2019 is likely to be an eventful year for Indian equities with the upcoming general elections keeping the market busy in the first half. The potential structural challenges facing rural India and unclear role of populist measures in deciding electoral outcomes imply that the post-May narrative will hold the key for a full-year performance.

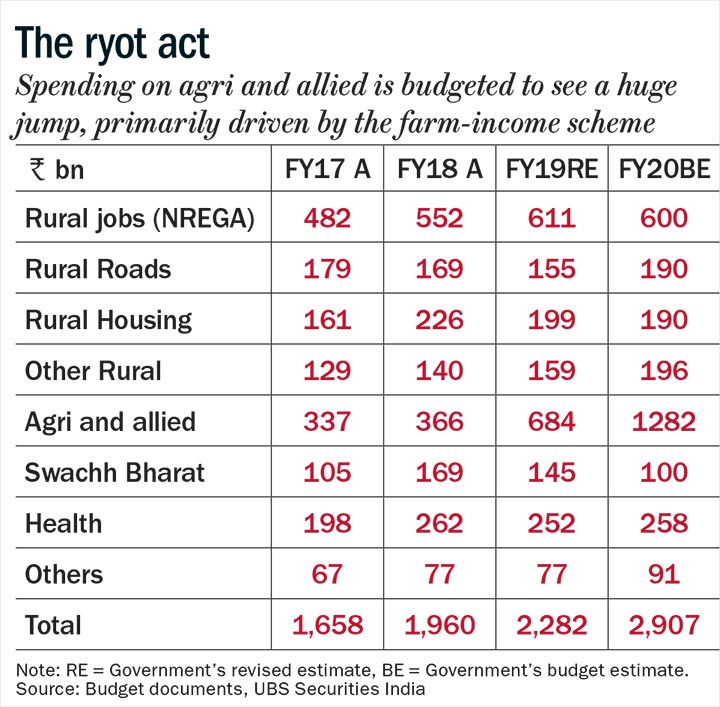

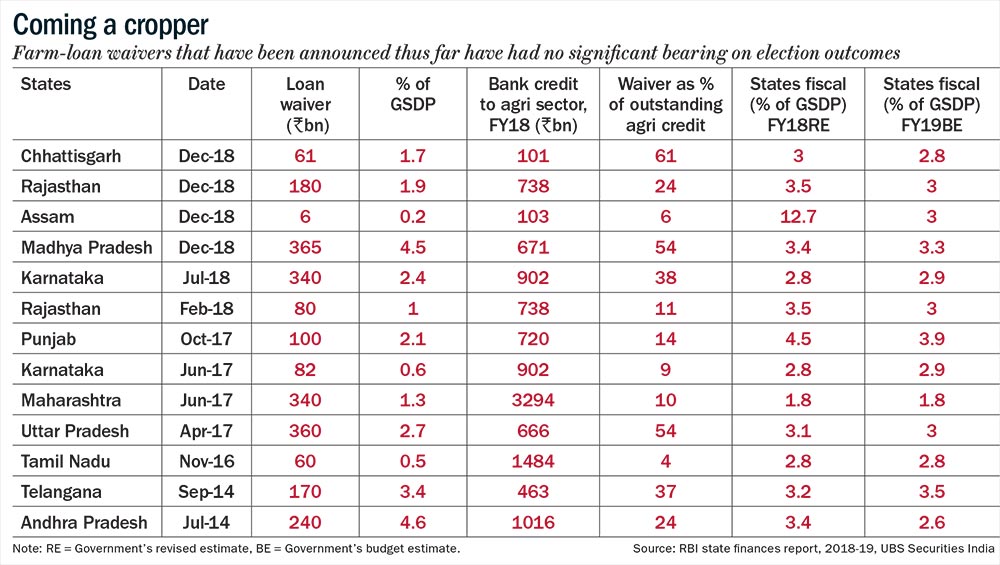

Leading up to the general elections, there is very little doubt that populism is picking up. Ten states have announced farm-loan waivers over the past two years as election promises. As a share of GDP, this is closer to 2008, when the-then leading opposition party, the Congress, promised a nationwide farm-loan waiver if voted to power. The states that have announced farm-loan waivers make up for 65% of the country’s agricultural credit and also accounted for 55% of farm-loan waivers in 2008. In the recent budget, the BJP-led government announced its flagship Pradhan Mantri Kisan Samman Nidhi Scheme (PM-KISAN) program, an income-support scheme to supplement rural income. Yet, our analysis of data during past elections indicate an unclear role of populism in ensuring an electoral victory.

