Picture this: the dying days of FY16. A 14-member team is working round the clock at a prominent asset reconstruction company (ARC). The goal is to acquire 90% debt of a pharma company that has fallen on hard times. While the control room is set up at the Mumbai head office, the ARC has positioned its troops in six different locations to co-ordinate with various banks. The ARC falls short and is only able to acquire 65%, with certain banks failing to meet the March 31 deadline. Cut to the present. About a year later, the situation is starkly different. Goaded by a policy push, banks offloaded Rs. 20,000 crore of bad loans in the last fortnight of March 2017, among which Rs.5,000 crore belonged to a single bank. Amidst this hectic activity, the ARC business is now attracting the biggest and the best globally. While Wilbur Ross was among the earliest entrants in 2006, JC Flowers has teamed up with Ambit and Lone Star with IL&FS. Even Brookfield has tied up with SBI and Apollo Global is an active player through AION, having partnered with ICICI Venture.

There has also been a change in the way ARCs have been going about their business over the past couple of years. Earlier, ARCs would even bid for a shut steel plant for its inherent real estate value, but now they are more likely to bid for operating businesses which can possibly be revived or restructured, says Dinkar Venkatasubramanian, partner, Restructuring and Turnaround, EY. A policy change has been the catalyst here too. In the beginning, it was entirely a game of asset collection. ARCs could buy distressed assets from banks paying 5% in cash and the rest in the form of redeemable security receipts. Their business model relied more on the 1.5 to 2% asset management fee than turning around the distressed asset.

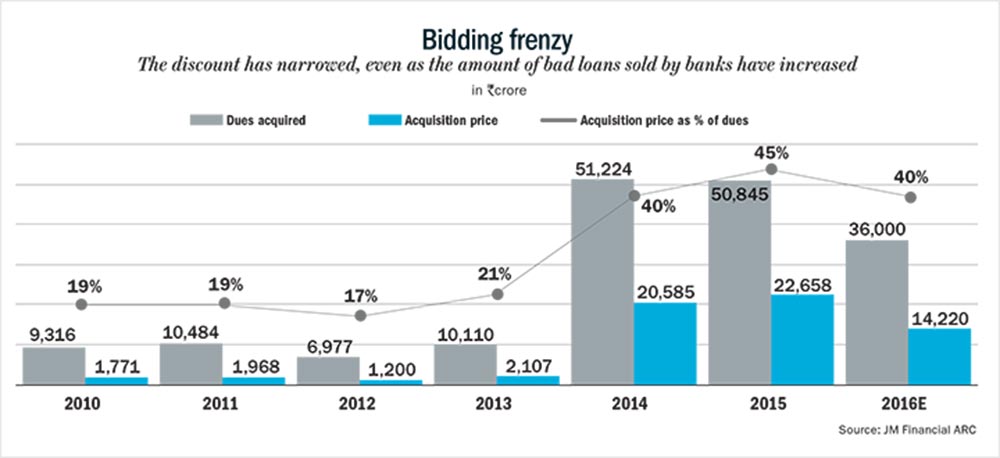

This correlation between securities receipts and management fee drove the aggressive asset collection during September 2013 to August 2014. “Before 2014, most of the deals that happened were just to get the assets out of the bank’s books into the ARC’s books and everybody was just playing for the management fee and there was no real focus on turnaround,” adds Venkatasubramanian. Banks also rushed to offer their NPAs to ARCs during this period as RBI allowed amortisation of loss on sale to ARCs over an eight-quarter period. This structural inertia only increased the recovery time and did not help in revival of assets. “The 5:95 model was driven by a management fee of 1.5%. ARCs could generate 18-20% return over a five-year period even with just a 33% recovery ratio,” points out Rajendra Ganatra, CEO, India SME ARC.

In August 2014, RBI changed the guidelines to dissuade ARCs from indiscriminate bidding with an eye on higher management fees and to nudge them towards repairing assets. The new guidelines increased the cash component to 15% and the management fee was linked to the net asset value at lower range of the NAV specified by the rating agency (rather than the outstanding value of security receipts). This increased cash commitment and linking of revenue to improvement in quality of assets have made ARCs focus on business value, instead of just the underlying asset value. From FY18 on, RBI has tightened the screws further by asking banks holding over 50% in security receipts to provision for them and for FY19 onwards, provisioning starts at a holding of 10%. The intent is to facilitate quick transfer of bad loans by allowing 100% FDI in ARCs and weeding out non-serious players by increasing the net owned fund to Rs.100 crore.

