A contrasting sight awaits visitors at the entrance of Escorts’ corporate office in Faridabad. A mini tractor stands next to a giant tractor. Nikhil Nanda, Escorts’ MD, and other key members of the management seem elated as they pose with the lineup for a photo-op. The smaller tractor (Farmtrac 26E) is the country’s first electric tractor, introduced last year and the giant (Farmtrac 6075 CRDI) is a recently-launched monster, aimed at the international market. It is a clear attempt to show how far the company has come since it first launched its tractors in 1954.

“Just 10 years ago, our company was in coma,” says Nanda, with a straight face. Being the oldest Indian tractor maker, Escorts’ pioneering effort ensured that it remained a strong contender, but challengers Tafe and Mahindra & Mahindra (M&M) raced ahead with the former gobbling up Eicher’s tractor business in 2005 and the latter acquiring Punjab Tractors in March 2007. When the Nanda scion moved into the top job, the company was beset with high costs, debt and ageing products, resulting in stagnant market share and low margins.

In a bid to turn the business around, Nanda roped in professionals to lead each vertical. October 2011 saw former Bajaj Auto executive S Sridhar taking over as the head of the farm-equipment business, which currently brings in 80% of the revenue. A year later, GVR Murthy of Tractors India joined as the head of construction equipment, a segment that contributes 15%. Dipankar Ghosh, with experience at John Deere, Caterpillar and Indian Railways, joined in October 2012 as the CEO of the railway products business, which now brings in 6%.

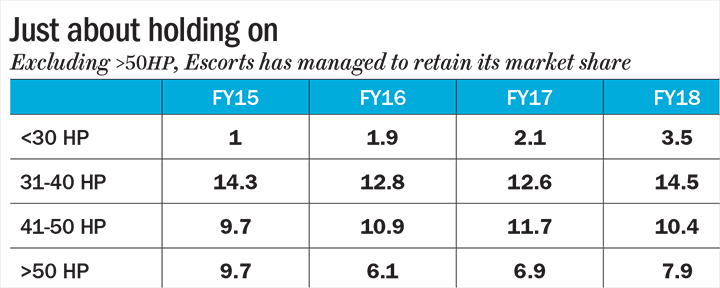

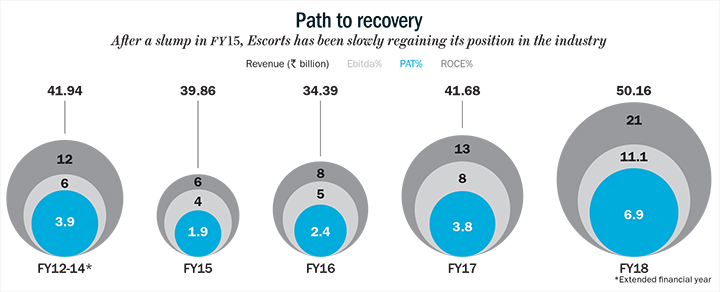

Though Sridhar and Murthy have since moved on, the management’s effort to address pain points, aided by recovery in the industry, nursed Escorts back to good health (see: Just about holding on) .Its revenue surged from Rs.39.86 billion in FY15 to Rs.50.16 billion in FY18, while operating margin vaulted from 5.47% to 12.18% over the same period. Profitability, too, soared from Rs.760 million in FY15 to Rs.3.47 billion in FY18 (see: Path to recovery).

Growth revamp

Escorts underwent a fair degree of change in the past few years in almost all sectors — be it products, markets, operational efficiency or cost compression initiatives. But the first step was to redefine its focus. Nanda’s first move, therefore, was to get rid of its chronically ailing business — auto components — that was clocking Rs.250 million in losses every year. “That business made no sense — neither in terms of aspiration nor contribution,” Nanda says. “It was eating into our earnings from other verticals, so we had to divest it,” adds CFO Bharat Madan. The business was sold in 2016 to Pune-based Badve Engineering in an all-cash deal.

Having divested the business, Escorts chose to concentrate on the remaining three verticals — agriculture (tractors), construction and material handling equipment (excavators, cranes, etc.), and railways.

But being a legacy player, Escorts had accumulated flab over several years. Its cost was bloated and its products were not fetching the best price. Escorts’ expenditure ate up 73% of sales, compared with the industry average of 67%. “We had to make our operations lean and efficient,” reveals Nanda.

Escorts worked systematically around the cost heads. The first axe fell on the suppliers. For any OEM, around 80% components are sourced from suppliers, accounting for 70% of the overall cost. The company launched an initiative called Leap, through which the material cost was brought down to be on par with the industry. The company also adopted total productive maintenance, a manufacturing strategy to improve operational efficiency. This ensured an overall equipment efficiency of 90%, up from 75%.

