“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.”

Nobel Laureate Daniel Kahneman’s eloquent quote renders this story completely irrelevant. You can stop reading now. Or, be a creature of habit and continue, simply to feed your curiosity or to sound intelligent in your next Zoom party. But please do so knowing fully well that this is an attempt to decode the past that is unexplainable and divine a future that is unpredictable.

There is no certainty in investing. Sorry, in life. And, therefore, in investing too. At 90, even after beating the Index every single time (every 10 years over the past fifty years), an investing wizard’s future performance can be questioned and the past scrutinized. You know whom we are talking about. Well, no one on Planet Earth has been skillful enough to beat the stock market over really long periods, and the one who has done so, we are yet to prove was all skill.

Right place, right time is chance. Right call is right only in hindsight. Welcome to the world of investing. Let me get down to business now.

For, dissuading the rare few who still care to read will not do any good to an already broken media model. How are we scribes supposed to pay our bills?

That 225-word rant is in response to the recovery the market has seen post COVID-19, as if the pandemic and the death-like stillness of the lockdown never happened. Just a few months ago, in March 2020, the market had cracked under the global pandemic and it felt like we are headed into another Great Depression. The scale of the catastrophe was staggering, like seen only in sci-fi movies. The Nifty lost 40% in value over the first three months of the year, without a pause. Then, snap. The gloom dissipated and the Index rebounded with a vengeance. Who would have guessed? But, of course, everyone has figured out exactly why! We have fallen comfortably back into our delusion of an ordered, reasonable world.

Post-mortems have been done: COVID-19 won’t last forever; it probably means disruption for a year for businesses. It was after all just one year of earnings, and what is the value of one year’s earnings in the overall price of an asset – may be just 5-10% of valuation.

Meanwhile, the Nifty kept climbing and stopped about 700 points short of the peak, seen at the beginning of the year. Now, a correction seems to be underway. “The rebound is perfectly justified,” says Samir Arora, founder, Helios Capital, adding, “But, it’s too much, too soon.”

March, in hindsight, seems like a missed opportunity. But hindsight is always 20:20. The future, on the contrary, still looks less certain than it seemed a month ago, especially after the recent volatility.

But, at Outlook Business, we have stuck to our tradition of trying to make sense of the madness by sieving through the data of companies that managed to beat the Index over the past five years and by looking for patterns for hints about the future.

The Outperformers

Out of the 260 companies with over Rs.50 billion in market cap as on March 31, 2020, about 110 made the cut in terms of beating the Nifty, which, by the way, gave 0.03% return over the past five years (April 1, 2015 to March 31, 2020). There were another 87 companies that made it to The Outperformers list with market cap between Rs.5 billion to Rs.50 billion. In the first quarter, because of the heightened fear of COVID, the market wiped out significant gain made during the past five years. Till December 31, 2019, the Nifty had cumulatively gained 30% since April 1, 2015.

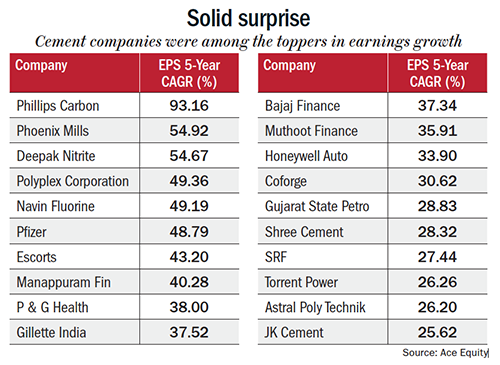

But, back to The Outperformers of the past five years. What stands out at first glance is the China-substitution story, which constitutes the entire chemicals, API (active pharmaceutical ingredient) and agrochem space. What stands out next are consumer companies, both discretionary and non-discretionary – out of the total outperformers, about 45 were from this space. Then, there is an eclectic bunch of companies from across sectors, from healthcare and technology to auto and banking and “others” (See: Solid surprise).

