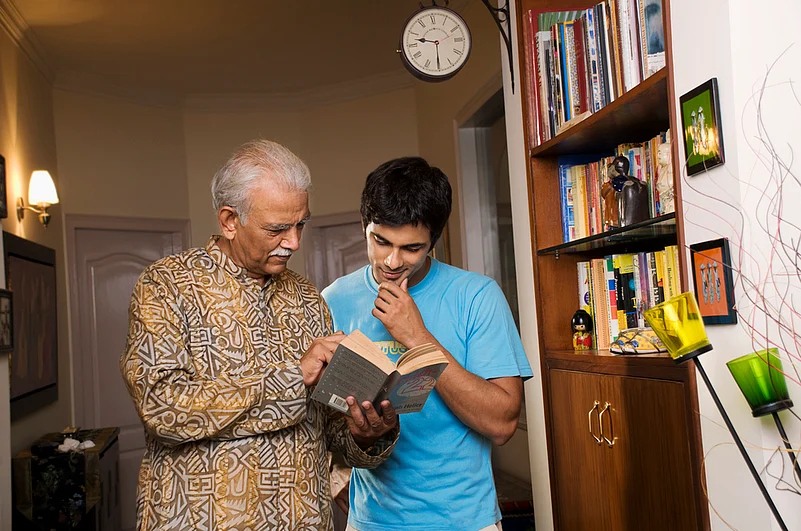

While everyone has taken to social media paltforms to celebrate Father’s Day, I have opted for a different approach. Our parents play a major role in our growing up, behind which their hard work is hidden. So, today as an ode to my father I will share the money lessons he has taught me, which I wish to carry till the end.

It’s not always Important to Earn Huge Amount to Accomplish All Your Life Goals

Similar to every other child, I also believed that money can buy you everything and anything. But with time, I realised how incorrect the idea was.

My father did not bring home a handsome package of Rs 10 or 20 lakh per annum. But whatever he brought, he ensured that it should be and ought to be managed well either by him or by my mother.

Experiences are equally important

His outlook towards life filled us with immense optimism. He emphasised on the fact that experiences are equally important. According to him, life has been given once so enjoy it. Rather he will always use to say that reveals his outlook towards life: “ Khali Haath Aye Ho or Khali Haath Jayoge.” So he always taught us never to miss out on life and enjoying it. Whatever you earn and save, but earmark a small chunk of your earning for getting these life experiences.

Don’t mind, when your wife heads the finance ministry at home

Living in a patriarchal society, we men take pride in declaring ourselves as the Head of the family. But with changing trajectory realise that some things are better left with the wife, like managing the money at home.

So, when the time came, he did not shy away from stepping down and allowing my mother to take charge. Through this I learnt that when you realise, that your wife is more efficient in money management, you should hand over the powers to her.

Living Frugally Is Not About Cutting Down On Your Needs

He was neither a miser nor a spendthrift. But he always ensured one thing that the money should not be wasted on any useless things. Rather make a good use of money. So he always focussed on spending on the things that have potential to reap benefit for you.

Invest Money In Safe Places

Many fancy instruments were a reason of great temptation, but he always put safety of money on priority. He never ran for huge profit that comes with huge risk. According to him, safety entails surety, so always invest in safe places.