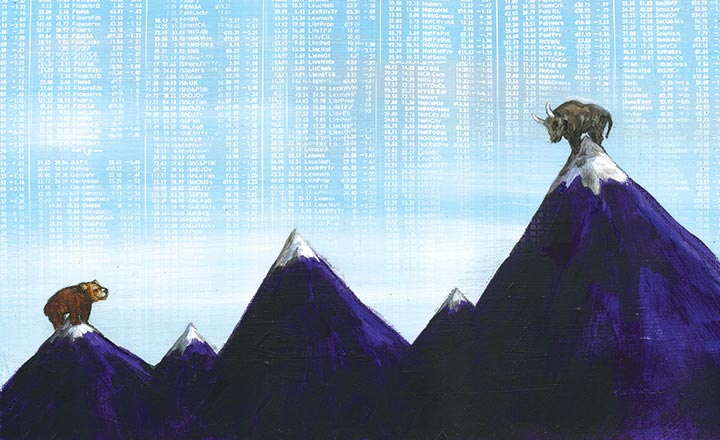

It’s been nine years since we hit the trough post the 2008 crisis. No one would have ever imagined that a bull market would bring us this far, compounding return at 17% from a low of 8,160 (Sensex on March 9, 2009) to 33,835 as on March 14, 2018. Incidentally, the ensuing period also saw some reputed public fund managers hanging up their boots such as KN Sivasubramanian, who bid adieu to Franklin Templeton MF after a 20-year stint, even as others such as Kenneth Andrade, known for his mid-cap picks, moved out of IDFC Asset Management to start his own venture, Old Bridge Capital. Now it’s Sunil Singhania who is setting up his own firm, Abakkus Asset Managers. Singhania, who managed retail money for 14 years at Reliance Mutual Fund before moving to Reliance Capital, believes it is the right time for public fund managers to come into their own. “My belief is that increasingly investors will begin to look at the fund manager rather than the organisation,” says the 50-year-old, who topped the 10-year Outlook Business-Value Research ranking for individual fund managers in 2016. Just like Andrade, who today manages assets of over Rs.1,500 crore, Singhania is looking at starting out with an alternative investment fund. “Eventually, my goal is to create an asset management company,” says Singhania, who is renting out an office at the Bandra Kurla Complex.

The optimism of fund managers is also driven by the fact that for the first time in decades, retail and high networth investors have taken up to mutual funds in a big way, pumping in an average Rs.15,312 crore every month into equity funds last year. The sweeping victory of the Modi government after the scam-tainted-rule of the Congress-led UPA and the ‘reform’ blitzkrieg that followed kept the Street riveted and baying for more even as the government embarked on a surgical intervention of the statistical kind. The Central Statistical Organisation changed the base year for tabulating all prominent economic indicators such as GDP, industrial production and inflation from 2004-05 to 2011-12. In doing so, the Modi government managed to change the slowdown narrative — the 4.7% GDP growth rate of FY14 was revised to 6.9% (See: Now you see, now you don’t). While the Street lapped up the numbers, not everyone was buying the growth story.

Shankar Sharma, co-founder and chief global strategist at First Global, wants to stick to the old series. “If a company changes its depreciation policy arbitrarily, it doesn’t mean I have to follow that. I will use my own model to calculate the core earnings of a company,” says Sharma, who believes India’s current GDP growth is around 5.5% even as new stats show the economy grew by 7.2% in the December quarter. Concurring with Sharma is YK Alagh, a noted economist and former union minister. “When the CSO states that the economy is doing well, to paraphrase Oliver Twist, I could have well said, ‘Sir, can I have some more?’,” says Alagh. The economist’s concerns stem from the conundrum created by the IIP post its switchover to the new base year in 2017. Industrial output, which was estimated at -0.7% (at FY05 prices) turned positive at 4.9%. Meanwhile, the growth of gross value added (at constant prices) of the manufacturing sector was 10.6% in FY16, 7.7% in FY17, 1.2% in first quarter of FY18, rebounding back to 7% in the second quarter. “Picture this against the IIP growth of 2% and 0.4% in Q1 and Q2 of FY18. This discrepancy is truly extraordinary. The turnaround in the manufacturing economy in terms of physical output and robust investment is not happening,” adds Alagh.

