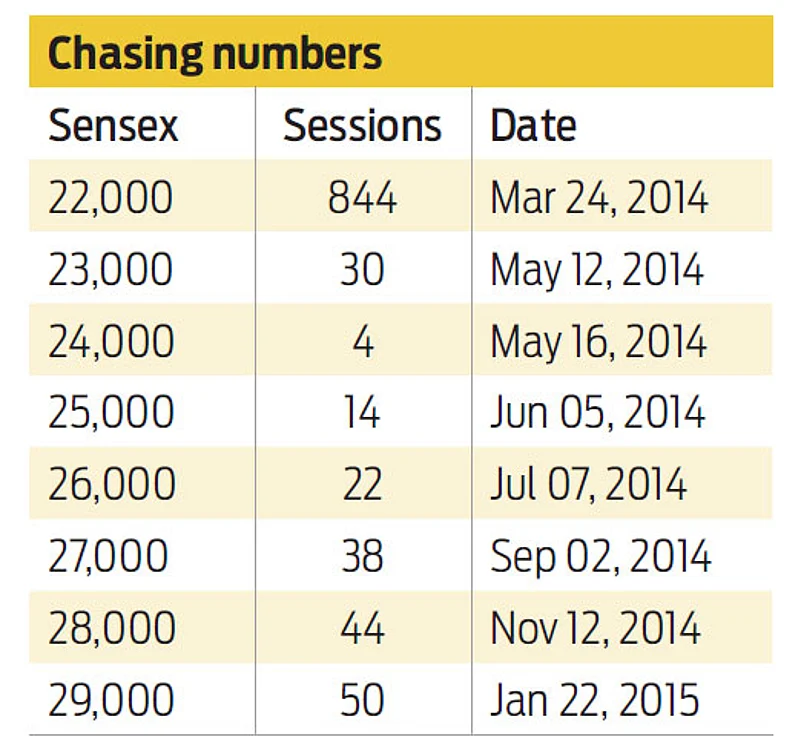

There is a new high that is difficult to miss these days. I am talking of the headlines touting the Sensex touching an all time high. Someone I worked with and who has been a close observer of the markets reminded me that it is not a common occurrence for the Sensex to touch a new high every now and then. He put his point across with stats that on an average since inception, the Sensex was up once every 20 trading days. Yet, newsmongers find it compelling to dramatise the new high every time it occurs.

Naturally, lay investors react in a manner that attracts them to investing, just the way avid shoppers get pulled by discounts and sales. These are also instances when one unknowingly tends to commit investment mistakes. The most common mistake I see new investors make is assuming that the future will look like the past. New investors draw all kinds of conclusion by assuming that the results of one phase of the market will match that of another phase. Such investors will often look at a recent bull market and assume that they should expect stocks to keep going straight up. Then they are shocked and get turned off of stock markets when they encounter their first correction assuming it to be signs of a bear market.

Advertisement

One of the reasons for people to get carried away by rising markets is their myopic view of the markets. They only see the markets going up. They do not pause to ask themselves why on earth will the markets only go up and not down. Then there are experts who chime, “this time is different” whether the market goes down or up, claiming rules of valuation apply and that the new situation bears little similarity to the past. For instance, the one year forward PE of the Sensex in the 2003-2008 rally was around 24X. In comparison, assuming the current rally commenced in September 2013, the one year forward PE of the Sensex works to approximately 18X.

Advertisement

One way to interpret the current state of the markets is to slot every stock as being overpriced; another is to find merit in investing in them because of their future prospects. We can look at the past to get an idea of what can happen or tends to happen, not what will happen. My advice, ask yourself if you understand your investments. If you don’t, you might be taking unnecessary risks and it would be better to keep your cool and keep it simple stupid (KISS) than get swayed by the noise.

The story first appeared in February 2015 print edition

Just one email a week

Just one email a week