But, back to The Outperformers of the past five years. What stands out at first glance is the China-substitution story, which constitutes the entire chemicals, API (active pharmaceutical ingredient) and agrochem space. What stands out next are consumer companies, both discretionary and non-discretionary – out of the total outperformers, about 45 were from this space. Then, there is an eclectic bunch of companies from across sectors, from healthcare and technology to auto and banking and “others” (See: Solid surprise).

An oddity the market has displayed is polarization in performance within sectors. That is, in the same sector, some companies have done exceptionally well while others have lagged. And this has little to do with the size of the companies. For example, over the past five years, Reliance Industries rose steadily through the period while Vodafone Idea was struggling to stay afloat and Bharti Airtel managed to deliver 3.6% return. If that example is as unfair as the regulations playing out in the sector, contrast the performance of Hindustan Unilever which delivered 21% return with that of another FMCG giant ITC which delivered -4.9%. For all the smoke around the tobacco business, ITC’s poor little cousin Godfrey Phillips made investors richer by delivering 16.27% return per annum, buying itself a place in The Outperformers list.

If you are fuming over our comparing a personal care company such as HUL with ITC that has a ‘sin’ business as its mainstay, then let us look at the ‘noble’ industry of pharma. Biocon delivered 28% return and Divi’s Laboratories delivered 17%, but the other big names including Dr Reddy’s, Cipla, Lupin Laboratories and Aurobindo Pharma were stuck in negative territory until this March, after which they have seen a sharp rise. But, once a darling of the sector, Sun Pharma still trades 50% below the level seen five years ago.

In the much talked about sector of automobiles, Maruti Suzuki, Bajaj Auto and TVS Motor made it to the list along with a bunch of auto ancillary companies. But Eicher Motors was conspicuous by its absence. Ironically, on the back of tractors, a business Eicher vacated years ago, Escorts has raced ahead and recorded 39% return on the back of 43% rise in earnings per share. Polarization in performance within sector has various reasons – in pharma, for example, it is because of dissimilar business model, and how the opportunities are unfolding in each segment. In certain other sectors such as telecom and auto, it is about how the economics is getting better for the winners, or how growth is likely to pan out in different segments.

Coming back to Eicher, the stock has been celebrated for being one of the biggest value creators in India’s history – an honour which Reliance Industries is now taking to an all new level. What is the probability that Reliance could head the same way? For that matter, could the entire market turn on its head over the next five years and could the worse half, the unloved ones, claim the top slot?

On that note, here are the current big shifts.

The trendsetters

Top stocks first. The China substitution story has played out in the stock market mainly in the chemicals industry – specialty chemicals, technical textiles and APIs. The performance of these stocks has come on the back of a clampdown on Chinese production due to environmental issues. Indian companies grabbed the opportunity and pocketed the growth over the past few years. Can this lead to a structural rise or will it fizzle out when Chinese capacities come back? According to analysts, the value of India’s specialty chemicals sector is likely to rise almost 2.5x to $87 billion by March 2025, driven by robust growth in emerging export opportunities. “If anything, COVID has made it more urgent and compelling for global companies to de-risk out of China,” says Neelesh Surana, CIO, Mirae Asset AMC. Seconds Bharat Shah, executive director, ASK Group, “Earlier, it was only a tactical shift, but now global companies are serious about alternative outsourcing destinations.” He believes India will score over other destinations with its better chemistry.

While some such as Aarti Industries have clocked long-term contracts with multinational companies, securing growth for the future, stocks are priced to perfection. “The margin of safety in some of these stocks may be low, but they can still offer good return because of the compounding effect in the future,” says Shah.

Another interesting shift unfolding is in the consumer space, with outperformers such as HUL delivering 21% return, on earnings growth of 9% and sales growth of only half as much, and others– Britannia, Nestle, Marico, Godrej Consumer and Dabur – delivering more than 5-10% return with respectable earnings growth but modest sale growth. Their stocks have begun to correct from a climb that had been persistent despite the companies’ topline flatlining since last year. Now, the gravity of hard numbers has caught up with them.

“Multiples in this sector have been fairly high for quite some time, because of the notion that these companies offered good as well as predictable earnings growth when the rest of the sectors were looking fairly uncertain. That perception is far from the truth,” says Sunil Singhania, founder, Abakkus Asset Manager.

