It’s been a few weeks since the demonetisation happened and inconvenience set in. Yet, chances of finding more people favouring the move, irrespective of its final outcome, are plenty. Never mind the inconvenience or the Rs 10,861 crore printing cost that one will incur to maintain currency flow immediately.

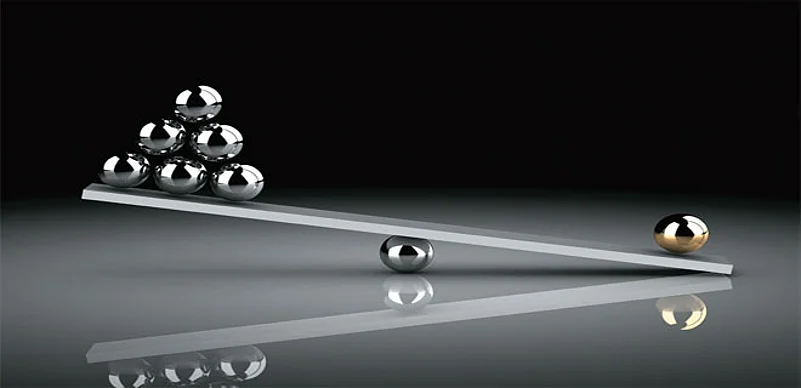

Freedom of speech, a constitutional right and by extension of the same, having a view on anything and everything is a national pastime. So, in the absence of any data which can clearly indicate the benefit of the move, every person has formed an opinion on the demonetisation move without understanding the implications. The rhetoric among those for the move being that it is good for the nation and for the future generations, based on the same bias that they carry.

One must read Richard Thaler’s recent book, ‘Misbehaving: The Making of Behavioral Economics’, a book that has some very interesting examples of how the majority carry a strong acceptance of their beliefs due to confirmation bias. Confirmation bias is the tendency that influences all of us to put more faith in information that agrees with what we already believe, and discount opinions and data that disagree with our beliefs. Thaler’s book is about how people have a tendency to search for confirming rather disconfirming evidence owing to the confirmation bias that they have. Laced with several examples from everyday life, the book can provide a fair degree of amusement.

As someone who meets and interacts with several people who like everyone else grapple with day-to-day life and finances, I am amazed at the confidence with which several well read people will argue why their fixed deposit is the best because it guarantees returns compared to market-linked products that are risky because of no guarantees. Confirmation bias explains in part why it’s nearly impossible to present enough factual evidence to convince a staunch guaranteed return favouring person that their choice has serious financial flaws.

Data, information and how it is communicated play a big role in the success of public policy and actions taken by governments. The GST (goods and service tax) stood for a one nation, one tax. However, that is not so, yet people who will be impacted by paying this tax on almost everything that they consume—goods and services, will end up paying tax at differential rates, including cess on certain items like aerated drinks and jewellery. The government has taken several measures to end black money, and its efforts are commendable and the thought is something that everyone agrees with.

There’s a lesson here for all of us—to avoid making bad decisions about investments or any other aspect of life, we must do two things: be aware of the danger of confirmation bias, and acknowledge that our judgment can be clouded by it. Second, aggressively seek out and understand information that disagrees with our existing belief. The second step may involve talking to people who don’t share our opinion, and listening to their reasoning rather than arguing our own point.