The concerns are not unfounded. The private capex cycle has only gone from bad to worse: from a CAGR of 49% in FY05-08 to 13% in FY09-12 and plummeting to a low of 4% over FY13-17. Gross fixed capital formation as a percentage of GDP has fallen from 32% to 29% in the first half of FY18. Public investment, too, has fallen from 32% of GDP to less than 28% “The country’s chief economic advisor, Arvind Subramanian and also the vice-chairman of Niti Aayog, Dr. Rajiv Kumar on numerous occasions have mentioned that a public investment revival will give the much needed boost, but their advice is falling on deaf ears. Instead of vision and lectures on reforms, the powers that be need to put in place a policy outline to spur demand,” adds Alagh.

Despite the growth chimera and the botched-up demonetisation move, the market was largely fixated on the supply-side interventions that the government ended up dishing out: such as the ease of doing business and the introduction of the Goods and Services Tax (GST). But the reality is that it was a benign macro environment that helped the government navigate the past four years. A softening of rates in the US and subdued oil prices helped keep the fisc in check. While the US kept the Fed rate at 0.25% for a good part between 2008 and December 2016, the Reserve Bank of India (RBI) pared the benchmark repo rate from a high of 8% in 2014 to the current 6%. But the party is slowly coming to an end with the Fed hiking rates back to 1.5% on signs of a strong recovery, aided by corporate tax cuts (See: An interesting phase begins). The RBI, too, despite holding on to rates has been quite hawkish about growing inflationary pressure, led by the recent hike in minimum support price, rising crude and the risk of lower GST collection.

Sharma feels the government was plain lucky to have hit the purple patch. “India’s macro improvement was not because of any great economic decisions. It was due to a single factor called oil. As a result, you got lower inflation, lower rates, and a manageable current account deficit. But now the entire virtuous cycle has played out. The lucky trade is over,” says Sharma.

Macro spill

When the BJP stormed into power in May 2014, crude prices were hovering around $108 a barrel, which by the start of 2015 fell 57% to $47 a barrel. The government conveniently used the fall to buttress its own coffers without passing on the benefit to the end consumer. But since 2015, crude prices have bounced back to $60 levels. In between, the government had hiked excise duty on petrol and diesel thrice; however its overall impact wasn’t felt on inflation. But now the government is in a spot. The Centre had reduced LPG/kerosene subsidy in FY18 to Rs.244 billion and has provided for FY19 subsidy provision at Rs.249 billion, assuming oil to be less than $60/bbl. According to the Petroleum Planning & Analysis Cell, a $10 surge in crude price will increase the subsidy by about $2 billion (0.08% of GDP) if fuel prices are unchanged. Correspondingly, a Rs.1 cut in excise duty will slash government’s revenue collections by $2 billion (0.1% of GDP). Also, given that petrol and diesel have a combined weight of 2.3% in the CPI basket, a 10% rise in crude oil price will result in inflation spiking up by nearly 25 basis points, were the Centre to pass on the full increase to consumers. Not surprising that bond investors are feeling more jittery than their equity counterparts about the government’s predicament. Post demonetisation, the benchmark 10-year yield, which had fallen to 6.2% at the end of 2016, surged to a high of 7.82%, and is currently hovering around 7.65% (See: A study in contrast). Sanjeev Prasad, MD and co-head of Kotak Institutional Equities, says, “Bond investors are less forgiving when it comes to macro changes as yields react much faster than equities. Further, equity investors have generally been attuned to good news thus far and are, hence, ignoring the ominous signs.”

In fact, the minutes from the RBI’s recent policy meeting reveal the growing hawkish stance of the monetary policy committee. Sharma though believes that till elections the government is unlikely to let a rate hike act as a spoiler. “I don’t think the government will allow a rate hike in an election year. Every data can be managed and the underlying assumption is that people will believe what is printed than what is intrinsically real. If you can convince 30% of the population, you have won the election in my view. So for now, I think the government will stay put on the interest rate,” feels Sharma.

