Rewind to the year 2013 — the last year of the UPA-II government. With the economy in shambles and a worsening fiscal deficit, the government announced several measures to curb gold imports. That July, the RBI banned gold leasing. Banks and nominated agencies were free to import gold, but they could pass it on to jewellers only against full payment (and not on lease, like earlier). That escalated the jewellers’ working capital requirements. A month later, in August, the government delivered another blow. It imposed the 80:20 import rule — up to 80% of gold imported could be sold in the country on the condition that 20% was exported.

Those were the bad years, and the memories still haunt jewellers. “The regulations had severely impacted the financial health of organised jewellers as working capital needs (and consequently debt) increased. Jewellers had to purchase gold upfront. This meant a significant increase in capital employed and return ratios took a hit,” recalls Jay Gandhi, AVP - consumer discretionary, HDFC Securities.

Titan, which runs the country’s largest organised jewellery chain — Tanishq — also came under pressure. According to Gandhi, Titan’s debt shot up from Rs.12.4 billion to Rs.21 billion between FY13 and FY14. Its interest coverage fell from 19 times to 11 times, and return on equity declined from 42% to 33%.

Despite temporary setbacks, Titan managed to survive this phase fairly well, says Sandeep Kulhalli, senior vice president-retail & marketing, Titan. “We pushed the envelope on gold exchange at that time, which clicked.”

Gold exchange, which Kulhalli talks about, is one of the three ways in which organised jewellers in India source their gold. One is through customers looking to exchange old jewellery for new pieces. The other two ways, typically, are imports (either directly or through banks who lease the gold to jewellers) and spot buying. While unorganised sellers also have a fourth channel — smuggling — they have been thriving on the exchange channel because they operate as ancestral jeweller for many families.

