The concluding months of 2018, witnessed some of the most lavish weddings of recent times. Be it the Bollywood celebrities like Ranveer Singh and Deepika Padukone to Priyanka Chopra or off springs of business tycoons such as the Ambanis and the Piramals. Needless to say, that all the events happened at a grand scale involving billions of moneys.

While these celebrities had fairy tale-weddings, many of us dream of having such gala weddings. However, it goes without saying that planning a wedding is an immensely exciting but an expensive affair at the same time.

Family gathering, never-ending parties and wedding rituals also have a financial cost attached along with.

Therefore, it is all the more important to make a solid plan for your dream wedding and be financially prepared for the expenses. In case you haven't begun yet, there is still time to manage a 'perfect one' by opting for other ways to fund it. One such way is a loan, which comes handy for short-term needs.

And that’s what Santa Lahiri of Nashik did. “I opted for a personal loan of Rs 5 lakhs from a nationalized bank for a period of five year.” However, the fact that at the end of five years had has to shell out almost Rs 6 lakhs did not please Lahiri much.

While weddings in India are generally lavish and celebrations span almost a week, these days’ couples often prefer a destination wedding or go for honeymoon abroad. According to a survey, when it comes to paying for the wedding, 42 percent wedding couples intend to contribute along with help from their parents, 32 percent prefer if their parents pay for the extravaganza, and 26 percent said they would like to pay solely from their own savings, as per the survey.

With high wedding costs followed other costs going so high, many individuals especially millennials choose to opt for personal loans to finance such events.

Millennials seem to believe wedding loans are a convenient and easy way to finance wedding by borrowing from banks, Non-Banking Financial Companies (NBFCs) or online fintech companies (includes peer-to-peer platforms).

However, are wedding loans or personal loans used for funding weddings really a good idea? Do they really help?

“It helps if one is not starting in the negative. Spending on weddings is one thing Indians love to do, why just Indians But if this costs them their future, it just isn’t worth it,” said Shweta Jain, a certified financial planner and Founder, Investography.

Wedding loans are usually unsecured personal loans that you can borrow for financing your wedding expenses ranging from booking venue, catering, decoration, buying gifts and jewelry. However, banks charge a high rate of interest for availing such loans.

Other eligibility parameters include age, minimum net take-home salary, credit score, reputation and size of the company working for and residence stability. In case, the borrower has a good credit history and score, the lender will offer a wedding loan with an apt interest rate analysing the profile of a borrower.

“This is one loan I recommend people to avoid and only spend what they can comfortably because I have seen lives ruined due to loans taken during weddings. Keep a ceremony as lavish or intimate as you can afford because the repercussions that might arrive due to loans and EMIs are just not worth it” confirmed Jain.

Key factors to keep in mind while applying for a loan

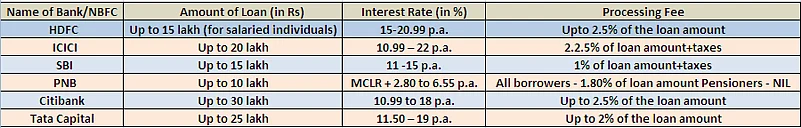

Needless to say there are certain things that one needs to keep in mind while applying for a wedding loan. First thing happens to be the EMI. Estimate the amount of EMI you can comfortably service considering your income and savings.Compare wedding loan offers from multiple banks and NBFCs then choose the offer that most suits you. There can be significant savings in interest, processing fees and other charges by comparing and choosing the loan scheme carefully.

In case, you plan to apply for a wedding loan despite knowing the drawbacks as discussed, then look at leading private or public sector banks since they offer loans at attractive interest rates compared to NBFCs and peer-to-peer lenders.

Alternatives to escape wedding loan

Just because loans are on offer, doesn’t mean you should take one. A wedding may be a dream but it shouldn’t result in a debt burden. It’s better to cut down on wedding expenses, rather spend keeping in mind your ability to spend and of course income. The best way to fund a dream wedding is probably to start investing in small amounts in tools such as SIPs and equities and eventually hold your dream wedding.