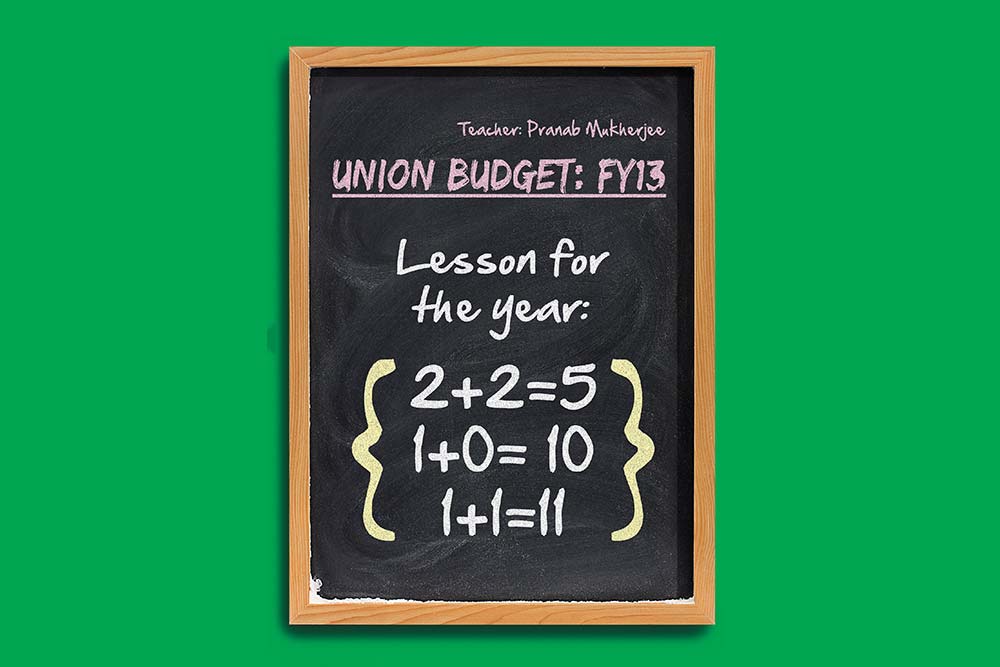

The emperor has no clothes’ or something to that effect should have been the headline post FY13 Budget day. Instead, along with the usual eulogies and clichés from industry, the newspapers also celebrated the landmark of 100 centuries. Never mind the fact that someone claiming not to play for the record books thought it right to take guard against a minnow and then crawled to reach it. Sure, your critics didn’t teach you your cricket, but neither did they go around asking for a duty waiver on a gifted Ferrari only to sell it later. Right, if we were to believe everything that is printed of late, then I am J P Morgan. But then, this is not about the legendary financier, nor is it a tirade against our collective hypocrisy. This is about the unrealistic fiscal deficit projected by finance minister Pranab Mukherjee in the FY13 Budget.

Either way you look at it, the FY13 fiscal deficit target is a sure miss. This is because it hopes for a best case scenario. Rajeev Malik, senior economist, CLSA, says the actual deficit will be 5.5% rather than the government’s target of 5.1%. For starters, the Budget assumes a real GDP growth of 7.6% whereas brokerages like CLSA and IIFL have a 6.3% and 6-6.5% estimate, respectively. That is only the beginning of a long disagreement on how FY13 might actually play out in terms of tax collections and subsidy reduction. H Nemkumar, head, institutional equities, IIFL, believes reform driven growth acceleration is now in doubt and the much required revival in investment cycle may be further delayed.

While everyone else is fretting about how the increasing fiscal deficit and ensuing liquidity squeeze could derail growth, there is a lone contrarian voice that should bring some solace to the FM. Shankar Sharma, co-founder, First Global, damns the hullabaloo, “Fiscal deficit is an incorrect and insufficient measure to look at a country’s macro picture. Debt as a percentage of GDP is what matters and on that count India is much better placed.” As proof, he points out that total debt/GDP has reduced from 74% in FY07 to 66% in FY12, despite a doubling of the central fiscal deficit as percentage of GDP from 2.5% in FY08 to 5.9% in FY12. Indeed, at a time when good news is in short supply, the finance minister should be glad that there is somebody batting for him.

Very crude

The bold announcement in the Budget on the expenditure side is that the government will keep subsidies below 2% of GDP in FY13 and further reduce it to 1.75% of GDP over the next three years. CLSA’s Malik again does not put much faith in the number. “Don’t fall for the ceiling of 2% of GDP for the subsidy bill. If crude oil prices keep rising, there is little chance of the government allowing massive increases in retail fuel prices given the political compulsions.” Nemkumar agrees, “The oil subsidy estimate (₹44,000 crore compared with FY12 revised estimates of ₹68,500 crore) will more likely be overshot unless oil prices decline substantially.”