But, now, not only do these valuations look high compared to the prevailing growth rates, there is also a question mark on how growth will pan out going forward. While we won’t stop buying soap and shampoo after COVID-19, with job losses and salary cuts, the consumption pattern could definitely change towards low-priced alternatives. And, if the past has taught us anything, it is that the stock market is never a one-way street. For a decade, HUL had been at the receiving end. “A darling of the stock market in the nineties, the stock remained rather flat from 2000 to 2010, because growth became hard to come by as consumers were downtrading, competition intensified in the business and the stock had already front-ended gain,” says Devina Mehra, co-founder, First Global.

Although companies are doing their best by offering a wider range of products, from haldi doodh to handwashs, investors seem to be making the switch to more undervalued pockets such as tech and pharma. The entire consumer staples basket may be headed for a long phase of correction. “For stocks to deliver even 10% return over the next 10 years, they will have to trade at multiple of over 50x ten years hence,” says Singhania. “But then, since most consumer stocks are quality companies with clean management, they may not see a sharp fall but will see a correction over time,” counters Surana

Strangely, consumer discretionary stocks, which were hit hard during the March meltdown, are seeing a rebound. Stocks from Maruti and Bajaj Auto to Whirlpool, PVR and Trent which had either shed all gain from the past five years or corrected 50% from the peak, have since recovered. Businesses that have resumed activity, such as auto companies, have seen a remarkable turnaround of 75% or thereabouts, while others have seen gain of 50%! Perhaps auto is doing well because of the theory that fear of COVID-19 will lead people to buy personal vehicles.

While that theory is yet to be tested in the face of job losses and cutback in salaries for a significant part of the private sector, it’s reasonable to expect people to spend less, save more and avoid debt. Even if people do not shun debt, the emerging pain in retail banking may not make it easy to borrow and spend.

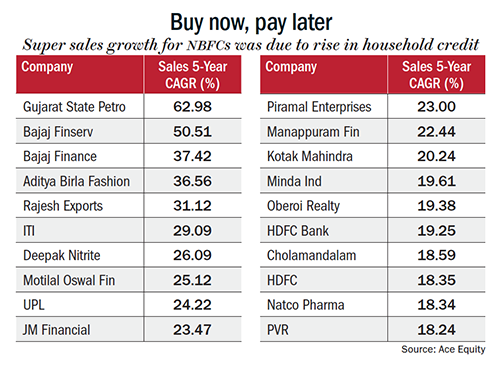

The huge surge in demand for discretionary over the past ten years, was led by easy financing (See: Buy now, pay later). Household credit went up from 12.4% (FY11) to 17.7% (FY19), while per capita income during the same period went up only 38% from Rs.1,459 to Rs.2,010. Now credit is hard to come by and consumers might not feel rich. Still, the market seems partial to discretionary stocks. For now, it seems we are blind to reason. But taking refuge again in Kahneman, “We’re blind to our blindness. We have very little idea of how little we know. We are not designed to know how little we know.”

Another prominent sector from The Outperformers that seems to be accelerating post-COVID is technology. Consumer staples are losing for the same reason that tech stocks have been gaining – predictability of growth. Over the past five years, Infosys as well as TCS clocked sales growth of around 10%, which is far better than consumer companies, though the earnings growth of tech companies was lower or in tandem with sales growth. But, with the rupee depreciating and the outlook for the currency continuing to be weak, it may mean bounty for tech companies while growth prospects remain intact or get better.

Some investors extend that same argument – about predictability of growth – to pharma companies. But that logic is somewhat flawed for neither the performance of companies nor stocks have anything to do with people popping pills. While it is certainly true that people are popping more pills for immunity and falling sick at the thought of COVID, this is at best a near-term trigger. “At a certain level, nothing has remarkably changed in the pharma sector. Essentially, it’s sector rotation at play,” says Arora. “After all, everything is a function of everything else.”