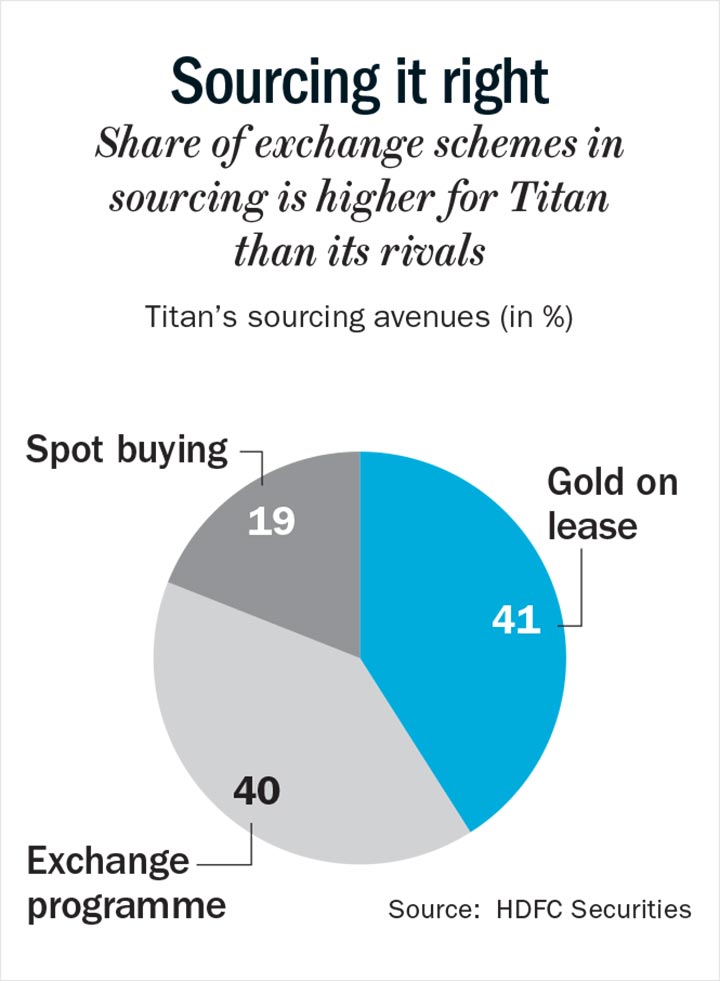

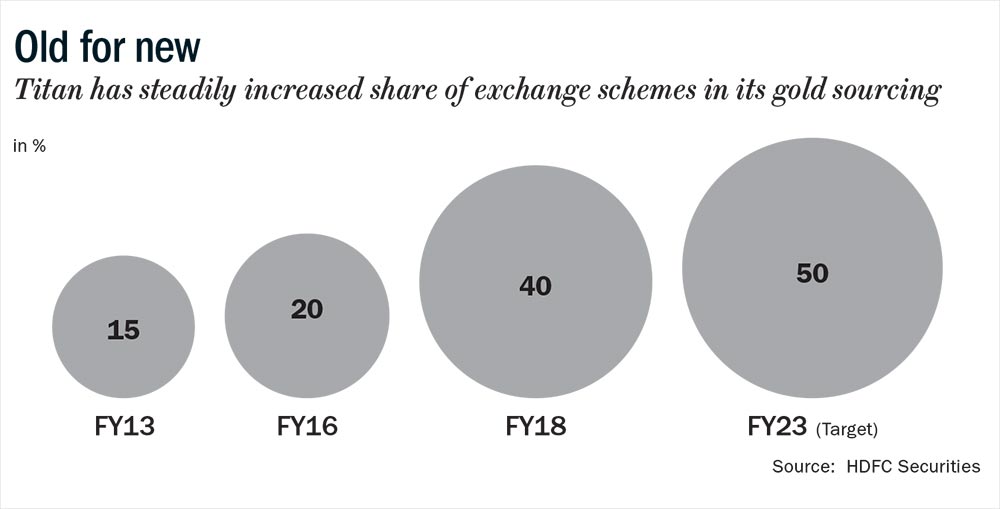

Gandhi says that most organised players, including Titan, had to reconsider their sourcing strategy. “After going through the regulatory crisis, jewellers realised they couldn’t be so heavily dependent on gold leases. So they started working on improving the contribution of gold from customers.” For Titan, the contribution of gold exchange (through customers) was hardly 15% in FY13. Over the next five years, as the company turned its focus on this avenue, the contribution went up to 40% in FY18 (see: Sourcing it right). For most leading jewellers that ratio at 25-35% is still lower than Titan’s.

According to Kulhalli, the ‘gold exchange’ programme helped Titan sail through the tough times, and became an effective customer-acquisition strategy. Being a relatively young brand, Tanishq does not have the advantage of traditional jewellers — a large pool of repeat customers who buy from them generation after generation.

“Every exchange is also an upsell opportunity for us,” says Kulhalli. “There is a lot of value involved in an upsell.” According to him, a customer almost always ends up buying double the quantity he or she wants to exchange. Balram Garg, MD, P C Jewellers, adds, “In recent times, there has also emerged a particular class of customers who love contemporary designs and are constantly looking for newer pieces. So it’s a win-win for the customers and us.”

According to HDFC Securities’ Gandhi, the total gold exchange market in India is about 340 tonnes, of which the top 17 odd jewellers account for only 82 tonnes (24% of the market). The unorganised sector makes up for the balance of 75%. Gandhi estimates that Titan and PC Jewellers account for 5% and 2% of the total gold-exchange market in the country and predicts that this market could nearly double for both over five years.

Jewellers have been working on making their exchange programme more appealing and Titan is no exception. The company wants the exchange contribution to go up to 50% by 2023 (see: Old for new).

When a customer comes to exchange gold, jewellers across the board, deduct a percentage of gold as commission. About three to four years ago, Titan used to deduct 8% but they have brought that down to 2%. Also, the “transparency of the entire exchange process is their differentiator,” claims Kulhalli. When a new customer walks into a Tanishq store with an old piece, Tanishq melts the gold and arrives at a value. This is unlike the traditional jewellers, who can accept an old piece and peddle it to another customer. Given that Titan further intends to leverage the exchange programme, Gandhi expects the company to achieve its target of 12% to 13% same-store-sales growth (SSSG) CAGR over the next five years.

Over FY16-18, after the restrictive regulations were withdrawn by the newly formed government, its SSSG was better than other jewellers. Jewellery revenue of Titan grew at a CAGR of 23% and store additions clocked 11% CAGR which meant higher SSSG of over 12%. For other leading jewellers, the SSSG has been around 7-8%.

One step ahead

With the surge in gold prices, overall volumes in the gold jewellery industry have been on a gradual decline. But Titan registered an annualised revenue growth of 11% over the past five years thanks to its premium positioning and ability to churn out new lines. “Over the past five years, the overall industry volume has been flat. It was 866 tonnes in FY14. Based on my estimate, it would be 816 tonnes at the end of FY19,” says Gandhi, adding that Titan has however bucked the trend.