The company also rationalised its manpower cost, which was 12% of sales, compared with 7% for the industry. “We reduced white-collar manpower by 30%,” says Madan. This was followed by the rejig of the product portfolio. At that time, Escorts didn’t know how to make very advanced tractors. The management, thus, scouted for technology partners across the world. They partnered with AVL, Carraro and Porsche for engines, transmission and product design respectively. “If you were in our R&D room three years back, you would have seen Indian, Italian, Austrian and American people working together,” chuckles Nanda.

The partnerships helped Escorts upgrade the Indian offering, populate the export portfolio, and obtain technology for the future. Over the past five years, the company has invested Rs.5 billion in R&D, increasing its spend from 0.5% of sales to 2.5% today.

But technology in itself is not sufficient to sell products. In most cases, marketing and distribution strategies make or break companies. Escorts was riding on two brands — Farmtrac and Powertrac — for decades without any differentiation in branding, distribution, market push and geographical focus. “Five years ago, we started positioning the two brands distinctly to address two different types of customers — Farmtrac was positioned as a premium product and Powertrac as a mass-market product,” says Shenu Agarwal, chief executive, emerging business (agri machinery). Thus, the two brands are now being sold through different dealerships.

Luckily for Escorts, the past three years have seen great demand for tractors. In FY18, tractor sales grew 22% to 709,000 units from 582,000 units in FY17. Saji John, analyst, Geojit Financial Services, says “Escorts has grown faster than the industry, increasing its market share, mainly through focused support to its top dealers in the north and a renewed push in the south.”

Madan acknowledges the tailwind: “The industry has done extremely well over the past three years and for us, the operating leverage has played out.” When Nanda talks about Escorts being in coma 10 years back, debt was a major factor behind that. But disciplined cost compression and product enhancement bailed it out. “This year we will be a zero-debt company,” says Madan. Total debt has fallen from a peak of Rs.5.53 billion in FY12 to Rs.500 million in FY18.

Rent, don’t buy

To keep the momentum going, Nanda is now thinking out of the box. “For 70 years, all we told farmers is to ‘buy our tractors’. Now we are saying, please don’t,” smiles Shailendra Agrawal, group COO. Why would a company that derives 80% of revenue from tractors tell farmers not to buy their bread-and-butter product? “Over the next decade or so, we will have a shared economy. Ownership will be passé,” asserts Nanda.

Escorts has built an app-based platform called Traxi, an abbreviation for Tractors plus Taxi. Evidently, it’s the Ola-Uber of tractors. While a machine can theoretically work for 365 days, the 4 million tractors in the country are doing only 200-300 hours a year. So, it’s beneficial for the farmer to call for a tractor when needed and pay by the hour.

“We are doing a number of such experiments,” says Agarwal. Renting a tractor would cost Rs.1,300 a year per acre whereas owning it means spending about Rs.83,000 every year on interest alone. Given that 95% of Escorts’ tractor sales are finance-driven (on par with the industry), renting seems more viable. “So unless a farmer owns 70 acres of land, it doesn’t make financial sense,” says Vikram Ahuja, founder, Zamindara Farm Solutions, a tractor-renting company.

The company has already been running tractor and equipment renting projects in Andhra Pradesh and Odisha. Nanda plans to roll it out nationally. Raman Mittal, executive director, Sonalika Tractors, steers clear of commenting on Escorts’ renting platform strategy, but says, “At an informal level, tractor and equipment renting and sharing had already been taking place for years in India.” Here again, rivals such as M&M are making their moves. It has taken the lead by setting up an on-demand farm equipment rental start-up, Trringo, through which farmers can book tractors by the hour. Nanda wants to combine other services with the rental initiative before going national. Sharing is just one of the many ideas. “Our plan is to innovate around various elements of the farming ecosystem,” he says.

Nanda is also looking to ramp up the share of exports from 3% last year to 10% within three years and is eyeing Tanzania and South Africa in particular. He is considering third-party manufacturing and is reportedly in talks to make tractors for two foreign brands.

New pastures

The recent stable ground has got Nanda thinking on his feet for the future. His strategy is inspired by what several global companies have tried in the past but only a few succeeded. Currently, though tractors bring in 80% of the revenue, the company has not been able to ramp up its market share. It has just inched up from 10.3% in FY16 to around 11.05% in FY18. M&M, with over 43% market share, is sitting pretty, followed by Tafe at 20%. Sonalika with 12% is just a nudge ahead of Escorts.

Not surprisingly, the management has plans to evolve from a pure tractor company into an agri-solutions company. Recently, Escorts launched an initiative called SHIP (sprayers, harvesters, implements and planters) to manufacture smart implements and layer new technologies through strategic collaborations. Alongside, the company will also sell crop solutions. “We now offer a complete technology bouquet for contract farming, from soil preparedness to harvesting, on rentals to paddy farmers,” says Nanda.

