After months of speculation, Walmart finally clinched the deal paying $16 billion for a 77% stake in Flipkart valuing the e-commerce major at $21 billion. While it gives Walmart a strong foothold in one of the fastest growing retail markets, the alliance will give Flipkart enough ammunition to take on Amazon in a market where both are fighting for supremacy. Having Walmart on its side will also help Flipkart reduce its overarching dependence on electronics and smart phones and increase its presence in under-penetrated areas such as food and grocery, which is fast catching everyone’s attention — for a good reason.

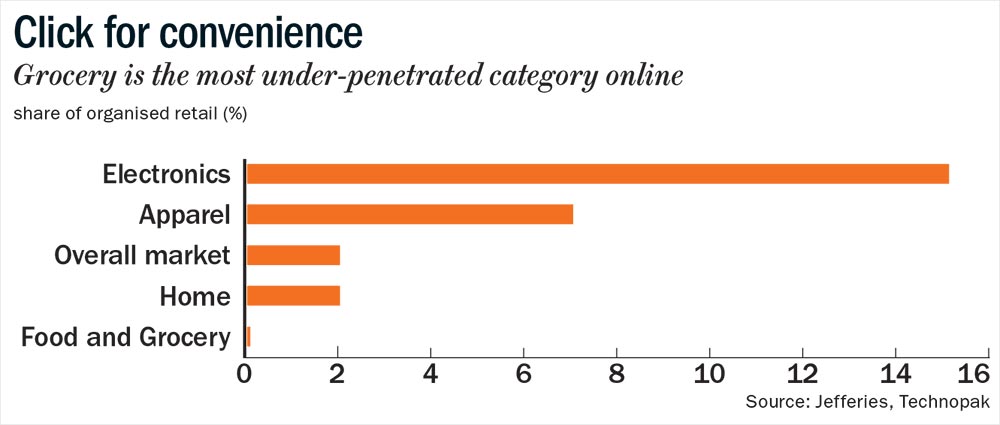

Indians spend more than half of their monthly income on groceries. As a result, groceries form more than 60% of India’s $600-billion retail market. Although, online sales still form a very small part of this market accounting for little more than a billion dollars, it is grabbing attention from everyone including offline retailers such as Future Group and DMart (see: Click for convenience). The online grocery segment is attractive for a couple of reasons. One, the frequency of transactions is a lot more in this space since groceries, fruits and vegetables form an integral part of any household’s budget. Two, online consumers put convenience over prices and probably don’t mind paying for the convenience while shopping for groceries. Finding and retaining such profitable customers is obviously the holy grail for online retailers.

For e-commerce majors such as Amazon and Flipkart who have built a significant customer base of nearly 100 million subscribers, groceries offer a great opportunity to increase transactions on the platform thereby increasing the lifetime value of their customers. For Amazon, food and grocery is likely to form more than half of its revenue in the next five years. In a bid to become the everyday and everything store for Indians, Amazon has already earmarked an investment of $500 million for its food and grocery business along with government’s approval to operate brick and mortar stores. In India, it sells groceries through Amazon Pantry in across 40 cities. It rebranded its express two-hour delivery service to Prime Now from Amazon Now, which will also offer its members same-day delivery in categories such as electronics and small appliances apart from groceries and household items. Amazon has 15 fulfillment centres across four cities — Delhi, Bengaluru, Hyderabad and Mumbai, to cater to its daily need and ensure timely delivery.

Flipkart’s initial foray into online grocery in October 2015 wasn’t very successful and the business was shut down the following year in February. Post its acquisition by Walmart, Flipkart CEO Kalyan Krishnamurthy indicated that Flipkart will roll out groceries in four to five cities by the end of the year. It relaunched its grocery business last year in November through a pilot program in Bengaluru.

It really helps that Walmart knows a thing or two about the food and grocery business with over 56% of its Feb 2017-Jan 2018 revenue coming from that space. Walmart’s well-documented expertise in sourcing goods cheaply and in building the requisite infrastructure will come in handy when Flipkart increases its presence in this segment.

As the big guns get ready to enter its turf, India’s largest online grocer, BigBasket is said to be in talks with investors to build a war chest to take on the impending competition. The company which raised $300 million from Alibaba in February 2018, is again looking to raise between $300 million and $500 million from Alibaba and a new set of investors. It ended FY18 with revenue of Rs.21 billion, up 50% from the previous year. Currently, the company fulfills 75,000 orders a day across 25 cities. It will soon set up offline stores and kiosks as well as start a subscription service for daily essentials. Further, it will increase its contribution from private labels, which is currently 40% of its revenue. In the grocery business where margins are wafer thin, private labels bring in higher margins. In the case of BigBasket, private labels allow them an operating margin of 10% against industry average of around 5-7%.

Not wanting to miss out on the action, leading offline retailers are also trying their hand at the online grocery space. For the Future Group this will be its third chance after its first two ventures went belly up. It plans to deliver groceries, fresh fruits and vegetables through its application, which is likely to be launched soon. For a membership of Rs.999, customers will get 10% discount on purchases. The retailer plans to fulfill orders using the nearest Easyday store to the customer. Easyday currently has about 950 stores and the plan is to eventually take the overall group store count to 10,000 by 2022.