While the business does offer huge runway for growth, it is both dynamic and challenging. Last five years, Cipla clocked sales growth of 7% and flat earnings; Dr Reddy’s booked 3% and -3%; and Sun Pharma, 5% and -28%. Their performance was dragged down primarily because of bad performance in two years – FY18 and FY19. What hit them hard was the US FDA’s tough standards. The generics market, too, continued to be intensely competitive and there has been heightened pricing pressure because of consolidation among the main buyers of generic drugs. Plus, the pipeline of drugs going off-patent has also been shrinking. “Companies are building their branded generics portfolio in the US, but it’s a painstaking process and will take time. The one part that is robust is the domestic business,” says Shah.

Pharma stocks clocked negative return till COVID but, post-COVID, there has been reversal. But, here is the clincher. Pharma accounts for only 3% of the Nifty. On the contrary, financials, with all its woes, accounts for 35% of the Nifty.

Bankers’ distrust

Within financials, it was only banks with a demonstrated record of clean books that were frontrunners the past five years. Corporate banks have continued to suffer a serious blow on the back of rising NPAs, while retail banks and NBFCs continued to ride the growth wave because of rising household credit. Bajaj Finance was the top performer with 40% stock return, which was backed by stupendous 34% growth in total income and profit. COVID brought down the stock from Rs.4,880 on February 20 to Rs.1,895 on May 22, before it recovered to the current level of Rs.3,300. “The company has aggressively provided for potential bad loans from COVID and has garnered enough liquidity which is most important in this environment,” says Shah. But, COVID uncertainties make it hard to predict how this segment will unravel in terms of loan slippages. “We had thought that the bigger problems in the banking sector were behind us, but the pandemic has once again raised concerns that the worst is not over yet,” says S Naren, CIO, ICICI Prudential AMC.

Meanwhile, the pain in the corporate segment continues to persist with most corporate banks still being weighed down by bad loans. ICICI Bank was one of the few corporate banks that made it to the list, but with mere 1.96% return. The risk for corporate banks now is the SME segment, which is under stress post the pandemic. If anything, chance of another avalanche is fairly high and it is difficult to call the bottom. “We have stayed away from financials completely because we know how this movie ends each time there is a downturn,” says Mehra.

The biggest of them all, SBI is down more than a third in absolute terms (-6% annualized) over the past five years, as investors fear that the bank may be drafted for ‘national service’. It’s not just state-owned banks, the whole PSU pack has been shunned by the market with stocks going for a song. Again, the concern around some of the PSUs seems unjustified because it is less about the business and more about the fear of companies misallocating capital under pressure from the government. “Value most certainly exists in public sector companies, but the market is shunning them because there are concerns relating to capital allocation and the disinvestment route taken thus far,” says Naren. “There has to be a trigger which can ensure these get re-rated. If the government decides to resort to strategic sales, it can unlock a lot of value,” says Surana. That’s a story for another day. But it might suffice to say that some PSU businesses are still sound with strong growth prospects. “Some of the companies in the power sector, for example, do not have any private competition and we can’t live without power, the demand can only rise,” says Naren. Arguably, the penetration story, if anything, has maximum potential with respect to power. Whether you buy dishwashers or washing machines or air-conditioners, or manufacture them here for exports, the one thing that is certain to grow is power demand.

The potential for growth in infrastructure, be it roads or railways is equally attractive except for the wrecked banking system and inability of the government to extend large public spending. “It’s a question of time, it could take much longer than one expects given the economic dislocations we have seen, but infrastructure will be a key driver for growth in India going ahead,” says Surana. “There is a lot of value in infrastructure and PSU stocks for whoever is willing to wait it out,” says Raamdeo Agrawal, co-founder, Motilal Oswal Financial Services. The operative line is ‘whoever is willing to wait it out’. “No fund manager can today afford to buy stocks that are not performing because investors are demanding and there is constant pressure on redemptions in open-ended funds,” reminds Agrawal.

That concern gets exaggerated out of proportion when some stocks defy gravity. Talking of gravity, is there a stock that has escaped its pull?

Defying gravity

That question is most pertinent when it comes to India’s Goliath, Reliance Industries, which has achieved escape velocity. The past five years have seen a steady climb as it was on its way to hoisting Jio as the numero uno in telecom.

