rs.164 in the New Year.

The brokerage has a buy call on the stock, but the writer, in his personal capacity, does not own the stock