Zetwerk is in talks to raise $100-125 million in a funding spherical, valuing the corporate a notch larger than its final valuation of $2.7 billion.

The business-to-business manufacturing providers startup has held talks with funds resembling Premji Invest, TCV Partners and Catamaran, according to a news report in Mint.

The spherical can be completely main fundraising, with the corporate’s current traders additionally topping up, according to the report.

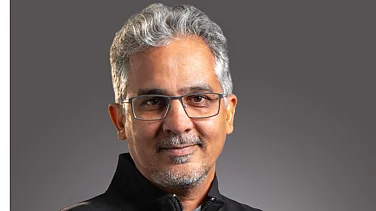

Founded in 2018 by Acharya, Srinath Ramakkrushnan, Rahul Sharma and Vishal Chaudhary, Zetwerk helps small and medium enterprises translate their digital designs into physical products. It operates in more than 25 industry segments.

Advertisement

The company offers manufacturing services to sectors such as consumer goods, apparel, defence, space and aerospace.

In December, the four-year-old firm raised its Series F funding spherical of $200 million from traders led by D1 Capital and Greenoaks, valuing it at $2.7 billion.

Earlier $150 million funding spherical helped it enter the unicorn membership.

Geopolitical tensions, hovering inflation and rising rates of interest have now made traders extra cautious in direction of riskier investments, in a marked change in sentiment this 12 months.

In the most recent funding spherical, Zetwerk is probably going to decide on a home fund to take care of steadiness on its capitalization desk or captable. “Though there’s inbound curiosity from international traders and crossover funds, the corporate is inclined to accommodate a home fund,” the report quoted people familiar with the matter.

Advertisement

The company counts funds such as Avenir, IIFL, Greenoaks Capital, Lightspeed Venture Partners, Sequoia Capital and Accel as its other investors.

Just one email a week

Just one email a week