Taking charge

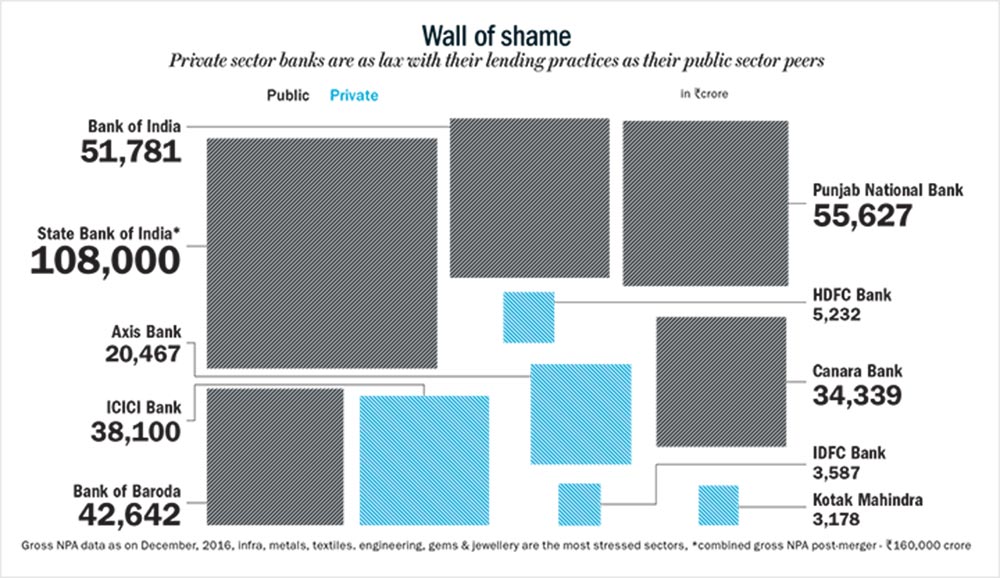

The central bank’s intent notwithstanding, pricing has been a bone of contention between banks selling bad loans and the ARC buying them. ARCs naturally want as deep a discount as possible (50% being the norm) and banks are loath to take those haircuts as they want to salvage as much as they can. Along with the limited absorption capability of ARCs, that is a prime reason why banks tend to hold onto a higher percentage of security receipts. It is not as if banks wouldn’t want to shed their bad loans but the price offered by ARCs is simply a function of asset quality deterioration. Many loans are just not worth the paper they are printed on. Ganatra says, “The high level of bad loans in public sector banks are a consequence of promoters overstating asset values and banks being lenient. Unless there is transparent price discovery for bad loans, the problem is unlikely to get resolved despite the entry of new players.”

Even when there is agreement on pricing, it is not as if ARCs are indiscriminately buying what’s on offer. One segment that is being warily approached is infrastructure, which accounts for 30% of the stressed assets (gross NPA + restructured) as per data compiled by EY. “With infra sector, the challenge is that there is no security available and moreover there is a clear requirement of non-fund based working capital guarantees and performance guarantees. We are not in the business of giving guarantees,” says Anil Bhatia, CEO, JM Financial ARC.

Apart from the problem of collateral, there is the size issue as well. The capital required to resolve infra is of a much higher magnitude. However, Edelweiss ARC has stepped up to the plate by having acquired 85% of the Rs.10,000 crore debt of Bharati Shipyard. “It was a huge asset sold at a sustainable debt level of 30% of loan value. We went ahead with this transaction as the shipbuilding business had 64 assets under construction and at least 20-25 are more than 80% complete,” says Siby Antony, CEO, Edelweiss ARC. The ARC has appointed Sameer Kaji as interim CEO at the since renamed Bharati Defence & Infra with the mandate to turnaround the company. The challenges faced by Edelweiss ARC reflect the troubles that the infra space can throw up. Antony adds, “Shipping industry is like EPC business. It only runs on bank guarantees. We wanted one bank to renew its guarantee, but it asked us to put up 100% cash. There are challenges, but we are confident that we can make the turnaround happen. We are working on the incomplete ships and have delivered three ships to the Ministry of Defence. So, the cash flows are coming as they release the payments.”

Edelweiss ARC has also been trying to revive assets in the steel sector. “Two of my steel acquisitions which are large exposure for me are showing signs of turnaround and also paying us. Both the units are port-based, so they will continue to do well as you get cheap ore and coal from international markets. The minimum import pricing to safeguard the industry against Chinese dumping is also benefiting these domestic players. Then, we have a steel unit in Raigad where we are trying to find a strategic investor but that is taking time. For the big steel companies this is the time for consolidation, but every unit has some of its own issues,” explains Antony.

Realty comfort

Other ARCs are adopting a more selective approach. Eshwar Karra, CEO of Kotak Mahindra-sponsored Phoenix ARC, says, “We are more inclined towards hospitality because it is backed by real estate. At the end of the day if you want to foreclose the loan, you will get some value as against say a loan given to a road developer or a power asset. There is hardly any residual value left there. Also, we are seeing reasonable revival in that space in terms of capacity utilisation. While average room rates are not improving, occupancy levels are improving on a pan-India basis.”

JM Financial ARC also has exposure to the hospitality space via Hotel Leela whose Rs. 4,100 crore debt it acquired in July 2014. Three years hence Bhatia seems satisfied at the outcome. “The objective was to bring it back to a sustainable level of operations. The promoters were able to sell one property and they are in the process of selling one or two more properties. The strategy is to become asset-light, have more management contracts and sell non-core assets for recoveries.” Hotel Leela completed the sale of its Goa property in December 2015 for a consideration of Rs. 725 crore and is in talks to sell its hotels in Delhi and Chennai.

According to Vinayak Bahuguna, CEO, Arcil, the country’s oldest ARC, the hospitality segment is throwing up a lot of turnaround opportunities. “The hospitality business in commercial centres relies a lot more on business travel. If the momentum of business activity keeps trending upwards, that’s where you could see traction because newer capacity takes longer to come up in bigger cities as compared to smaller centres. Also, absorption rates are better in larger cities compared to smaller cities.” However, it is not all rosy as Bahuguna himself attests. “Markets that are reliant on tourist traffic can be more susceptible to global issues. For example, the Goa market can get affected if the Russian currency is devalued or there is some terrorist threat and people say we rather not visit unsafe destinations. And if you lose a season, you have lost one year of revenue,” he adds. While Arcil is looking to build greater capability in retail and SME loans so that it gives them steady volume over the years. Currently, hospitality is around 10-15% of the ARC’s AUM.

This is the first of a two-part series. You can read part two here.