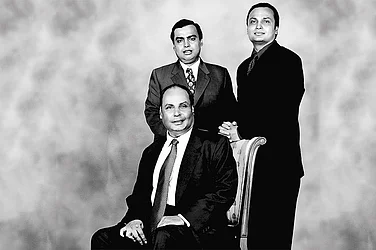

Nothing draws a crowd like a family feud. There is a visceral thrill in seeing the claws out, knives sharpened and sly insinuations leaked to the public. From Mahabharata to the modern day Ambani or Hinduja feuds the division of paternal wealth has seldom been peaceful.

But then not all sibling squabbles end up in bad blood. The Godrej Group is a recent example. In April this year, the 127-year-old conglomerate made headlines by formally announcing the amicable division of their businesses between the families of brothers Adi and Nadir Godrej, and their cousins Jamshyd Godrej and Smita Godrej. Through meticulous negotiation and a family settlement agreement, the two branches of the group resolved ownership issues that had lingered for over six years.

The fate of the corporate sector, and the Indian economy, is closely linked to the development of family-owned enterprises in the country. A Confederation of Indian Industry (CII) estimate pegs the contribution of such businesses at 60%–70% of gross domestic product (GDP) in developed and developing economies.

According to other estimates, family businesses account for 70% of India’s publicly traded companies. There is always a concern about the impact of disputes as the family and business grow. Only 13% of family businesses survive till the third generation and only 4% go beyond the third generation, according to CII.

As India Inc continues to thrive amidst booming capital markets and a growing economy, the imperative of future-proofing companies becomes ever more pressing. Past instances have shown that prolonged disputes within family enterprises can impede growth, making proactive planning all the more essential.

Ruby Ahuja, senior partner at Karanjawala & Company Advocates, a legal firm, says that families have had to bear the cost of long-drawn legal battles in courts under the full glare of the public. “The legal costs are too high as it takes a long time to resolve litigation in Indian courts. The clear answer for family businesses today is to put everything on paper for future generations,” she says.

Split Wide Open

Often, businesses find themselves becoming victims of disagreements between family members. The disagreements usually range from issues of succession to the division of wealth.

Mehul Bheda, partner at Dhruva Advisors, a consultancy, says that family disputes in the past have acted as a drag on India Inc’s growth. “Operations are impacted because time and energy are spent on these feuds. Long-running disputes have a negative bearing on the business,” he says.

The effects of the Modi Group conflict best demonstrate how India’s fourth-largest conglomerate in the ’70s and ’80s splintered into different companies. While Gujarmal Modi expanded the company into different verticals, disagreements between five brothers—including K.K. Modi, B.K. Modi, S.K. Modi, U.K. Modi and V.K. Modi—unravelled the empire.

While family disputes have existed for some time in Indian corporate history, Bheda says that post-liberalisation the opening up of the Indian economy also played a role. “When capital markets picked up, many members realised that there is a value of which they wanted a fair share,” he says.

In the past four decades, India Inc has seen several disputes which have resulted in the split of businesses. The Ambanis, Birlas, Munjals, Bajajs, Modis and Shri Rams are some of the notable families where disputes over businesses resulted in splits (see Fractured Families).

The case of the Shri Ram family provides an interesting lesson, for both industry and the family itself. Founded in 1889 by Rai Bahadur Ram, Delhi Cloth and General Mills started as a textile business in the national capital. It diversified into sugar, chemicals, rayon, tyre cord, fertilisers, information technology and engineering products, among others. But the year it turned a centurion, the conglomerate underwent a four-way split due to differences between brothers Bharat Ram and Charat Ram, and their nephews.

The company witnessed another split a decade later when the chemicals business, SRF, went to Arun Bharat Ram, the son of Bharat Ram. Today, the company is managed by Arun Bharat’s sons Ashish Bharat Ram and Kartik Bharat Ram. The family accepts the mistakes of the previous generations.

To ensure that the future of the company is secure, and the family business survives beyond the third generation, Arun Bharat Ram and his family decided to put pen to paper (see "It's Not About Me..." pg 40).

Blueprint for the Family

While getting a blueprint of how to run family affairs might seem straightforward, Indian companies often struggle to put in place the right sort of framework which can ensure smooth functioning.

A survey by Deloitte India noted that 72% of companies in the sample had a succession plan in place. However, only 27% thought it was effective. One of the biggest reasons cited is the lack of an institutionalised succession process.

There are different ways of dividing family riches. Some, like Godrej, go for a family settlement agreement (FSA) which documents the legal questions of ownership and use of brand identity. Many families also opt for a trust model as well which can divide their wealth among different members.