While the government can choose to delay a rate hike, what it can’t afford is a slack in tax collections. The government’s big bet that GST will widen the indirect tax ambit and improve collections is still to play out. Prasad of Kotak is skeptical about the government managing to raise enough resources next fiscal, given that it is already staring at a Rs.50,000 crore GST revenue shortfall in FY18. “There is considerable uncertainty on GST collections. We believe that the average monthly run-rate budgeted for FY19 may be on the higher side. The government’s fiscal deficit target of 3.3% may be difficult to achieve without a significant pickup in GST revenues.”

To shore up revenues and nip evasion, the government had ushered in the e-way bill for inter-state goods movement in February. But the rollout was far from smooth. The online system crashed on Day 1 of the rollout and has since been deferred to April 1. While plugging leakages to shore up revenue is one way of addressing the issue, the real challenge for the government is to spur private investment as its biggest lever, the banking system is still to come out of its bad loan mess. Though the introduction of the bankruptcy code was expected to speed up non-performing asset (NPA) resolutions, the Nirav Modi affair has proved to be a big mood spoiler.

Unbankable

That public sector banks are creaking under a pile of bad loans is old hat, but the depth of the rot continues to surprise. In December 2017, RBI’s Financial Stability Report (FSR) stated that NPAs were expected to rise from 10.2% of the total loans in September 2017 to 10.8% in March 2018 and further to 11.1% by September 2018. That is at a time when aggregate net profit of Indian banks have slumped from about Rs.91,000 crore in FY13 to Rs.43,900 crore in FY17. In fact, the central bank’s recent stress test shows that close to 20 banks would fall short of the required 9% capital adequacy if gross NPA crosses 16%. While the exchequer has earmarked Rs.2.11 lakh crore as capital to be pumped into 20 state-run banks by March 2018, the over Rs.13,000 crore fraud at Punjab National Bank (PNB) raises a question on how chronic is the problem. Neelkanth Mishra, MD and India equity strategist, Credit Suisse, feels that the government can’t assess how much is enough. “Of the Rs.2.11 trillion recap announced, Rs.1.35 trillion was recap bonds that actually had no impact on the fisc because it was a cash-neutral transaction, Hence, the government can find another Rs.2 trillion through such a move. But the question is how do you know whether another Rs.2 trillion is going to do the trick?” For example, in the case of PNB, the fraud amount is twice the Rs.5,700-crore capital infusion due from the government. Fundraising through stake sale is also difficult as 12 of the 21 stated-owned banks are under RBI’s prompt corrective action.

With the RBI banning all debt recast plans, around Rs.2.8 trillion worth of loans, where payments have remained outstanding for 60 to 90 days, run the risk of becoming NPAs. Though insolvency proceedings are an option, bankers are unwilling to take deep haircuts. It was evident when Rajnish Kumar, chairman of SBI, said at a recent press meet: “I would be happy when resolution happens and I don’t mind some hair cut, but I don’t want to go bald.” SBI has already written off bad loans worth Rs.20,339 crore in FY17, the highest among state-owned banks, and has gross NPAs at 10.35%, as on December 2017, on its books.

What’s worrying about the whole issue is that there is not enough capital for banks to spur a capex recovery. According to a rating agency report, while Rs.1.6 trillion of capital will go towards provisioning, Basel III solvency will require Rs.0.5 trillion and another Rs.0.4 trillion would be needed for migrating to the Indian AS regime. Effectively, as on date, banks are still short of Rs.0.4 trillion, with no growth capital to fuel a recovery in the capex cycle, which has hit a 13-year low. Though bank credit has grown 10% in December, it’s been largely led by retail loans from private sector banks, PSBs’ credit growth was just 2%. Mishra of Credit Suisse feels that in light of the PNB scam, decision making can slow down. “That can prove to be a further drag on growth,” he adds.