The disaggregated data of nationwide farm-loan waivers of 2008 suggests that the political impact may not be that obvious. A look at key states where loan waivers were dominant did not indicate improved results for the Congress in the 2009 elections, vis-à-vis other states which did not have any material waivers. Same was the case for states with high spending on the National Rural Employment Guarantee Act (NREGA) then.

But how is this narrative of populism important for the markets? Reforms and policy decisions are ultimately the key to sustaining market valuations. This is especially visible over the past four years when improving macro stability and reform momentum boosted investors’ confidence in India’s long-term growth visibility. This confidence has helped the market to re-rate despite a weak earnings growth. This observation is in contrast to 1997-98, when despite double-digit earnings growth Indian equities de-rated and underperformed as investors remained unsure about the coalition government’s ability to stay committed to the reform policy trajectory. The reforms narrative over the past four years has seen some setback, of late, in the minds of investors, with announcements of farm loan waivers, stepping back from oil price deregulation and events around the Reserve Bank of India. Thus, the key question is that is ‘populism’ a reality beyond May 2019, reflecting structural challenges in rural India? Excluding credit support, agricultural growth has been weak, and terms of trade have not been positive. The current government’s policy focus has been towards improving market access for farmers, food storage/processing infrastructure and insurance. However, these steps are structural in nature. This is something investors would keep an eye out for now, but the base case remains of policy trajectory discipline and stability post elections.

A Wild Card

The income support scheme, PM-KISAN, entails direct cash transfer of Rs.6,000 a year for small and marginal farmers. To assess the on-the ground feedback regarding the scheme we interacted with senior politicians, policy makers as well as local administrators. Indian voters are used to pre-election handouts but few experts suggested that as the cash transfer is annual rather than a one-time payment, it could work politically. We think farmers will respond to it positively as this guaranteed amount can be used as collateral to take loans from banks (can be levered 3-4x). Large states such as Uttar Pradesh already have data on almost 10 million beneficiaries with landholding records already digitised. The number of likely voters in these households is 2-3x this number. This compares with 81 million votes cast in the 2014 elections in the state, with the BJP winning 34 million votes. The scheme is, thus, a wild card that - if implemented and marketed well – could influence voting behaviour.

View From The Street

Investors look unfavourably at increased populism at the expense of other spending options, such as infrastructure as it is associated with not just a skew in spending but is also accompanied by fiscal expansion.

Populism through fiscal expansion has a more near-term effect — negative for rate-sensitive sectors such as cyclicals but positive for consumption-oriented sectors. Populism funded by cutting down expense in other areas (the obvious one is capital expenditure) has limited short-term consequences, as fiscal discipline is not disturbed, but there is loss of productivity in the longer term. Capex cycle stays sluggish under this approach, especially if private capex is also running weak, thus, negatively impacting industrials and infrastructure. Overall, from a market perspective, while macro growth may recover a bit, political and policy uncertainty keep us cautious. Our discussions with investors suggest that the rich market valuations may be pricing in a steady policy regime as well as a sharp earnings recovery. While a positive narrative on reforms and policies supported rich valuations over the past four years, the build-up of populism’s unclear role in deciding electoral outcomes will be the key for the rest of the year.

Meanwhile, cuts in earnings estimates (from 15-20% at the start of the year to single digits) have become a recurring trend for the past six years. There will be some support in FY20, driven largely by normalisation of earnings for financials but the underpinning macro growth drivers - policy impulse, private capex cycle, exports and credit- are in various phases of a recovery mode. Thus, a broad-based pick-up in earnings is unlikely, and there is a risk to consensus’ optimistic earnings projections for FY20-21, in our view.

Overall, with likely cuts in the earnings trajectory and uncertainty around politics and policies, the market’s risk-reward remains unattractive. With a range of possible electoral outcomes (right from a comfortable majority for the BJP-led National Democratic Alliance to a third-front led coalition government), the best risk-reward could come from staying overweight on private corporate lending banks (especially those with a strong retail liability franchise), rural-focused names, property, select consumer discretionary and information technology.