However, trusts and FSAs have not always proven enough. The K.K. Modi family is fighting over a trust deed left behind by the patriarch after his death in 2019. Lalit and Samir—the sons of K.K. and Bina Modi—are challenging their mother’s control of the trust.

Family constitutions have been around for a while in the country. Dabur, Emami, Dr Reddy’s, GMR and Murugappa group are some of the big names who have formulated family constitutions.

Radhika Gaggar, partner and co-head of private client practices at law firm Cyril Amarchand Mangaldas says that such constitutions are effective when it comes to implementation in the Indian context.

“For any large, multi-generational family in its third or fourth generation, a family constitution is of immense help to them in just documenting their understanding about how they are going to govern themselves, how they are going to enter the family business and how they are going to work with professionals,” she says.

There are no fixed guidelines on how a family can choose to draft a family constitution (see specimen constitution). From a single pager to an over 300-page document, they can range in variety and size.

The Ashish and Kartik Bharat Ram family had decided on a family constitution back in 2006 when they were preparing to take over the reins of SRF from their father Arun Bharat Ram. The goal was simple, to keep the family together. The constitution has clauses to take care of strategic differences and division of wealth within the family.

The family also ensured that the aspect of gender parity in their constitution by ensuring sons and daughters are put on an equal footing. While the spouses were consulted, Kartik says that the wives have no role in the decision making when it comes to SRF. Like in most Indian family businesses both their spouses have been kept out of the shareholding agreement and the decision making of the company. To promote cohesion, the family has also mandated regular meetings and excursions. (see The Peacemaker)

A family constitution accessed by Outlook Business showed the granular planning of a company. The constitution detailed the number of hours family members will work, how the wealth will be invested and the overall governance structure.

Laying Down the Rules

Setting up family councils and assemblies is one of the ways the constitution allows the voice of most of the family members in the governance of business. While the assembly typically has all the members, the council has a few selected people who make the most important decisions for the future of the family.

Kavil Ramachandran, professor of family business and entrepreneurship and senior adviser at the Thomas Schmidheiny Centre for Family Enterprise, Indian School of Business, explains what a well-drafted constitution looks like: “It consists of everything, from governance policies to clarity on succession. While most of the clauses are not legally binding and have persuasion-based adherence, the shareholder agreement is the critical part.”

Another important area in these types of constitutions is how they make provisions to resolve disputes. To avoid a courtroom drama, families are conscious of confidentiality and privacy. Gaggar says that there are different stages in a dispute resolution mechanism which is written in the family constitution. “It starts with informal mediation by a senior family member or a senior trusted adviser of the family. If that does not work, then a panel of trusted advisers can be brought in to resolve it. The next stage is arbitration. The final recourse is the offer for exit,” she says.

The mechanism allows for confidentially resolving the dispute by seeking recourse to arbitration. This is not possible if there is a dispute within a family trust, according to Shaishavi Kadakia, partner at Cyril Amarchand Mangaldas. “Disputes within a trust cannot be arbitrated. A Supreme Court judgement has said that these disputes have to go to court,” she says.

While India Inc is not new to family courtroom drama, families might look for ways to avoid the possibility of their future generations going to court to resolve disputes over wealth. Not only for the members of the family, but this is also crucial for investors looking to get a share of the growing pie of India Inc.

“Written governance norms have a positive bearing on survival and growth of a family business which in turn would fuel the investor’s confidence in the company,” says Gautami Gavankar, non-executive director at Kotak Mahindra Trusteeship Services.

Future is Here

As India’s capital markets trot along, no corporate would want to miss the premium available on valuations. India Inc is preparing for new generations to take over soon. Pirojsha Godrej, son of Adi Godrej, is set to take over as chairperson of the Godrej Industries Group in 2026. Reliance Industries shareholders approved the appointment of Mukesh Ambani’s children Isha, Anant and Akash to the board in 2023.

There are global examples to follow for Indian businesses. While surviving beyond three generations might look to be a tall task, several Japanese firms have shown the way. According to the Research Institute for Centennial Management, over 52,000 companies in Japan have survived for more than a century.

Bheda of Dhruva Advisors says that investors themselves act as catalysts for a company. “Sometimes an investor can come in and ask the family to put in place a succession plan within three years,” he says.

But largely, institutionalising the future of a family business is being led by family members themselves.

Ashish Bharat Ram gives a word of advice to India Inc: “Abide by the saying that business is about capitalism, family is about socialism.”