Just about a year ago, the Reserve Bank of India (RBI) gave a shot in the arm to India’s already booming digital payments ecosystem. It allowed banks to extend a pre-sanctioned credit line to its customers through the National Payments Corporation of India’s (NPCI) Unified Payments Interface (UPI). A year on, the shot has provided limited stimulus. And standing in its way is NPCI’s own RuPay credit card.

Launched last decade, the RuPay was NPCI’s answer to the market domination of Visa and Mastercard. In 2022, RuPay credit cards were allowed to be linked with UPI. The RBI helped when it prohibited exclusive deals between banks and credit card companies in March this year and said banks would have to offer customers multiple credit card choices. RuPay gained big. RuPay’s rise has been transformative for India’s credit industry and has challenged the global players. But the success of RuPay has placed NPCI’s other creation—the credit line on UPI—at a significant disadvantage.

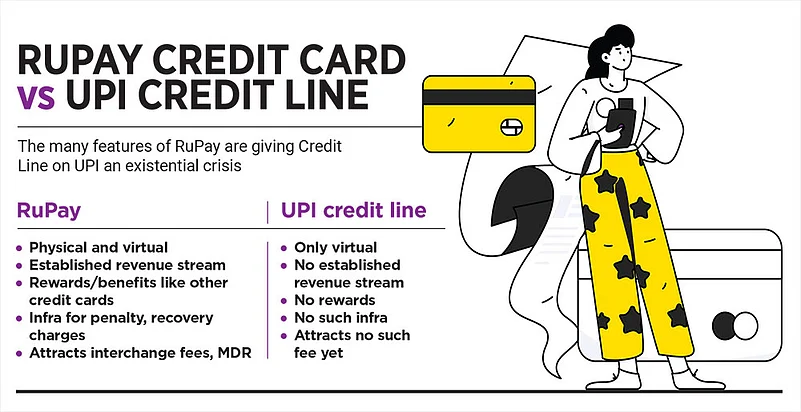

With RuPay cards linked to UPI, there remains no reason for banks to offer a credit line through UPI and little reason for consumers to use the feature.

RuPay’s Big Bite

The RuPay credit card has seen significant uptake in recent months and especially since the RBI forbade exclusive deals between banks and network credit cards. Since its integration with UPI, the market share of RuPay credit cards has more than tripled from 3% in the 2023 fiscal to 10% in 2024, according to an estimate by fintech start-up Kiwi. Currently, around 30% of newly issued credit cards in India are on the RuPay network, up from just 5% in the 2023 fiscal.

RBI’s recent direction to banks to offer reward points and other benefits in tune with other credit cards from September 1 is expected to bolster RuPay further. And while this will mean a bigger margin for RuPay, it will make the UPI-based credit line even less competitive because users of the credit line enjoy no such benefits.

Until recently, one would need a physical credit card to access benefits of the card, but with RuPay integrated into the UPI model, banks are rolling out virtual credit cards. HDFC Bank, Kotak Mahindra, IDFC FIRST and AU Small Finance have all rolled out virtual RuPay credit cards that work through UPI helping them save on plastic.

All this has meant that the UPI credit line has little to distinguish itself against the RuPay credit card.

Rethink the Product

While banks by and large have joined the RuPay network, the credit line has only had limited success. Only seven banks have gone live with the ‘Credit Line on UPI’ feature—Axis Bank, HDFC Bank, ICICI Bank, Indian Bank, Karnataka Bank, Punjab National Bank (PNB) and State Bank of India (SBI).

Credit transactions from the UPI-linked credit line are reportedly between Rs 100–200 crore out of the total Rs 10,000 crore, according to numbers quoted by NPCI managing director and chief executive Dilip Asbe before the media. The credit line feature accounts for 1–2% of total credit transactions done via UPI, with the rest happening through RuPay credit cards.

“The credit line could benefit from the introduction of rewards similar to other credit cards, making the product more appealing to users,” says Sameer Singh Jaini, founder and chief executive of consulting firm The Digital Fifth.

The credit line feature offers no incentive for banks to adopt it. Most banks that are offering the credit line feature are doing it either free of cost or for a nominal charge via UPI platforms such as Google Pay, Paytm or Navi. “There is limited commercial clarity for banks regarding the credit line on UPI, and TPAPs [third party application providers] are yet to see significant revenue from it,” says Mohit Bedi, co-founder of Kiwi.

On the other hand, UPI-linked credit cards attract interchange fees and merchant discount rates (MDR) for collecting and processing payments on behalf of merchants, making them more lucrative for banks. “UPI-integrated credit cards have taken off very well. With MDR and interchange charges well established for credit cards, the same framework can be extended to the credit line, making it more attractive for the issuers,” says the Digital Fifth's Jaini.

Banks need applicants to have a credit history to be eligible for a credit card. Indians in tier-ii and tier-iii cities have limited credit history

He acknowledges that launching a new product of the credit line kind in any banking environment is complicated because it is a profit and loss-oriented activity. With no system in place for revenue or recoveries, the credit line model becomes a risky bet for banks.

The credit card-linked UPI system works better because “besides an interchange fee of 2.3–2.5%, there are a lot of penalties and charges in the credit card infrastructure”, says Neil Shah, partner and vice-president at market research firm Counterpoint.

The Case for Credit Line

With an organised system in place for credit cards, does the credit line feature even need to exist? Experts say yes because India continues to be a credit-starved economy. Those tracking the space say a credit line on UPI could vastly promote financial inclusion. Despite RuPay’s success, only 3% of Indians currently have access to formal credit cards, according to a report titled Decoding India’s Credit Card Market by consulting firm PwC.

Banks require applicants to have an existing credit history to be eligible for a credit card. Most Indians in Tier-II and Tier-III cities have limited credit history. A credit line can provide people in these places a foot in the door to build a credit score, says Kiwi’s Bedi.

“If fintech firms and NBFCs are allowed to participate, the credit line feature has significant potential for advancing financial inclusion,” says financial services firm Dvara Holdings’ group chief technology officer and head of partnerships Madhusudhanan S.

Broadly, the financial services industry does believe in the utility of the credit line but the an ecosystem must be built in line with the system in place for credit cards. “The [credit line] product is unsecured lending coupled with small ticket size. Banks or any prudent lender will take a cautious approach before scaling the product. This evolution will take time,” says Bedi of Kiwi.