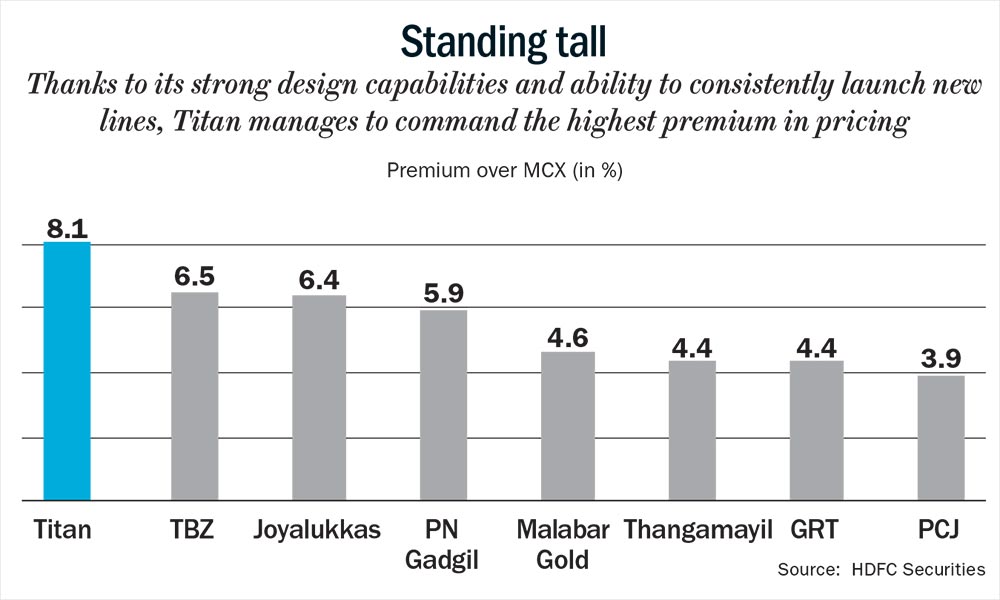

Titan’s biggest differentiator has been its designs. “The company has invested a fair degree of time and effort to be design focused,” says Harish Bijoor, brand strategist and founder, Harish Bijoor Consults. This allows the company to command a premium, over traditional jewellers and organised players. “Tanishq made design sturdy, appealing and for every day. This, along with its ability to update itself constantly, worked to its advantage,” says Bijoor.

Their premium over MCX price (the price of gold at multi-commodity exchange) used to be as high as 15%. It is still high at 8% (compared with TBZ’s 6.5 and Joyalukkas’ 6.4%) (see: Standing tall). As a result, Titan’s margins are nearly 1.6-1.8 times compared with margins of other leading jewellers.

Tanishq, its flagship brand, has a network of 267 stores across 167 brands. Other brands such as Mia, which focuses on everyday wear, has about 25 standalone stores and 18 shop-in-shops across 19 cities. Zoya, its luxury brand, has about three stores and CaratLane, in which Titan acquired a majority stake in 2016, has about 45 stores.

It is hard to have a brand in the jewellery space and command a premium. Tanishq has managed to do both. Jewellery still brings in the largest chunk of revenue — 80% — for Titan while watches contribute 14%, eyewear 2.7% and its other commodities such as perfume and sarees contribute 3.3%. The company expects its jewellery division to account for Rs.400 billion from an overall revenue of Rs.500 billion by 2022-23 and its high-value diamond business to make up for half the jewellery sales in the same time period, up from the current 30%.

While the industry volumes are likely to continue its downward trend, Titan is focused on increasing its market share. A lot of its market share gains will come from the shift from the unorganised sector to organised sector, in an overall declining market.

The regulatory changes such as introduction of goods and services tax (GST) also bode well for the organised sector that has already been growing at a much faster clip than the overall industry. Organised players have grown at a CAGR of 35% over the past five years, whereas the overall industry has grown only at 5-7%. “Trust and transparent practices are behind this shift from unorganised to organised sector,” points out Garg.

The share of organised players is likely to increase from 24% to 42% over next five years. Titan’s market share is expected to double from 4% to 8% during the same period.

Shedding the old for new has worked well for Titan so far, and they are looking at making the exchange-programme part of their long-term strategy.