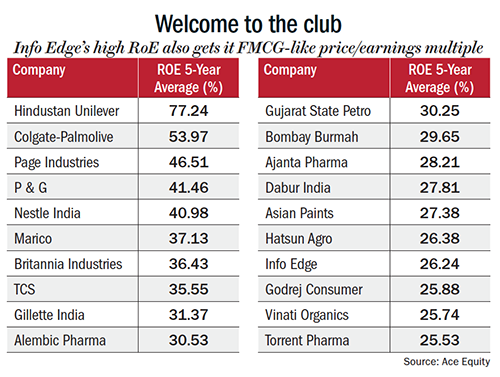

After the fire-sale post-COVID, Reliance, too, fell to Rs.900 (roughly double the price five years ago) but thereafter the fireworks began as its fundraising spree reinforced its position as a promising data-and-retail play of the future. Reliance is the biggest pureplay on digital available today – the other being Info Edge (See: Welcome to the club).

After raising $20 billion from 13 overseas investors in Jio Platforms, the next round of dollar shower has started with Silver Lake investing $1.2 billion in Reliance Retail. Five months after the lockdown, Reliance finally forged a deal to buy assets of Future Group for Rs.247.13 billion edging out the promoters with a 15-year non-compete clause.

Sensational as it is, this is probably the first time a company its size has posted such a stunning performance on the bourse, so much so that it is giving fund managers a headache with the stock accounting for a super-sized weightage of 14% in the Nifty and 18% in the Sensex. The next biggest stock in Nifty, HDFC Bank commands a weightage of 9.99%. According to Sebi, a fund manager cannot hold more than 10% of assets in a single stock.

What is the chance that Reliance’s dream run could be derailed? Slim. There have been a few missteps in the past — the foray into telecom the first time around in 2002, which did not go well because of execution failure, and then KG Basin going off script.

The exuberance this time around is because of the winner-take-all nature of digital businesses. With its proven ability to swing regulation in its favour, a huge war chest of cash, alliances with the biggest global tech firms and captive customer base of nearly a third of India (Jio customers) the company seems invincible.

“It’s unique story where a galaxy of high-profile investors have co-invested including the biggest names in tech – Google, Facebook. That’s a story investors can’t ignore,” says Arora. Additionally, there is enough money going around the world. “More and more institutional money will chase the company going forward given it’s a unique opportunity to participate in India’s digital story,” says Arora. First Global’s Mehra sounds circumspect. “The big move is based on the new business strategy. Going ahead, it will be driven by execution,” she says. The one possible scenario in which Reliance may not hold up is if the overall market crashes again.

Road untraveled

What will drive performance going forward? Well, this fiscal, we will see a contraction in economic growth not seen in 40 years. Obviously, the next fiscal (FY22) will see higher growth because of the low base effect and, by FY23, things should return to normal. But all assumptions could go awry if the pandemic decides to stay on beyond this year.

One way to argue could be that every crisis presents an opportunity. Interest rates, which are the greatest trigger for corporate earnings are the lowest in India’s history and crude price has fallen, significantly improving the country’s balance of payments. “The two most important things we want from the world – oil and capital. Both are cheap,” says Surana. “Taxation is conducive. After 17 years, we have a current account surplus. Considering the country’s potential, we should see structural growth unfold. From that perspective, the market is attractively valued,” he adds. But, from a one-year perspective, Surana acknowledges, the market may be fairly valued.

Going ahead, opportunities for bottom-up stock picking will present themselves, but when the overall market is flat or bearish, a larger segment will end up at the losing end. “There is too much money, too much research and too many people tracking stocks. With so much competition, it is hard to find great ideas that will give superior return. That means for majority of fund managers to do well, the market will have to do well overall,” says Agrawal.

Meanwhile, there is divergence that remain unexplained. For one, if banks are in bad shape from the ongoing NPA saga, how can businesses do well? After all, credit is the most important fuel for growth. And if businesses are in good shape, as the stock market rise would have us believe, how can banks do badly? Also, the volatility in the recent days is making investors a bit more wary, than they were a couple of months ago. That brings me back to Kahneman’s wisdom. “After a crisis we tell ourselves we understand why it happened and maintain the illusion that the world is understandable. In fact, we should accept the world is incomprehensible much of the time.”