India’s Walmart, DMart is also experimenting with the online space. The retail chain believes in offering the lowest every day prices. As of now, DMart’s online ordering and home delivery services are restricted to Mumbai. The plan is to expand its online presence across cities gradually.

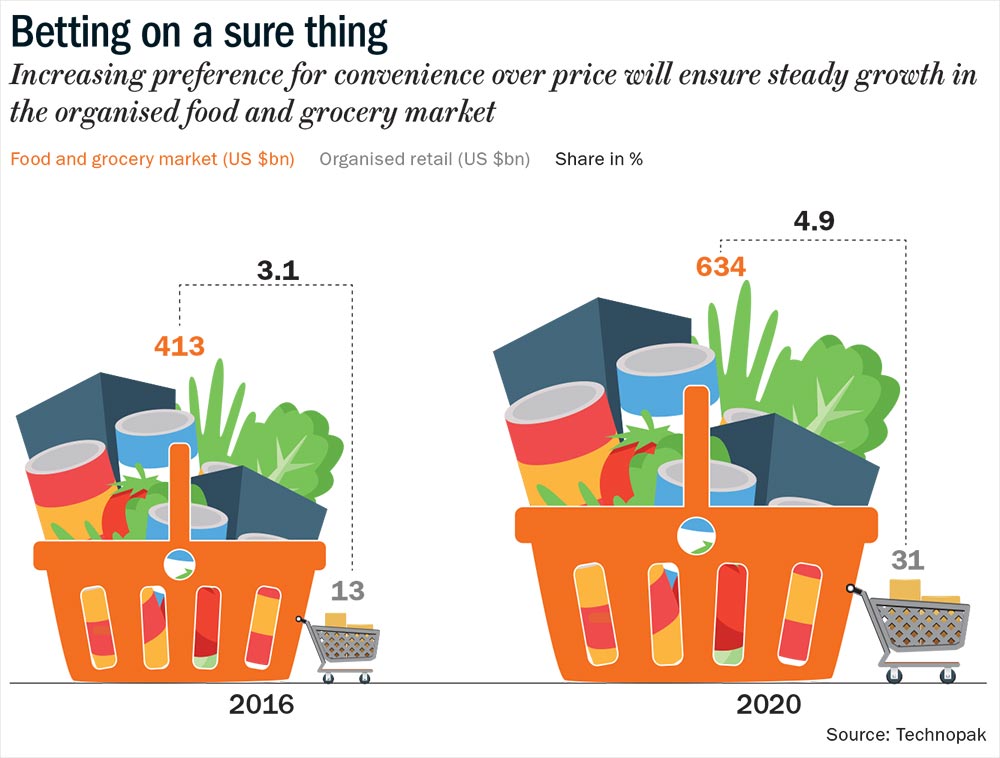

Taking a leaf out of DMart’s book, India’s second largest online grocer Grofers got back on its feet. After a mindless expansion across more than 15 cities that burnt a huge hole in its pocket, leading to shutting down of operations in nine cities, the company transitioned from a hyperlocal model to an inventory model in early 2017. Now, the firm has reduced the number of stock-keeping units and turnaround time while increasing contribution from private labels. In early 2018, Grofers managed to raise $60 million from SoftBank and Tiger Global and Russian investor, Yuri Milner. After the turnaround in operations, it is hoping to clock revenue of over Rs.20 billion in FY19 as against Rs.7.5 billion in FY18 on increasing daily orders (see: Betting on a sure thing).

Despite the excitement around the space, the online grocery model is not easy to execute. Even Amazon has struggled with online grocery in the US and is hoping to get it right with its Whole Foods acquisition. BigBasket claims to have the highest contribution from fruits and vegetables that is 16-18% of overall revenue. About two-thirds of Walmart’s revenue in India comes from food and grocery. It is a tough business to execute because the margins are thin and the products are perishable, thus necessitating a highly efficient supply chain to keep customer rejections low.

While deep-pocketed players such as Flipkart and Amazon may also want to scale up through acquisitions, both Grofers and BigBasket were said to be in talks with the two online bigwigs for a possible stake sale. Although they eventually raised funds on their own, they will continue to be prime targets for acquisition as will be micro delivery players such as Milk Basket.

Even India’s largest retailer Future Group has not ruled out a stake sale to a global player. For offline retailers such as Future Group and DMart, having an omnichannel presence puts them on a stronger wicket to take on the competition. Since grocery remains a hyperlocal business, it is essential to keep last mile delivery costs in check and get the product mix right to keep the model viable. Being a hyperlocal business is also what has allowed kirana shops not only survive the onslaught of organised retail but also thrive amid competition. The online grocery market is slated to see a four-fold increase by 2020 and for now those growth rates are likely to keep the interest of both offline and online players alive in this space.