India’s infrastructure is expected to witness a substantial boost in the coming years, backed by the government’s core sector push. The Centre had allocated a record Rs.3.69 lakh crore to infrastructure in the previous Budget. A lot of other factors, too, have come together, making it a propitious time for the sector. Moody’s has just delivered the good news of a rating upgrade, which will, in turn, favourably impact the rating of public sector enterprises. With bank recapitalisation in the works as well, we see infrastructure as a sector to go long on.

Utilities have always been considered as an option that enables investors to capture higher-than-average dividend. Also, utilities are low-beta stocks and provide relatively stable growth. Given the current state of development and policy environment, Powergrid Corporation of India provides a superior combination of growth and stability. I see this as the best utility stock which will see a sustained appreciation over the next four to five years.

The government seems determined to pursue a path of investment-led growth with infrastructure as the key area. The current regime intends to provide 24x7 reliable power supply and is working towards policies to enable that. Further, the Ujwal Discom Assurance Yojana scheme has reduced losses in state-run utilities and improved efficiencies. Transmission and distribution sectors had accumulated losses of about 4% of GDP and 22% of all outstanding bank debt was in the power sector by the end of 2015. The scheme aims to bring the gap between average tariff realised and average cost of supply to zero.

The current regime also aims to make the power purchase agreements enforceable, which have severely hurt power generating companies, especially in the renewable space. The Centre is targeting generation of two trillion units of energy by 2019. This means increasing the current production capacity by two times more to provide 24x7 electricity.

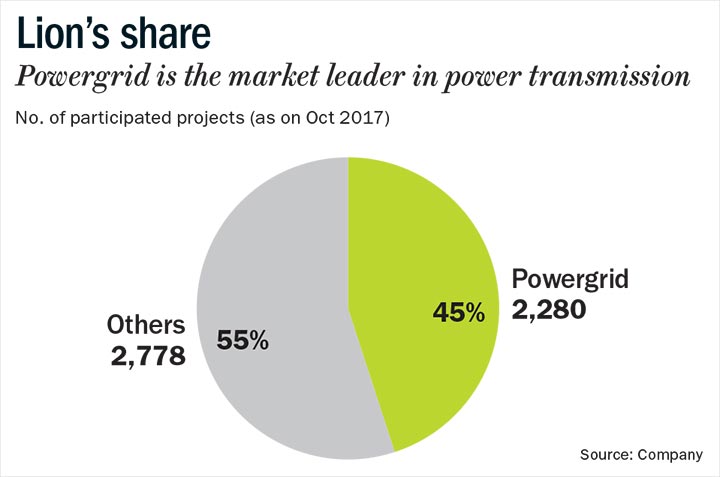

This is the reason why utilities should deliver a superior risk-adjusted return in an economy such as India. Though, not all utility stocks are of investment grade, Power Grid, which transmits more than 50% of total power generated in the country, certainly makes the cut. The company is also setting superior standards in project management and operations for the industry, leveraging capabilities to consistently generate maximum value for all stakeholders.

Best of the rest

Power Grid has been ranked as the fastest growing electric utility company in Asia for the past four consecutive years. The company owns and operates about 85% of the country’s total extra-high voltage/ultra-high voltage transmission network. It has maintained availability of transmission at 99.8% in FY17, highest by Indian standards.

The company has also diversified into railway electrification, telecom towers and data centres. Indian Railways plans to electrify all its routes by FY21-FY22, for which Powergrid has already started implementing pilot projects. Other opportunities include 30GW wind, 20GW solar ultra-mega power plant and 7GW nuclear integration into the national grid. Powergrid’s management has also consciously sought to diversify revenue streams by increasing the share of consultancy fees and engineering, procurement and construction work. Newer avenues can emerge from smart cities and electric vehicles. The company has also expanded its footprint internationally and is now targeting Saarc and African markets.

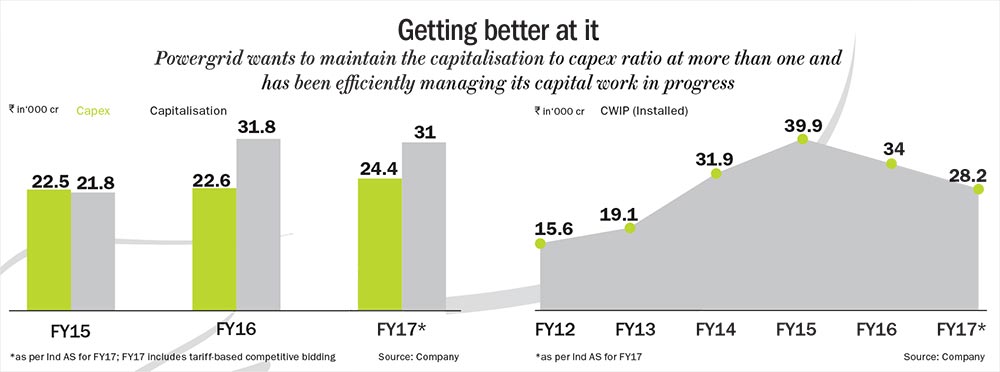

In FY17, the company capitalised about Rs.31,000 crore and incurred a capex of Rs.24,429 crore. The management intends to increase the capex to capitalisation ratio above 1.0 in the immediate future. Powergrid is likely to commission projects worth Rs.1.24 lakh crore over the next four to five years, backed by strong visibility in the tariff-based competitive bidding. Total work in hand was Rs.1.3 lakh crore at the end of FY17, of which Rs.39,000 crore was capital work in progress. The company intends to execute the balance Rs.91,000 crore over the next three years or so. In FY18, the company plans to execute Rs.25,000 crore, which implies that for the next two years it will witness higher-than-average capex of Rs.30,000 crore. Hence, the capex and capitalisation rates can converge to around Rs.30,000 crore.

Long-term story

If the government’s efforts to revitalise the renewables sector succeeds, this will further boost Powergrid’s prospects. We can expect this to play out in the next five years. This could provide an upside to the stock, though it is difficult to make an estimate now.

The company has delivered 20% CAGR in sales over the past six years. In FY18, revenues increased by 17% in first half to Rs.14,882 crore, with an operating margin of 89%. Income from other verticals such as telecom are low, but growing fast. Powergrid has well-managed its working capital, reflected in healthy operating cash flows. The receivable overhang is just 40 days and it has also managed to keep the debt-to-equity ratio consistent at 70:30 for the last few years.

As the company is expected to sustain the capitalisation rate and improve on capex in the next three to four years, it will sustain the earnings momentum, though higher base effect comes into play. The earnings per share growth is expected to be in the 20%-plus range over the next three to four years, while ROE is expected to be in the region of 16%. At current levels, the stock is trading at a price to book of 1.3x (FY19 estimates) and looks reasonable.

Powergrid is the best stock in the utilities segment with unmatched operating parameters compared with its peers. Given its dominant position in the transmission segment, there may not be enough headroom in terms of market share growth. However, with Powergrid’s competitive strength and diversification of revenues, the stock can deliver at least 3x return in the next four to five years, implying a compounded return of 25% annually.

The writer has an interest in the stock