In fact, in a knee-jerk reaction to the PNB scam, the finance ministry has now asked all PSBs to probe all NPAs above Rs.50 crore for potential fraud. Samir Arora of Helios Capital, which runs a long-short fund from Singapore, believes it will only make bankers more apprehensive. “There is no way the banker can say with 100% confidence that there is no fraud. What if later on it indeed turns out to be fraud? Then they will hang the banker. If the banker says, there is always the possibility, then it will create more stress in the system that every case is fraudulent. This kind of approach is pretty negative.” Agrees Sharma of First Global, who feels the government just got overzealous. “Look at how the subprime crisis was handled in the US. Despite being an outright scam, nobody was arrested, there were fines and a rap on the knuckles but the financial system was not put to risk. Hence, it bounced back. Here we are going into a police state mentality over what is essentially a matter of risk. This fear psychosis is extremely negative for capitalism…when the world is rocking in terms of growth we are really struggling. It’s a real pity.”

That adverse sentiment is evident on the Street where the Nifty PSU Bank Index is down 20% YTD, but what’s surprising to see is that MFs have piled on to the public bank space, whose weightage at 4.6% in the overall MFs portfolio as of December 2017 is much higher than the sector’s weight (3%) in the BSE 200 Index. HDFC Mutual Fund, the largest fund house in terms of equity AUM, counts SBI, Bank of Baroda and Canara among its top holdings in the HDFC Top 200 Fund, which has over Rs.15,200 crore in assets, while SBI is the second-largest holding in HDFC Equity Fund which has over Rs.21,600 crore in assets. The weightage of SBI in both the funds is over 15%. Prashant Jain, executive director and CIO, did not comment on the fund’s view since the AMC is readying for a public listing. But in an earlier interview in 2016 with Outlook Business, he had explained his stance on public sector banks. “Corporate lending is more cyclical; it goes through ups and downs with business cycles and, in stressed times, asset quality issues can rise. This is what is happening today. It’s not the first time this has happened nor will it be the last such cycle. Way back in 2001, the situation was similar. As the economy improved, the stock performance did too.” While Jain is keeping his faith in the India growth story, foreign investors are seeking better alternatives.

No longer India shining

Even as banks are fighting their own demons, the government is now being spooked by a worsening macro with the current account deficit doubling to 1.2% of GDP in the second quarter from 0.6% of GDP in the year-ago quarter, thanks to rising crude and gold imports. Aditya Narain, head of research, institutional equities, Edelweiss Securities believes that rising gold and crude is just half the story as electronics import (up 30% y-o-y), too, is on the rise, accounting for 25% of the deficit widening. “The government has tried to do its bit by framing an electronic policy to encourage manufacturing here. But the reality is that there is no economics in manufacturing higher value added goods in India,” says Narain.

Besides, what is also hurting is the 40% decline in trade surplus of labour-intensive sectors such as gems & jewellery, textiles and leather goods. The disruption owing to GST implementation has hit labour-intensive sectors given that during the first nine months of FY18 exports were flat, while imports spiked 45%. The gems and jewellery sector contributes 7% to the GDP and accounts for 15% of India’s merchandise exports.

The other aspect that Mishra of Credit Suisse is concerned about is the possibility of banks going slow over rolling over existing trade credit in wake of increased scrutiny of short-term borrowing facilities linked to imports or exports in wake of the PNB scam. “Fewer rollovers have hurt the rupee in the past two weeks,” Mishra mentions in a report. Now with the RBI scrapping quasi bank guarantee instruments such as the letter of undertaking and letter of comfort, the sector’s worst fears have come true. The impact on gems and jewellery exports, which is already down 9% in the current fiscal, could be severe. A further fallout of the move could be on consumption since the sector employs a labour force of more than 4.5 million. Narain though wants to play it by the ear. “If you want to argue for a strong bear case that could be a point, but you need a bigger fall in the sector for such an outcome.”