New construct

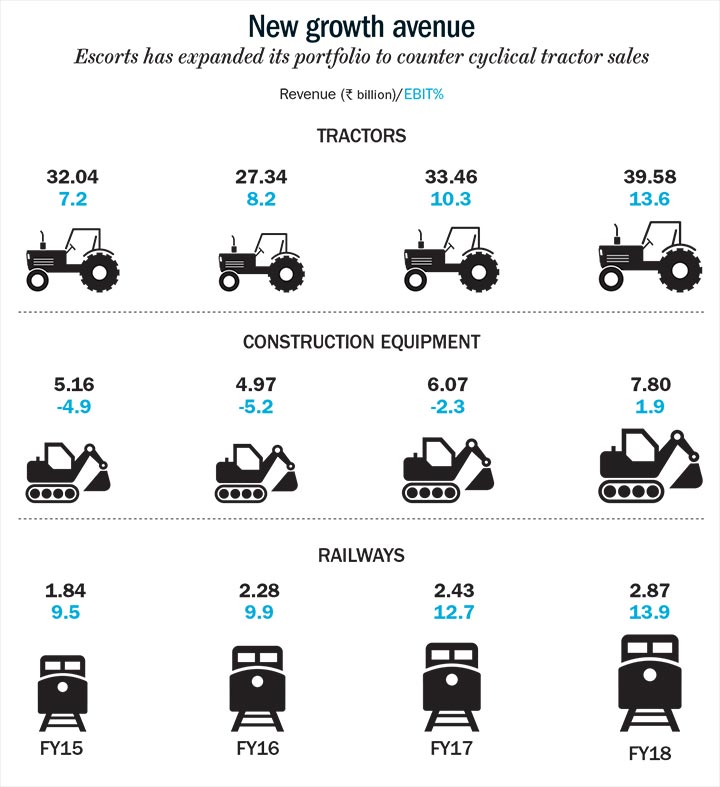

Given that tractors is a cyclical business, and realising that only a diverse portfolio can be a hedge against its vagaries, Escorts has invested in growing its exports portfolio and expanding geographically, apart from trying to grow the construction equipment and railways businesses (see: New growth avenue).

In construction, Escorts is a market leader in small cranes and material-handling equipment. This vertical brought in Rs.7.80 billion in FY18. Cranes have been the biggest gainer in FY18, with a growth of 82.1% followed by backhoe loaders that grew 25% and compactors which grew 16%. But Escorts has been selling low-end cranes that make low margin. “Now we are going to the next level of technology with truck trains or rough terrain cranes. The country’s growing infrastructure thrust gives us great confidence.” says Agarwal.

With the surge in outlay for infra projects and the government opening up mining again, equipment suppliers have seen brisk business. “We will be seeing a lot of growth from construction business, although the margin may not be as good as other verticals,” says Madan.

Interestingly, Escorts was instrumental in industrialising Faridabad and bringing in JCB, Yamaha, and Ford to India. Now, as Escorts hopes to take major strides in the construction business, the question is if it is ready to take on the likes of JCB. Aware of JCB’s foothold in the market, Agrawal says, “We are targeting niche markets such as mines rather than taking them head-on.”

John of Geojit sees merit in the move. “The share of new products in tractors stands at 20% currently and these have better margin than existing products. Revenue from construction equipment and railways will also bring in sizable improvement in FY19,” he predicts.

Last year, railways brought in Rs.2.80 billion. Nanda is upbeat on railways, primarily because of the upcoming high-speed rail and metro projects. “It is a very high margin business of 20-25%,” justifies Nanda. But Escorts faces serious competition from European and Japanese giants in these segments. “We have been strong in couplers, braking systems and suspensions, but we are now looking at being complete suppliers of train car parts,” says Agrawal.

The big toys Nanda and team showcased outside their office are going to up the play for them. Of the Rs.5 billion spent on R&D, a substantial chunk has been spent on this initiative. “Last year, we sold 2,000 tractors and this year we are up 50%. We ultimately want 10% of the revenue to come in from exports by 2020,” reveals Nanda. For FY19, the company is targeting exports of 3,000 tractors. Mittal of Sonalika, which exported 14,000 tractors in FY18, feels it’s a good strategy. “International market offers a good future opportunity for Indian tractor makers. We have been exporting not only to developing world but even to countries in Europe and the US.”

Escorts will turn debt-free this year but whether the company will eventually reap a bumper harvest depends on how well its non-core businesses flourish. Nanda, who brought Escorts back from the brink, though, has sown the seeds of growth.