The concept of value for money works easily in case of businesses that have a tangible benefit. So, in case of a car maker, the value is in the form of the car that a buyer buys. If you try and replicate the same logic to financial services, two things stand out: first, the benefit is not tangible, and second, the benefit will actually come in at a later day. Due to this anomaly, most people stay away from putting their money into financial instruments that seem complex for their imagination. I guess that is why bank savings, fixed deposits and recurring deposits score over every other financial instrument.

Yet, every fund house, insurer, lender or broking house will state loud and clear about being customer-centric in their approach to plying their wares. I do not doubt their integrity.

But, I am not too sure how many of them actually understand their customers. Google mis-selling and the first page will have more references to financial mis-selling than one would have imagined. The dictionary meaning of mis-selling is the act of selling something that is not suitable for the person who buys it. Where does the suitability mis-match arise when it comes to financial products?

Considering every financial services entity claims to be customer-centric, the flaw is in the manner in which the intangible benefits are communicated. I have never understood what insurers mean by death benefit, for I do not see anyone benefiting from my death; leave alone my immediate dear ones. The asset management companies mention exit loads, benchmark returns, alpha and risk reward returns, which is all unnerving.

To me, customer-centricity is about providing solutions based on a deep understanding of customer needs, preferences, and behaviours.

Although customer-centricity is a concept that practically everyone agrees with; yet, it takes a lot more than good intentions to implement. I am sure pressures of achieving targets could be a reason why a well-intended tactical instrument, such as derivates is pushed to a first-time investor who cannot tell the difference between a listed company and an IPO.

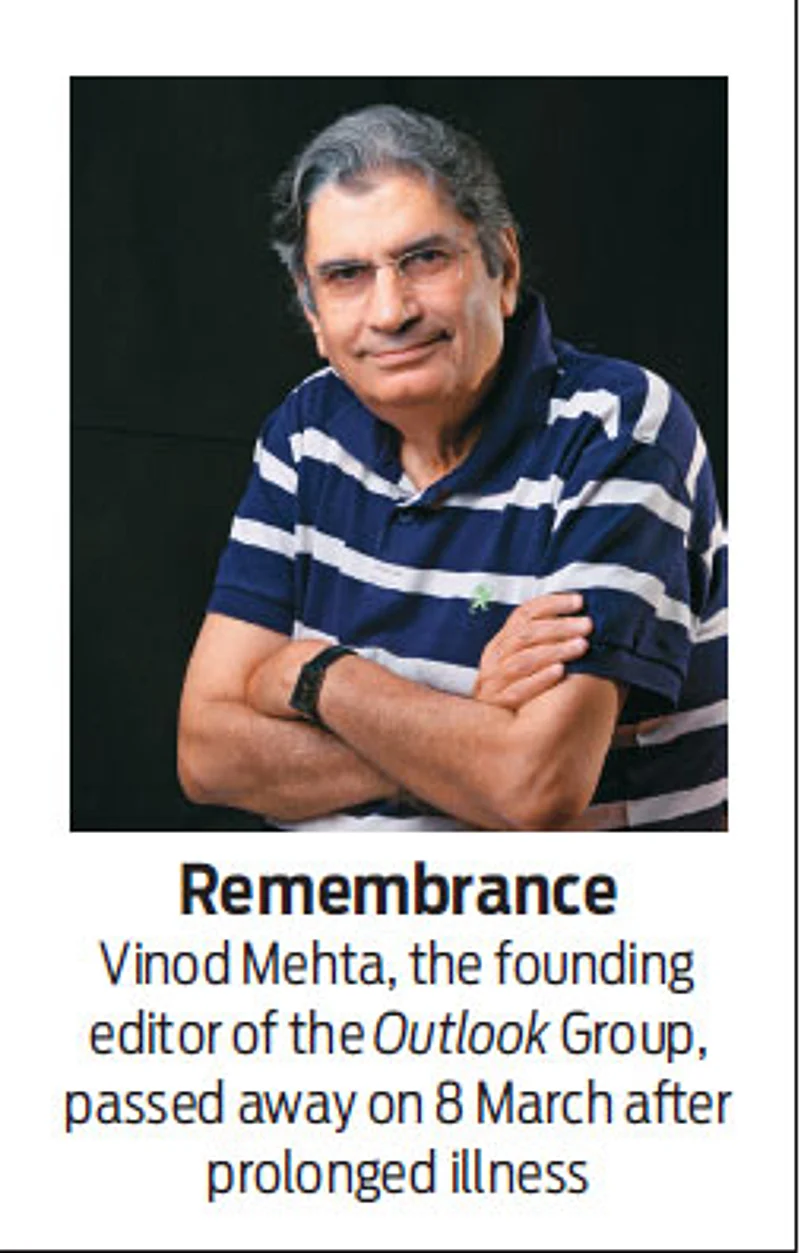

As the founding editor of the Outlook Group, Vinod Mehta, would say, “Your readers are typically looking for simple, easy to understand, safe financial products in which they do not lose money.”

To effectively put the needs and aspirations of customers at the centre of the product benefits, financial service providers will need to rethink their approach and invest significant efforts and resources to change their mindsets when communicating product benefits. This is something that my team and I would strive to follow.