Retirement should be planned much in advance so that there is no dependency factor attached during that phase of life. Unlike investing to save tax only, investments should be made create wealth.

“The best way to ensure a steady income after retirement is to plan your retirement and make investments while you are working. However, it is never late to start investing for a better retired life. The government and various financial institutions provide investment options and benefits for senior citizens and you should take advantage of the same,” said Rahul Agarwal, Director Wealth Discovery/EZ Wealth.

“For most senior (above 60 years of age) and super senior (above 80 years of age) citizens in India, preserving their retirement corpus, deriving a fixed sum of periodic income and keeping tax liability at bay are of prime importance. It is, thus important to be aware of the various provisions designed specifically to cater towards the needs of the greying population and profit from the array of additional benefits provided by the Indian government to maintain the same standard of living as before,” said Tarun Birani, Founder and CEO, TBNG Capital Advisors.

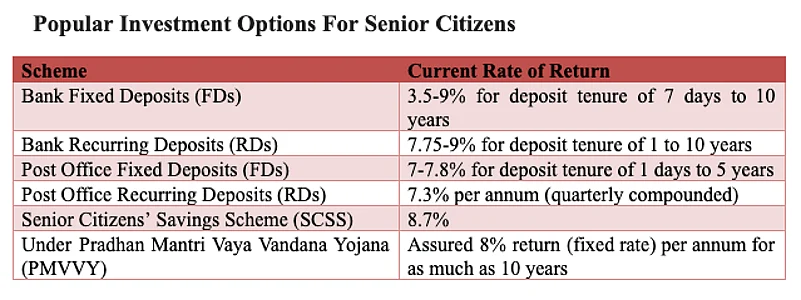

Some of the popular avenues of investing are Bank Fixed Deposits (FDs) and Recurring Deposits (RDs); Post Office Fixed Deposits (FDs) and Recurring Deposits (RDs); Senior Citizens’ Savings Scheme (SCSS); Pradhan Mantri Vaya Vandana Yojana (PMVVY) and National Pension System (NPS).

Apart from the above schemes that specially benefit senior citizens, one can also invest in other common investment avenues as mentioned below that can help to build a perfect retirement portfolio like Post Office Monthly Income Scheme (POMIS) Account, Mutual funds (MFs), Tax-free bonds, Immediate annuities, National Saving Certificate (NSC) and Insurance premium.

Due to life stage senior citizens cannot and should not take any investment decisions that entail capital risk. Most of the schemes that cater to the needs of senior citizens take into account the financial situation of a retired senior citizen, and a majority of them offer slightly higher returns with added security. For example, most of the banks and post office FDs and RDs interest rate for senior citizens are generally higher by minimum 0.25% than the normal rate, said Agarwal.

The definitive edge that senior citizen schemes have over regular investment products is in terms of slightly higher returns, some investment products also have some added tax advantage that are inherent to the scheme.

“Senior citizen schemes have a great potential to maximise the retirement corpus of the individual. These schemes are usually low risk and steady returns affairs with a few exceptions. The benefit of these schemes is more apparent when we consider that the income of the working professionals is going to drastically decrease after retirement and relying on schemes such as EPF alone is not going to provide the individuals with sufficient amount of money to last their entire retirement, said Birani.

Most of the senior citizen schemes that promise low risk have returns in the range of 8-10%. These include fixed deposits, senior citizens savings scheme, post office monthly income schemes. The tax free bonds offer slightly lower percentage returns in the range of 7-8%. The ELSS scheme offers higher returns as the risk component is higher and the returns are linked to the market volatility, in the range of 12-14%, he added.

Things to consider while investing in senior citizen schemes and why

1. Regular cash inflows

Senior citizens depend on returns from their investments for their daily expenses. Therefore, they need to select a suitable scheme that will provide them with regular and predictable cash inflows.

2. Capital protection

Since senior citizens are dependent on their retirement corpus, it is important to invest in schemes with low risks since any loss in capital would translate to the loss in income.

3. Investment liquidity

If the investments are not sufficiently liquid then the individuals may be vulnerable to financial risks since they don’t have enough flexibility when it comes to their capital.

4. Taxes

Some senior citizen oriented schemes provide the investors with tax benefits. Thus, senior citizens must be aware of the schemes that take advantage of tax exemptions and deductions as post tax returns are the ones that people will actually receive.

5. Inflation

Inflation is a perpetual part of the economy. With time effects of inflation are bound to get worse as the income level of senior citizens is going to be constant or keep on decreasing. Thus, it is wise to keep a track of expenses and invest schemes or product that can also help beat inflation over a period of time.

6. Lock in period and Penalty for premature withdrawal

Senior citizens should opt for investments, which come with lower lock in period keeping in mind the uncertainties in life. An ideal investment product for a senior citizen would be something that has no lock-in period and no premature withdrawal penalty.