In fact, if oil prices do correct, it will not be because the FM has under-provided for oil subsidies. That will more be an outcome of a new cycle of reduced investor risk appetite. In other words, the currently high crude price or a fall in capital flows does not augur well for a government whose net market borrowing is expected to rise 10% to ₹479,000 crore in FY13. Malik says this is bound to strain domestic liquidity and could generate fears about crowding out of credit to the private sector. “Liquidity could tighten further if capital inflows are inadequate and RBI will have to keep relying on open market operations and CRR cuts.”

Unsurprisingly, analysts now expect no appreciable respite from the central bank. Before the Budget there was widespread expectation about the RBI lowering rates by as much as 2% in FY13. Now most analysts are reassessing that stance given the wishy-washy initiatives to control expenditure. Sharma, however, turns the argument the other way, blaming the central bank for the abysmal situation. “Monetary tightening has contributed to India’s slowdown, which has slowed tax receipts, thereby worsening the deficit.” Even if that is true, the fact of the matter now is that with growth looking shaky, inflation sticky and the rupee jittery, the RBI does not have too many options. Malik says, “Since there is a lot of suppressed inflation in the system that the Budget has not addressed, the RBI will now cut the repo rate by 0.50% than the expected 1.5%.”

Although there is no restraint on spending, the government is desperate to raise revenue through all means possible. That explains the increase in service tax and excise duties despite its inflationary consequence. And then there is the proposed retrospective taxing of cross-border transactions. But that is not where the pipe dreams stop.

Under insured

Last fiscal, divestment was a sham, given that until February, only about ₹1,400 crore was raised against the targeted ₹40,000 crore. Then in March, the ONGC divestment was rammed down the throats of public sector institutions like LIC. That is how the FY12 divestment figure hit ₹14,000 crore. Its plan to raise ₹30,000 crore through divestment has its share of headwinds, the ONGC fiasco notwithstanding. For it not only assumes a benign market, but benevolence from local investors too. The retail investor seems as interested in subscribing to primary or follow-on paper as Aishwarya Rai is now in Vivek Oberoi. As for foreign institutional investors, their enthusiasm for humouring the government was seen in their response to the ONGC issue.

Unless LIC is arm-twisted to subscribe to another ₹30,000 crore worth of government paper, it will be a tough act to pull-off. Then, the government’s slugfest with Vodafone could just keep new interested FDI on the sidelines till the haze clears. As for the ₹40,000 crore to be raised through spectrum auctions, Indian telcos whose balance sheets are creaking after the 3G overbidding might tread softly. And for companies like Vodafone and Telenor, the government has rubbed them the wrong way already and that story could get messier.

Ironically, due to the insipid FY13 Budget and a downside earnings bias, there is no fundamental trigger for sustaining the market rally seen earlier this year and any further rise from here-on depends entirely on foreign flows, says Nemkumar. That is not very good news for the government because it must surely be counting on foreign capital to make its planned divestment programme a success. The market was ecstatic after last year’s pronouncements not pausing to think about how realistic the estimates were.

Post the FY12 Budget, the market rallied 10% over a month. But this time the market is doing a double think. Investor expectation from the Budget was very high given the perceived lack of initiative on part of the administration in the past year. Since Budget day, the benchmark Sensex is down 3.5%. Fool me once shame on you, fool me twice shame on me — that seems to be what the market is telling the FM.

Politely impolite

Meanwhile, the central bank has a tightrope to walk. If inflation continues to stay at 7%, the RBI will balk at cutting the repo rate and resort to CRR cuts to infuse liquidity. Its hands are full dealing with the rising 10-year G-Sec yield, a depreciating rupee and shrinking forex reserves. The government, on the other hand, could make all kinds of noise for rate reduction in order to boost animal spirits and reduce the cost of its borrowings. This friction could severely test the independence of the central bank this year.

If there was one single factor underpinning the optimism of Indian businessmen it was the expectation of lower interest rates in FY13. Not that the finance minister is unaware of that, but there was nothing that communicated that understanding in the FY13 Budget. What we had instead was another round of illusionary math, the kind seen in the FY12 Budget. The end result was that the 4.6% projected deficit morphed to a revised estimate of 5.9%. So, don’t be surprised if the fiscal deficit for FY13 comes in at 6% and all you get is a shrug from the finance minister by way of explanation. Alternatively, there is always the Eurozone to blame.