Even as the narrative is still evolving, the developments don’t bode well for the rupee, which after a six-year straight decline had closed in the green against the dollar in CY17, gaining over 6% to 63.87. A hawkish US Fed stance is already showing on EM currencies with the Indonesian rupiah hitting a two-year low. The Dollar Index has already seen a third straight week of gains to a level of 90.12 and if it continues to trend higher, it can drag the rupee lower in the coming days from the current 64.90. During FY14-17, foreign direct investment flows had kept the rupee stable but going ahead that’s unlikely to be the case and, hence, the rupee could be more susceptible to global portfolio flows (see: Feeling the squeeze).

While the $421-billion forex reserves will prevent the rupee from going into a freefall, January’s trade deficit, the highest in four-and-a-half years and the slowdown in foreign portfolio flows are a cause for concern. Since the beginning of March 2017, India offshore fund flows have declined from $804 million to $112 million by the year end and turned negative in the case of ETFs from $398 million to -$55 million. Offshore funds and ETFs are a subset of the overall foreign portfolio investor flows. Also, the highest-ever February sell-off by FIIs happened last month when they dumped equities worth Rs.18,619 crore.

The turn of events has been triggered by the imposition of a 10% long term capital gains tax. Arora of Helios believes the move will prove detrimental. “For an investor who has a choice among 10-15 countries, a 10% rise in tax will make a difference. It will reduce India’s relative attraction because investors will look at post-tax returns and if the country was ranked among the top four EM markets that will no longer be the case now.” Sharma expects the move to also impact the shift of domestic investors to financial assets. “The zero LTCG was an incentive for investors to take equity risk over the perceived safety of gold, real estate, and fixed income. The idea was to move savings away from largely fixed income and assets such as gold into equities. If India’s equity ownership had been 20-30%, the imposition would have made sense but today we are talking of mid single-digit penetration,” quips Sharma.

In fact, in dollar terms, foreign investors haven’t really made any money off India. The MSCI India Index has been underperforming the MSCI EM Index since 2016 and has continued in the current year as well.

Not surprising then that FIIs are voting with their feet. Their sell-off has continued in March, with Rs.6,000 crore being pulled out thus far. Unlike domestic investors who have no option but to stay invested within India; FIIs evaluate India-based risk-reward profile vis a vis other emerging and global markets. Hence, it comes as no surprise that China continues to be the flavor of the season. The country in January saw the highest inflows at $9.2 billion, aided by non-ETF flows of $5.5 billion. Prasad of Kotak believes that it’s not without reason that investors are flocking there; the MSCI China Index surged 51% last year in dollar terms. “Foreign investors look at India as just a consumption story but the stocks are still expensive. If you look at the narrative over the past one year, new investment areas are opening up in the world, be it low-cost or labour intensive manufacturing or in high-end technology such as AI and the likes. Unfortunately, India does not fit in either of the theme. Now look at China, investors can buy a Tencent, they can buy a Baidu, the diversity across themes is humungous,” says Prasad.

What’s the score?

With the din around the government’s reform push dying down, investors are focusing more on India Inc’s scorecard. As per the Economic Survey 2017-18, India’s corporate earnings to GDP ratio has fallen to 3.5% compared with 9% for the US. The poor earnings trajectory has been compounded by the reluctance of India Inc to invest in growth. According to CMIE, investment in new projects in 9MFY18 at Rs.4.43 trillion was less than half of Rs.9.21 trillion in the comparable period of the previous fiscal. One reason for the poor investment could also be the low utilisation levels. According to the RBI, capacity utilisation in the recent quarter was 71.8% against a high 80% five years ago. Arora believes that post 2008, corporates have still not fully regained their animal spirits and are still in deleveraging mode. “One of the problems with capex cycle is that all corporates are trying to deleverage and what may be right for each company is not necessary right for the whole economy,” feels Arora.

Since the beginning of the current fiscal, Sensex and Nifty’s FY18 earnings estimates have been slashed by over 11% and 9%, respectively. Prasad of Kotak believes the uncertainty over earnings are a tad too many. “There are too many variables at play — monsoon, the banking problem and not to mention political uncertainty that kicks in later. So, how does an investor take a call really? It’s not as if things have become so cheap that one cannot worry about the macro that much.” S Naren, chief investment officer of ICICI Prudential Mutual Fund, the country’s biggest AMC in terms of assets under management, though is optimistic in his outlook. “We believe earnings will improve over the next 12 months and the lower profit in the near term is likely to lead to a very good base effect a year from now.” Despite the recent correction, at the current level, the benchmark Sensex is trading at a multiple of 18x. However, according to Sharma, multiples don’t mean a thing. “Multiples only matter at the extremes — at 5x or 50x. You can always say why 18 is right and why 24 is too high. It’s a waste of time to get into that, you should only focus on whether earnings growth will come through and to that I can only say that small-caps across a lot of sectors will see strong numbers ahead, which is why I remain bullish on small-caps. Since 2014, small-caps have done 4x better than large-caps, and I don’t see that trend changing.”

One of the reasons for Sharma’s exuberance is that small-caps are not prone to macro shocks like the large-caps are. “My case for India’s bull market was less about the structural story, and it was just that interest rate came down and with that factor change obviously, you cannot make a case on multiples to expand.” Arora of Helios, though negative for the short-term, is not overtly bearish. “Between 2004 and 2006, there were 17 consecutive interest rate hikes by the Fed and still the market went up. In the case of India, even if there is a 25 basis points increase, who cares beyond a point so long as other aspects are in place. It’s not a crisis today but obviously the buyer will back off, like we have,” explains Arora.

But for now, more than foreign investors, what’s more important is what happens on the domestic flow front given that domestic institutional flows in CY17 was 5x that of foreign flows — net inflows into MFs was $31.9 billion against the $8 billion net buying by FIIs (See: As good as it gets). Though on a one-year basis equity MF returns are still positive, but year-to-date returns across categories be it large cap, small cap, multi cap and sectoral funds are in the red between 1% and 8%. The risk is if the market continues to drift or drops from the current level, then the one-year return, too, will turn negative. Arora believes that’s a huge concern. “The biggest risk is that the general public still hasn’t been tested in a bad market. Right now, I don’t think that they have to panic so much as they have made 35-40% return, but what happens if the return is down 15-20%?” Agrees Singhania, “By July, if the market continues to be at the same level as it was last year then the return will look negative to flat and that’s when things could get tricky.” Naren though believes that retail investors have matured over the years. “They are opting for SIPs and products such as dynamic asset allocation/balanced funds wherein investments are diversified across asset classes. This will ensure that the investment experience is likely to be better in the days ahead, even if the market were to turn volatile.”

How the market behaves will depend on how the earnings numbers look when they start trickling in. In FY18, according to Bloomberg consensus, earnings are expected to grow at 11%. But the risk is for FY19 and FY20 earnings as analysts are looking at 18% and 27% growth in the Nifty at Rs.563 and Rs.606, respectively, from Rs.476 seen in FY18. With the US imposing import tariff on steel (25%) and aluminium (10%), metal prices have fallen and that could well put pressure on the earnings of commodity players back home.

The bigger concern is that rural demand continues to be weak with the agriculture sector, in nominal terms, expected to grow at 2.8% in the current fiscal owing to weak monsoon compared with 9% in the previous year. The news for the new fiscal isn’t good either with a below normal monsoon predicted with the possibility of El Nino weather pattern developing in the second half of 2018. That’s a big worry. Mishra of Credit Suisse says, “Half of the country’s workforce, comprising agriculture, is still not consuming. If that large a population is not seeing income growth, then broad based indicators will not do well.” Prasad of Kotak expects more downgrades in the near future. “I am sure earning numbers will be cut by 4-5% and on top of that political uncertainty will emerge, the cost of which is a lot higher than it was maybe six months back.”

Compared with other emerging markets, Sharma of First Global believes India will be out of reckoning. “Globally, the environment is conducive and because the global tailwinds for equity markets are fairly strong things will be not so bad for India. But as a market we will underperform for sure.” Like a true fund manager, Naren makes a case for equities as a good long-term asset class. “It should be a part of an investor’s overall asset allocation, but currently equities are not exactly cheap.” While most would be hoping that the bulls continue to rumble on the Street, Singhania will be fervently praying that a fall comes his way to set his boat sailing.